美股期權個股詳情

OMCL241220C40000

- 7.15

- 0.000.00%

延時15分鐘行情收盤價 11/26 16:00 (美東)

0.00最高價0.00最低價

7.15今開7.15昨收0張成交量5張未平倉合約數40.00行權價0.00成交額55.95%引伸波幅3.74%溢價2024/12/20到期日5.45内在价值100合約乘數23天距到期日1.70時間價值100合約規模美式期權類型0.8386Delta0.0378Gamma7.39槓桿倍數-0.0374Theta0.0207Rho6.20有效槓桿0.0283Vega

Omnicell股票討論

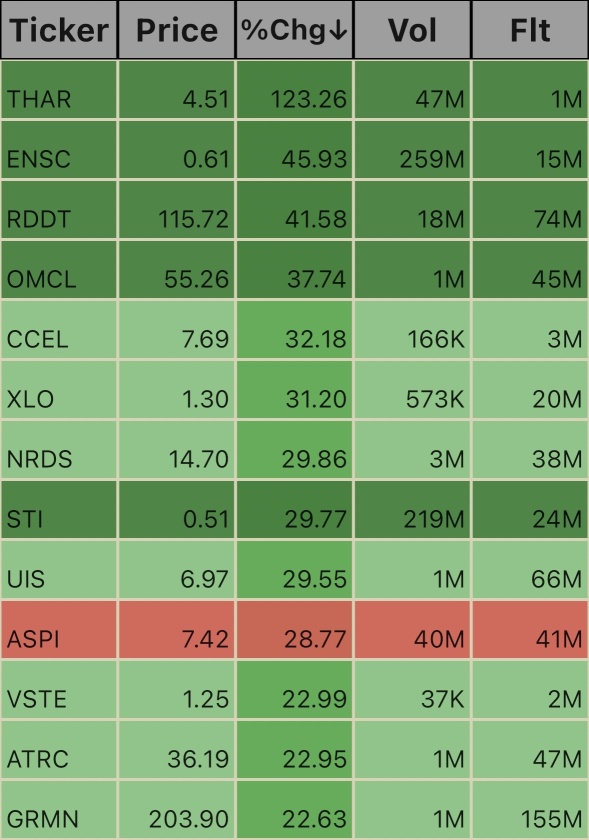

$佳明 (GRMN.US)$ $AtriCure (ATRC.US)$ $Vast Renewables (VSTE.US)$ $ASP Isotopes (ASPI.US)$ $優利系統 (UIS.US)$ $Solidion Technology (STI.US)$ $NerdWallet (NRDS.US)$ $Xilio Therapeutics (XLO.US)$ $Cryo-Cell International (CCEL.US)$ $Omnicell (OMCL.US)$ $Reddit (RDDT.US)$ $Ensysce Biosciences (ENSC.US)$ $Tharimmune (THAR.US)$

5

1

Omnicell stock is undervalued, presenting a buying opportunity. The company's future outlook is optimistic with robust cash flows expected to increase share value. However, consider other factors like financial health before investing.

1

The company's debt situation and EBIT loss of US$31m over the last twelve months raise concerns about its financial health. The balance sheet is considered far from match-fit and the stock is deemed very risky.

Omnicell's low P/S ratio suggests limited growth. Lackluster future revenue forecasts damages its value. Investors await improved performance as current weak outlook pressures stock price.

Given the falling EPS and poor performance over the last three years, future earnings performance is being considered critical for shareholders. Potential investors are cautioned to ensure they are investing in a high-quality business amid challenges.

The sharp cut to revenue forecasts suggests that investors should temper their expectations for Omnicell, Inc. Also, analysts anticipate slower revenue growth than the wider market, which could lead to increased caution among investors.

Omnicell's recent financial troubles and its current liabilities make it a risky investment. Investors should bear in mind the firm's debt management and performance when considering its viability.

$Omnicell (OMCL.US)$5年来营收除2020年萎缩0.54%以外增长了4年,平均增速为12.6%,营业利润受成本费用大幅飙升影响在2020和2022年均有大幅下滑,2022年转为微亏,净利润受所得税返还影响在2022年略有盈利。

2023上半年营收萎缩9.3%,营业利润亏损0.15亿,净利润亏损0.12亿。

目前市值19.6亿,即使按2021年0.78亿利润高点计算市盈率也达到了25,估值没什么吸引力。

2023上半年营收萎缩9.3%,营业利润亏损0.15亿,净利润亏损0.12亿。

目前市值19.6亿,即使按2021年0.78亿利润高点计算市盈率也达到了25,估值没什么吸引力。

Upgrades

• $Allogene Therapeutics (ALLO.US)$ : Goldman Sachs Upgrades to Buy from Neutral - PT $32 (from $9)

• $ChampionX (CHX.US)$ : BofA Securities Upgrades to Buy from Neutral - PT $22 (from $25)

• $CSX運輸 (CSX.US)$ : Stifel Upgrades to Buy from Hold - PT $37 (from $39)

• $德希尼布FMC (FTI.US)$ : BofA Securities Upgrades to Buy from Neutral - PT $8 (from $9.50)

• $諾福克南方 (NSC.US)$ : Stifel Upgrades to Buy from Hold - PT $2...

• $Allogene Therapeutics (ALLO.US)$ : Goldman Sachs Upgrades to Buy from Neutral - PT $32 (from $9)

• $ChampionX (CHX.US)$ : BofA Securities Upgrades to Buy from Neutral - PT $22 (from $25)

• $CSX運輸 (CSX.US)$ : Stifel Upgrades to Buy from Hold - PT $37 (from $39)

• $德希尼布FMC (FTI.US)$ : BofA Securities Upgrades to Buy from Neutral - PT $8 (from $9.50)

• $諾福克南方 (NSC.US)$ : Stifel Upgrades to Buy from Hold - PT $2...

14

1

暫無評論

Den the Dragon :