Metals & Mining Weekly Wrap: Gold Retreated From Record High; Rio Tinto to Invest in Lithium Project

Hello mooers! Welcome to our new column that focus on the metals & mining industry.

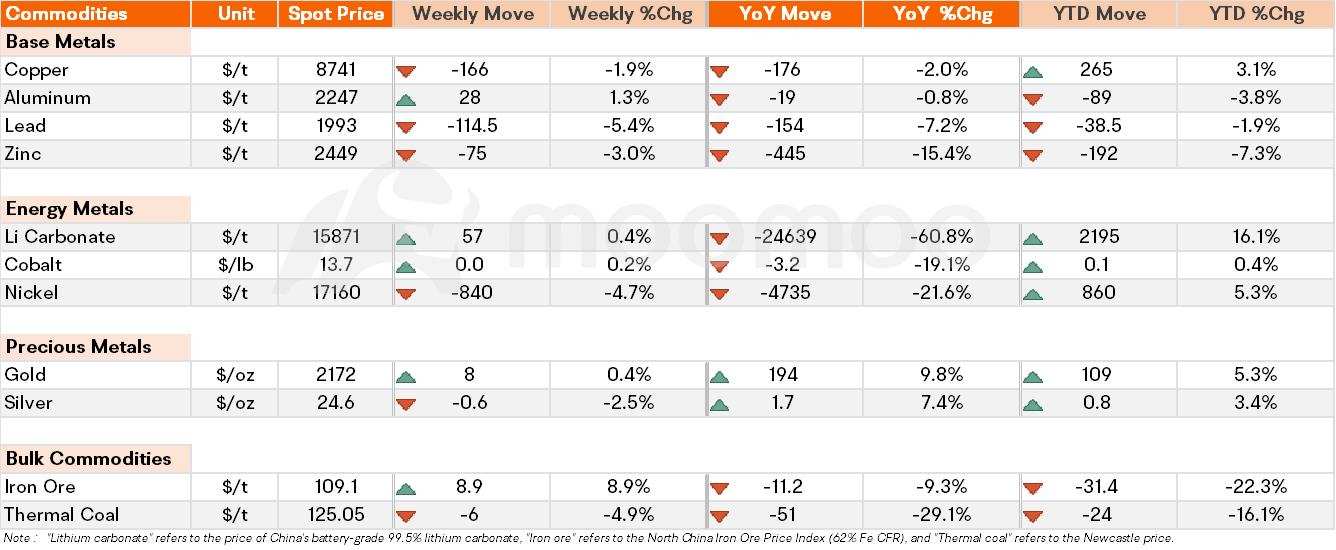

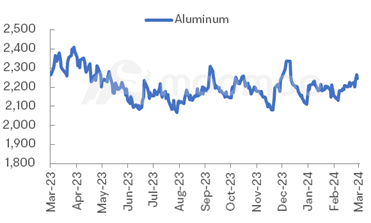

Spot Price Snapshot

Key Price Moves

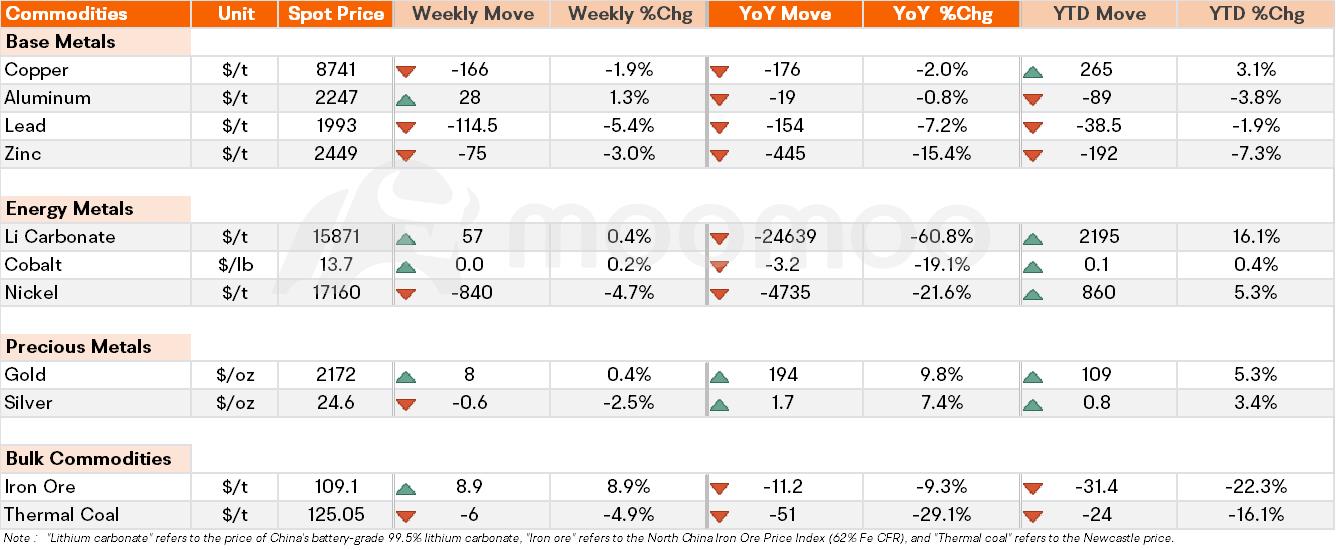

Gold: the prices of $金先物(2412) (GCmain.US)$ exceeded $2,200 per ounce for the first time in history on last Thursday, following the announcement from the US Federal Reserve that it intends to implement three rate cuts in 2024, despite concerns about rising inflation. While the price declined on Friday, gold has still risen by almost 10% since mid-February, as investors make new bets on the precious metal in response to the prospect of more relaxed US monetary policy.

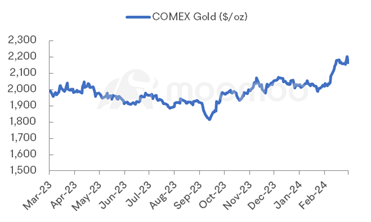

Aluminum: The prices of $アルミニウム(2502) (ALImain.US)$ have been boosted by growing demand from China, the largest consumer of the metal. According to customs data, China imported 720,000 tons of unwrought aluminum and related products in the first two months of this year, a year-on-year increase of 93.6%. As a result, the spot price of aluminum on the London Metal Exchange rose by 1.3% to $2,246.5 per ton and hit a peak of $2,264 per ton earlier, marking the highest level since last December.

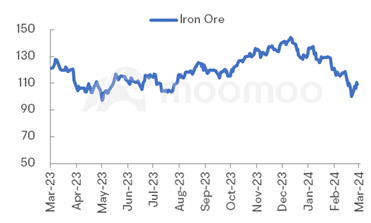

Iron ore: The spot price has once rebounded above $110 per tonne due to a slightly better-than-expected performance from China's steel industry in January and February, as well as more positive data on industrial production during the same period.

Top Company News

Rio Tinto Plans $535M Investment in Lithium Project in Argentina

$Rio Tinto Ltd (RIO.AU)$, the global mining company, has announced that it will invest $535 million in its Rincon lithium plant in Argentina, with the aim of commencing production by the end of the year. The Rincon project was acquired by Rio Tinto from Rincon Mining in 2022 for $825 million, and the company intends to build a battery-grade lithium carbonate plant with an annual capacity of 3,000 tons.

