美股期權個股詳情

IYR241129C86000

- 0.00

- 0.000.00%

延時15分鐘行情收盤價 11/26 09:30 (美東)

0.00最高價0.00最低價

0.00今開0.00昨收0張成交量0張未平倉合約數86.00行權價0.00成交額119.81%引伸波幅-15.75%溢價2024/11/29到期日16.08内在价值100合約乘數2天距到期日0.00時間價值100合約規模美式期權類型0.9646Delta0.0078Gamma6.28槓桿倍數-0.1290Theta0.0055Rho6.06有效槓桿0.0065Vega

美國房地產指數ETF-iShares股票討論

Hello Mooers! ![]()

In today's discussion, I would like to share one particular financial asset that almost one in two Mooers will invest in and/or trade before the rate cuts come and, at the same time, would like to hear from your comments and opinions.![]()

In my previous survey on which financial assets Mooers will invest and/or trade before the rate cuts come,![]() nearly 50% voted for REITs, wh...

nearly 50% voted for REITs, wh...

In today's discussion, I would like to share one particular financial asset that almost one in two Mooers will invest in and/or trade before the rate cuts come and, at the same time, would like to hear from your comments and opinions.

In my previous survey on which financial assets Mooers will invest and/or trade before the rate cuts come,

25

84

The Federal Reserve's signal for rate cuts has injected vitality into the market, akin to a strong stimulant. From the decline in U.S. Treasury yields to traders betting on the extent of the rate cuts, every corner of the market is telling the same story: rate cuts are imminent.

However, the market rebound is not without its challenges. While the uptrend in U.S. stocks is robust, it is also fraught with uncertainties....

However, the market rebound is not without its challenges. While the uptrend in U.S. stocks is robust, it is also fraught with uncertainties....

3

1

Hello Mooers! ![]()

I would like to share some financial assets that are on my watchlist and/or in my portfolio and, at the same time, would like to hear from your comments and opinions.![]()

With many mentioning that a rate cut may happen, probably within the next 12 months, my plan would be to invest in the following:

![]() High-yield bonds

High-yield bonds

![]() Crypto

Crypto

![]() REITs

REITs

![]() Small-cap stocks

Small-cap stocks

Let me go through eac...

I would like to share some financial assets that are on my watchlist and/or in my portfolio and, at the same time, would like to hear from your comments and opinions.

With many mentioning that a rate cut may happen, probably within the next 12 months, my plan would be to invest in the following:

Let me go through eac...

45

42

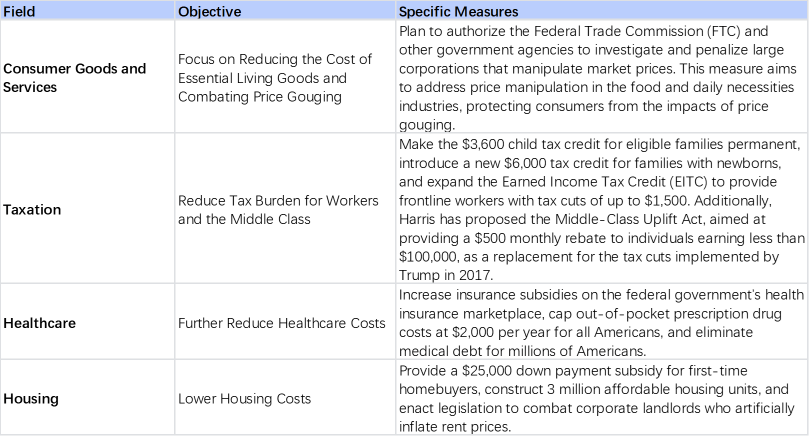

In the complex landscape of global political and economic affairs, Kamala Harris's emergence has undoubtedly drawn widespread attention. As the Democratic presidential candidate, her policy ideas and future plans are becoming key research subjects for markets and analysts.

Harris's background, personal experiences, and her stance on various critical issues will profoundly impact the future political and economic landscape....

Harris's background, personal experiences, and her stance on various critical issues will profoundly impact the future political and economic landscape....

7

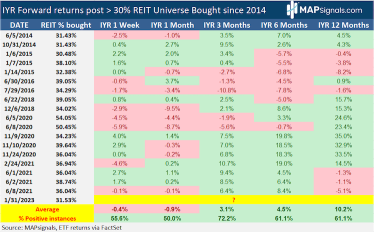

In the cyclical fluctuations of financial markets, the interest rate decisions of major central banks like the Federal Reserve have always been the guiding force behind global asset allocation. Recent data shows that the U.S. unadjusted CPI year-on-year for April was 3.4%, a slight decrease from the previous month's 3.5%. Meanwhile, the core CPI monthly rate slowed to 0.3%, the lowest level since last December, marking its first sign...

+8

7

As the domestic real estate market enters a downturn cycle, the difficulty of making money from real estate as an investment asset has soared exponentially in the country. Meanwhile, in overseas markets, Real Estate Investment Trusts (REITs) offer investors a unique investment tool that provides a broad entryway into the real estate market.

By pooling together various real estate investment portfolios, investors can purchase REITs just li...

