No Data

002142 Bank Of Ningbo

- 25.82

- -0.53-2.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Minsheng Securities: The action of insurance funds increasing their holdings in Banks is still ongoing, with high growth and high dividend symbols being the preferred choice in the Sector.

According to the disclosure from the Hong Kong Stock Exchange,瑞众人寿 increased its shareholding in China CITIC Bank Corporation (00998) by 3 million Listed in Hong Kong shares on March 12, at a price of 5.9439 Hong Kong dollars per share, totaling 17.8317 million Hong Kong dollars.

Exclusive | After 2.58% comes 2.49%! Some Banks' consumer loan interest rates have reached new lows, breaking through the significant thresholds of "2.6" and "2.5".

① After applying limited-time coupons, some banks like the Bank Of Beijing and Bank Of Ningbo have lowered the interest rates on consumer loans to an annualized 2.5%, with the minimum rate being 2.49%. ② Recently, there has been a clear downward trend in personal consumer loan interest rates. Since the beginning of the year, the interest rates for personal consumer loans at major commercial banks have successively fallen below the thresholds of "2.6" and "2.5." ③ While widening income sources, industry insiders remind to pay attention to the balance between innovation and compliance.

The Past Three Years for Bank of Ningbo (SZSE:002142) Investors Has Not Been Profitable

Independent Director Li Hao of Bank Of Ningbo (002142.SZ) has completed a shareholding reduction of 0.015 million shares.

Bank Of Ningbo (002142.SZ) announced that as of February 6, 2025, independent Director Mr. Li Hao has reduced...

China Shares Gain Following USPS Package Ban Reversal; Bank of Ningbo Down More Than 1%

Research Reports Exploration | Zheshang Securities: Maintain the Bank Of Ningbo "Buy" rating, Target Price 30.82 yuan.

The Zheshang Research Report points out that the Bank Of Ningbo (002142.SZ) will see an 8.2% year-on-year revenue growth in 2024, an increase of 0.8 percentage points compared to Q1 to Q3 of 2024; the net income attributable to the parent company is expected to grow by 6.2% year-on-year, which is a slowdown of 0.8 percentage points compared to Q1 to Q3 of 2024. Revenue growth has slightly improved, while profit growth has slightly slowed, with performance in line with our previous expectations. The annual revenue growth rate has slightly increased, determined mainly due to the favorable bond market in Q4 of 2024, and a rebound in other non-interest income growth. At the end of Q4 2024, the non-performing loan ratio is 0.76%, unchanged from the end of Q3 2024. The allowance coverage ratio is 389%, compared to Q3 2024.

Comments

$Luxshare Precision Industry (002475.SZ)$

$Hangzhou Hikvision Digital Technology (002415.SZ)$

$Muyuan Foods (002714.SZ)$

$NAURA Technology Group (002371.SZ)$

$CGN Power Co.,Ltd. (003816.SZ)$

$S.F. Holding (002352.SZ)$

$Bank Of Ningbo (002142.SZ)$

$Jiangsu Yanghe Distillery (002304.SZ)$

$Guosen (002736.SZ)$

$Iflytek Co.,ltd. (002230.SZ)$

$Focus Media Information Technology (002027.SZ)$

$Rongsheng Petro Chemical (002493.SZ)$

$Zhejiang Sanhua Intelligent Controls (002050.SZ)$

���������...

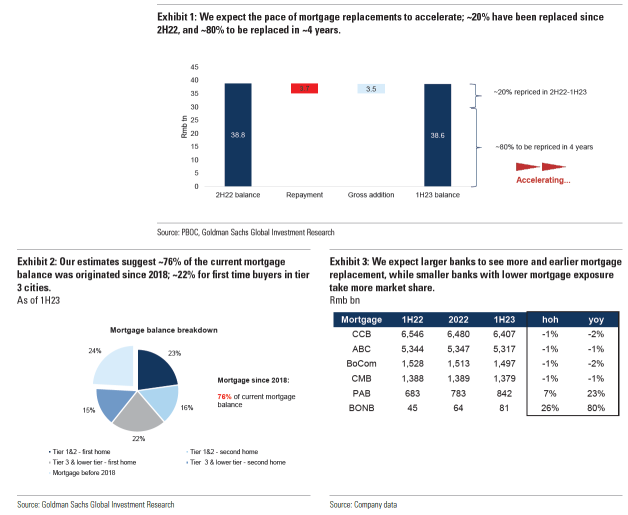

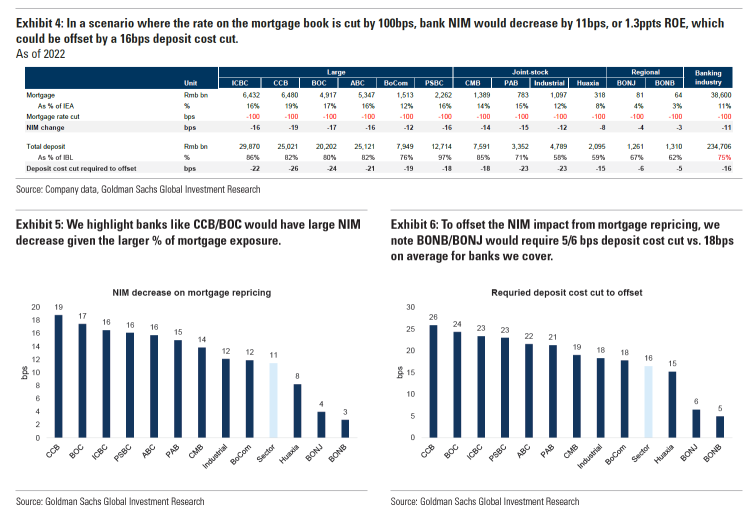

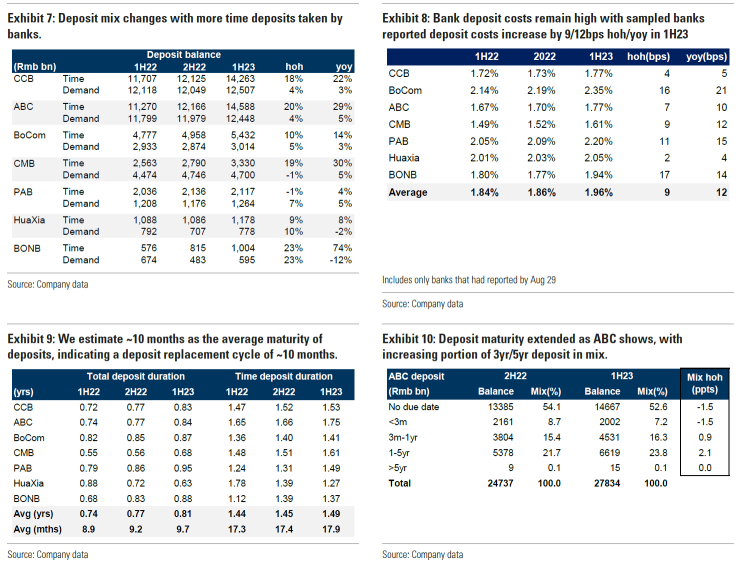

We expect 1) the pace of mortgage replacements to accelerate on a one-off rate cut on existing mortgages. Previously, we estimated ~4 more years to complete the mortgage replacement, assuming ~10% replacement completes in a half year and that the replacement cycle started in 2H22, and that ~20% of the mortgage book had been remortgaged by end-1H23.(...