MinRes Purchases Poseidon Nickel Plant for Lithium Processing Hub

$Mineral Resources Ltd (MIN.AU)$ is planning to purchase the Lake Johnston nickel concentrator plant and tenure in Western Australia from fellow ASX-listed firm Poseidon Nickel. The intention of MinRes is to convert Lake Johnston into a lithium processing hub in the southern Goldfields region of the state. The company will pay $1 million initially for the site, followed by another $6.5 million upon completion of the sale and a further $7.5 million after 12 months.

Albemarle Participates in Spodumene Auctions

$Albion Resources Ltd (ALB.AU)$, a global leader in the production of lithium, has partnered with Metalshub, an associate of the London Metal Exchange, to organize several auctions for the sale of lithium supplies. These auctions will allow potential customers to bid on the supplies at a price they consider appropriate. The first auction is scheduled for March 26th, and Albemarle will offer 10,000 tonnes of chemical-grade spodumene concentrate, which is sourced from the company's hard rock mines in Australia. The auction will be conducted in English and Mandarin, and the Chinese Yuan will be used as currency, recognizing the importance of Chinese demand in the renewables industry. The bids submitted during the auction will remain confidential.

Vale Considers Building Another High-Pressure Acid Leach Plant in Indonesia

$ヴァーレ (VALE.US)$'s Indonesia unit is currently considering the construction of a high-pressure acid leaching (HPAL) plant, named "SOA HPAL", which is estimated to cost around 30 trillion rupiah (approximately $1.9 billion). This will be Vale's third project that will convert nickel ore into mixed hydroxide precipitate, a material that is used to produce batteries for electric vehicles. The plant is expected to have an annual production capacity of 60,000 metric tons of nickel.

Source: moomoo, Yahoo Finance

免責事項:このコンテンツは、Moomoo Technologies Incが情報交換及び教育目的でのみ提供するものです。

さらに詳しい情報

コメント

サインインコメントをする