No Data

01088 CHINA SHENHUA

- 32.550

- +0.150+0.46%

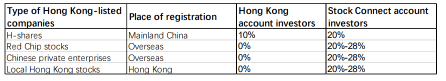

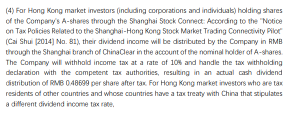

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Shanxi Securities: The coal long-term contract mechanism is progressing steadily, and the degree of marketization has increased somewhat.

Due to the continuation of the current medium to long-term contract benchmark price, and the market price of coal for electricity is still relatively high compared to the long-term contract price, the 2025 plan is beneficial to coal leading enterprises that have performed high-quality performance in the past.

gtja: The long-term fund allocation with a high dividend logic remains unchanged. The fundamentals of coal for 25 years still have relatively high certainty.

In 2025, without considering policy stimuli, the certainty of the fundamentals of coal may still remain at the forefront of all industries.

Citic sec: The long-term agreement policy in 2025 may have a positive impact on coal companies with a higher proportion of long-term agreements.

The overall change in the 2025 long-term coal contract framework is not significant, with the signing ratio requirements being adjusted downwards each year.

Right For Malaysia's Energy Transition To Include Nuclear

CICC: The proportion of hold positions in consumer stocks in Hong Kong for the third quarter of 2024 has increased significantly, with alibaba-W receiving much attention after its inclusion.

China International Capital Corporation released a research report stating that in Q3 2024, the total scale of public fund holdings in Hong Kong stocks has significantly increased, and the proportion of southbound transactions has also risen, but this is not due to active shareholding. In the segmented industry, alibaba-W entered the Hong Kong Stock Connect in September, and the holding ratio in the consumer discretionary sector has increased the most. At the same time, the new economy sectors such as consumer services, pharmaceuticals, and biotechnology also saw significant increases. On the individual stock level, alibaba-W (09988) has been quite favored after entering the connect, and public funds have also increased their holdings in technology leaders like Tencent (00700), while CNOOC (00883) and china mobile (00941) saw a noticeable decline. In terms of heavy holdings.

Research Reports Deep Dive | CICC Securities: China Shenhua Energy's long-term growth potential is promising, maintaining a "buy" rating.

Changjiang Securities' research report indicates that china shenhua energy's (601088.SH) third quarter performance exceeded expectations compared to the previous quarter, primarily due to a reduction in coal costs and a significant increase in electricity generation. Considering that the company's new Xiejie No. 1 and No. 2 well projects, totaling 16 million tons/year, are expected to be put into production in 2027-2028, the gradual implementation of coal power projects under construction, the commencement of the 0.75 million tons/year coal-to-olefins project, and the steady progress of the 0.3 billion ton capacity expansion project of the Shan Shuo Railway and the 0.45 billion ton capacity upgrade project of the Shuo Huang Railway, the company's medium to long-term growth prospects are promising. Maintain 'buy' rating.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD351.6 million, HKD326.1 million and HKD160.6 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ , $CHINA SHENHUA (01088.HK)$ and $CHINA MOBILE (00941.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $TENCENT (00700.HK)$ was the most active stock with ...

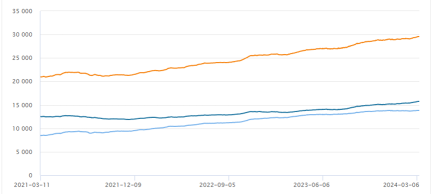

Southbound trading has been crucial in stabilizing Hong Kong’s stock market amid geopolitical risks.

BOCI expects strong demand from Mainland investors for Hong Kong stocks to continue due to attractive valuations and high dividend yields.

The volume of southbound trading is projected to grow from RMB289.4 billion in 2023 to RMB600 billion f...

Analysis

Price Target

No Data

No Data