美股期權個股詳情

MU241220P185000

- 60.55

- 0.000.00%

延時15分鐘行情收盤價 12/13 16:00 (美東)

0.00最高價0.00最低價

60.55今開60.55昨收0張成交量0張未平倉合約數185.00行權價0.00成交額0.01%引伸波幅-21.41%溢價2024/12/20到期日82.50内在价值100合約乘數4天距到期日0.00時間價值100合約規模美式期權類型-1.0000Delta0.0000Gamma1.24槓桿倍數0.0000Theta0.0000Rho-1.24有效槓桿0.0000Vega

美光科技股票討論

美光科技即將在12月18日公佈的盈利報告受到矚目,這是因為該公司在半導體行業的地位以及市場最近的趨勢。

考慮的關鍵因素:

* 人工智能推動的需求: 人工智能和機器學習的激增顯著提高了對內存和存儲解決方案的需求。作為DRAM和NAND市場的主要參與者,美光科技處於良好的位置以受益於這一趨勢。

行業庫存水平:半導體行業...

考慮的關鍵因素:

* 人工智能推動的需求: 人工智能和機器學習的激增顯著提高了對內存和存儲解決方案的需求。作為DRAM和NAND市場的主要參與者,美光科技處於良好的位置以受益於這一趨勢。

行業庫存水平:半導體行業...

已翻譯

已翻譯

12

1

嗨,mooer們! ![]()

需要快速了解本週的活動嗎?請查看moomoo全新的 業績和經濟日曆 開始控制項本週!![]()

要了解更多詳情,請查看 財報日歷 和 經濟日歷!

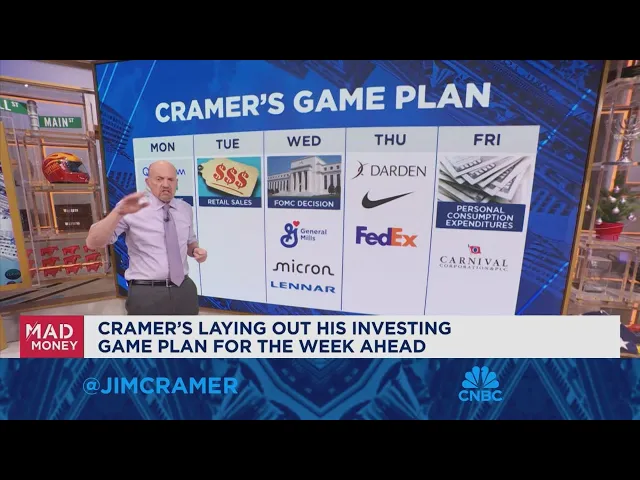

本週,包括各家公司在內 $聯邦快遞 (FDX.US)$ , $美光科技 (MU.US)$ , $黑莓 (BB.US)$ 正在發佈他們的收益。市場將如何對公司的結果做出反應?讓我們猜一下吧!

更多公司...

需要快速了解本週的活動嗎?請查看moomoo全新的 業績和經濟日曆 開始控制項本週!

要了解更多詳情,請查看 財報日歷 和 經濟日歷!

本週,包括各家公司在內 $聯邦快遞 (FDX.US)$ , $美光科技 (MU.US)$ , $黑莓 (BB.US)$ 正在發佈他們的收益。市場將如何對公司的結果做出反應?讓我們猜一下吧!

更多公司...

已翻譯

5

1

$美光科技 (MU.US)$ 105買入是否太高 🤔

已翻譯

1

3

$美光科技 (MU.US)$ 今晚110!

已翻譯

2

1

$美光科技 (MU.US)$

美光2025財年第一季度 業績電話會安排在 12月18日晚上4:30 (美東時間) /12月19日早上5:30 (新加坡時間) /12月19日早上8:30 (澳大利亞東部時間)。立即訂閱參與與管理層一起進行的實時業績電話會議!

看漲還是看跌?

您對此有什麼預期 Micron的Q1 收益有什麼預期?公司會超越還是低於預期?記得點擊“Book”按鈕查看管理層的看法!

免責聲明:

這份演示是爲了

美光2025財年第一季度 業績電話會安排在 12月18日晚上4:30 (美東時間) /12月19日早上5:30 (新加坡時間) /12月19日早上8:30 (澳大利亞東部時間)。立即訂閱參與與管理層一起進行的實時業績電話會議!

看漲還是看跌?

您對此有什麼預期 Micron的Q1 收益有什麼預期?公司會超越還是低於預期?記得點擊“Book”按鈕查看管理層的看法!

免責聲明:

這份演示是爲了

已翻譯

美光 FY2025 Q1 業績電話會

12/18 15:30

預約

預約 2

$美光科技 (MU.US)$

今晚看起來會達到110度

今晚看起來會達到110度

已翻譯

4

$美光科技 (MU.US)$ 加油 micron,在聖誕節前創下歷史新高

已翻譯

1

暫無評論

goodfortune : 請使用moomoo賬號登錄查看

101723620 : maybe 112-113