By pooling together various real estate investment portfolios, investors can purchase REITs just li...

+6

26

5

The major indices have seen their best week of 2023 and more gains are in store from a fundamental and technical analysis perspective. We cover the stocks and ETFs to watch that could see the most upside. Plus get ready for severe weather, heatwaves, bushfires, severe thunderstorms and flooding with a list of ETFs to keep on your radar. And you need to watch Block's shares as it's poised for a rally.

_________

What's happening...

_________

What's happening...

20

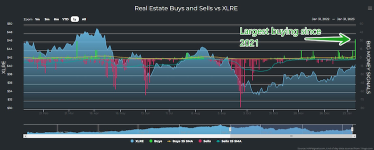

Tuesday saw a wicked rally in stocks. Notably, Real Estate names were a major beneficiary of the surge.

Keep in mind that the trend has been heavily skewed to the buyside for nearly all of January. Tuesday points to an extreme level of buying in Real Estate names that could indicate a pullback in the coming weeks.

Let's first take a look at the daily inflows. Below plots the daily buy and sell counts of REITs and Real Estate names based on our algos. T...

Keep in mind that the trend has been heavily skewed to the buyside for nearly all of January. Tuesday points to an extreme level of buying in Real Estate names that could indicate a pullback in the coming weeks.

Let's first take a look at the daily inflows. Below plots the daily buy and sell counts of REITs and Real Estate names based on our algos. T...

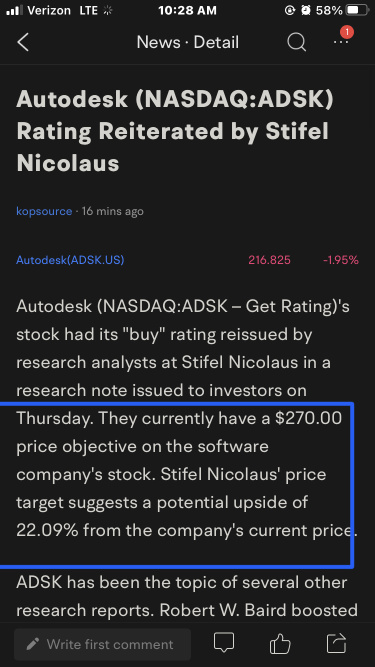

$歐特克 (ADSK.US)$

$SPDR 標普500指數ETF (SPY.US)$ $標普500ETF-Vanguard (VOO.US)$ $特斯拉 (TSLA.US)$ $蘋果 (AAPL.US)$ $納指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR道瓊斯指數ETF (DIA.US)$ $亞馬遜 (AMZN.US)$ $美元指數 (USDindex.FX)$ $美國房地產指數ETF-iShares (IYR.US)$ $AMC院線 (AMC.US)$ $遊戲驛站 (GME.US)$ $蔚來 (NIO.US)$ $3B家居 (BBBY.US)$ $Twitter (Delisted) (TWTR.US)$ $羅素2000ETF (LIST2714.US)$ $谷歌-C (GOOG.US)$ $谷歌-A (GOOGL.US)$ $特朗普概念(已隐藏) (LIST2592.US)$ $Meta Platforms (META.US)$ $迪士尼 (DIS.US)$ $戴文能源 (DVN.US)$ $沃爾瑪 (WMT.US)$ $百思買 (BBY.US)$ $富樂客 (FL.US)$ $迪克體育用品 (DKS.US)$ $黑莓 (BB.US)$ $塔吉特 (TGT.US)$

$SPDR 標普500指數ETF (SPY.US)$ $標普500ETF-Vanguard (VOO.US)$ $特斯拉 (TSLA.US)$ $蘋果 (AAPL.US)$ $納指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR道瓊斯指數ETF (DIA.US)$ $亞馬遜 (AMZN.US)$ $美元指數 (USDindex.FX)$ $美國房地產指數ETF-iShares (IYR.US)$ $AMC院線 (AMC.US)$ $遊戲驛站 (GME.US)$ $蔚來 (NIO.US)$ $3B家居 (BBBY.US)$ $Twitter (Delisted) (TWTR.US)$ $羅素2000ETF (LIST2714.US)$ $谷歌-C (GOOG.US)$ $谷歌-A (GOOGL.US)$ $特朗普概念(已隐藏) (LIST2592.US)$ $Meta Platforms (META.US)$ $迪士尼 (DIS.US)$ $戴文能源 (DVN.US)$ $沃爾瑪 (WMT.US)$ $百思買 (BBY.US)$ $富樂客 (FL.US)$ $迪克體育用品 (DKS.US)$ $黑莓 (BB.US)$ $塔吉特 (TGT.US)$

3

2

暫無評論

Cui Nyonya Kueh : 我不喜歡,所以不喜歡![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![菜刀 [菜刀]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) 。不要抄我的啦,我用狗你也用狗

。不要抄我的啦,我用狗你也用狗 ![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![菜刀 [菜刀]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![菜刀 [菜刀]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![菜刀 [菜刀]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![菜刀 [菜刀]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![菜刀 [菜刀]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh : 謝謝你,願神速![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh :

104255742 :

Mars Mooo 樓主 104255742 :

查看更多評論...