No Data

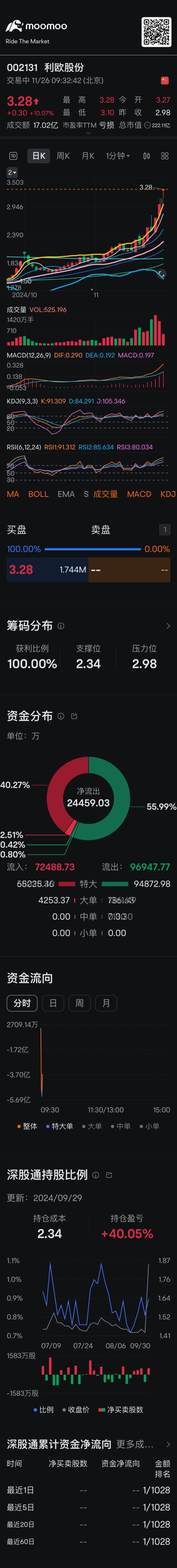

002131 Leo Group Co.,Ltd.

- 4.26

- +0.11+2.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Leo Group (SZSE:002131) Could Be Struggling To Allocate Capital

Leo Group Co.,Ltd. (002131.SZ): pb ratio is 2.82 times, rolling pe ratio is negative.

On December 5th, Gelonghui reported that leo group co.,ltd. (002131.SZ) issued a notice about severe abnormal fluctuations in stocks trading. According to data released by China Securities Index Co., Ltd., as of December 5, 2024, the company's pb is 2.82 times. The pb for the industry classification "L72 Business Services" is 1.89 times, indicating that the company's current pb is higher than the aforementioned industry pb. The rolling pe for the industry classification "L72 Business Services" is 25.88 times, while the company's rolling pe is negative.

[Data Monitoring] The trading volume of honglietf has surged, and three leading funds have teamed up to sell off leo group co.,ltd. for nearly 0.6 billion.

① The trading volume of the two honglietf has significantly increased compared to yesterday, with the huatai-pb csi dividend low volatility etf (512890) seeing a 113% increase in trading volume. ② Several high-priced stocks were heavily sold by frontline speculators, with leo group co.,ltd. being sold off by three speculator seats totaling nearly 0.6 billion.

Longhu Bang | Lui Yizhonglu bottoms out 360 security technology inc. at 0.234 billion yuan, while the new speculative group sells more than 0.1 billion yuan of net263 ltd. shares.

The top three net buy amounts on the dragon and tiger list for the day are funeng oriental equipment technology, leo group co.,ltd., and guangdong golden dragon development inc.

Dragon and Tiger List | The Foshan faction gambled 0.169 billion yuan on zhejiang netsun for 7 days and 6 consecutive boards, while stock trading to support a family also bottomed out grinm advanced materials at 0.31 billion yuan.

Guoguang Electric, Sichuan Development Lomon, Leo Group Co.,Ltd., Zhejiang Jinke Tom Culture Industry, Zhejiang Netsun, Grinm Advanced Materials, Hengxin Shambala Culture, SGSG Science&Technology

leo group co.,ltd. (002131.SZ): has established close partnerships with leading media platforms such as ByteDance, baidu, Tencent, and many well-known mobile phone manufacturers.

GlobeHunters reported on November 19 that leo group co.,ltd. (002131.SZ) recently stated in its investor relations activities that the company's main clients come from the internet plus-related, autos, consumer electronics, and fast-moving consumer goods industries; at the same time, the company has established close partnerships with leading media platforms such as ByteDance, baidu, Tencent, and several well-known mobile phone manufacturers.

Comments

No Data