No Data

00902 HUANENG POWER

- 4.000

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Bank of America Merrill Lynch: Last year, the defensive yields from thermal and hydro power performed exceptionally well in the Utility Sector, upgrading HUANENG POWER (00902) rating to "Buy."

The MSCI China Utilities Index rose about 17% last year, performing in line with the market. Among them, defensive yields like thermal and hydro power have performed exceptionally well within the Sector. It is recommended that investors choose defensive stocks this year and add to positions when individual quality Beta stocks experience price corrections.

Huaneng Power International Sells 2 Billion Yuan of 10-Year Bonds

HUANENG POWER (00902.HK) issues 2 billion yuan Bonds.

Gelonghui reported on January 15th that HUANENG POWER (00902.HK) announced that the company has recently completed the issuance of its first phase of medium-term notes for the year 2025. The bond issuance amount is 2 billion yuan, with a term of ten years, a par value of 100 yuan, and an issuance interest rate of 2.00%. The funds raised from this bond will be used to replenish the company's working capital, adjust the debt structure, and repay bank loans and upcoming maturing Bonds.

Express News | Huaneng Power International - Principal Amount of up to RMB130 Bln or Equivalent

Express News | Overseas Regulatory Announcement- Issue of Mid-Term Notes

CITIC SEC: In 2025, the power grid will face intense policy-driven catalysts; it is recommended to invest in the Ultra High Pressure Sector with strong policy synergy.

The bank is Bullish on the fact that grid investment will maintain double-digit growth in 2025, and it is expected that with the implementation of key matters such as the subsequent National Grid annual work conference, the Industry will enter a phase of intensive policy catalysis.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD356.5 million, HKD55.7 million and HKD23.4 million Southbound Trading net outflow from $TENCENT (00700.HK)$ , $XIAOMI-W (01810.HK)$ and $HUANENG POWER (00902.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $CNOOC (00883.HK)$ was...

There was HKD95.3 million Southbound Trading net outflow from $GENSCRIPT BIO (01548.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $CHINA MOBILE (00941.HK)$ was the most active stock with highest net inflow of HKD205.2 million, while $HUANENG POWER (00902.HK)$ was the m...

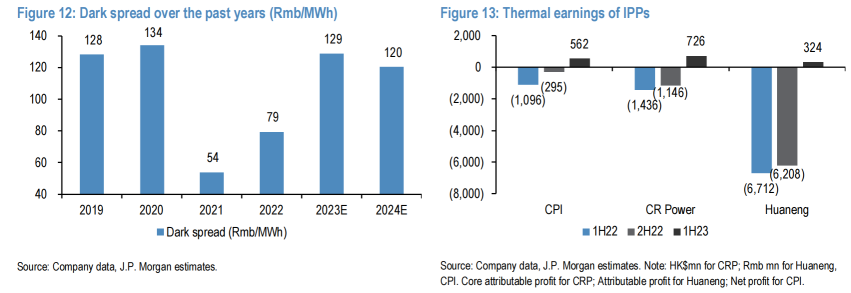

1. Profit for Q1 2023 reached RMB 2.25 billion, up by 335.3% YoY:

In Q1 2023, the company achieved a revenue of RMB 65.27 billion, an increase of 0.03% YoY, and a net profit of RMB 2.25 billion, an increase of 335.30% YoY, with a basic earnings per share of RMB 0.10. Coal power generated a slight loss of RMB 70 million in Q1, while wind power and sola...

No Data