No Data

01799 XINTE ENERGY

- 7.780

- +0.320+4.29%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Breaking the "involutionary" competition! The two major photovoltaic leaders announce "production reduction and control of output."

Tongwei Co.,Ltd's subsidiary Yongxiang Co. and Daqo Energy have a total production capacity of over 1.2 million tons. Analysts expect that this production cut will reach at least 0.8 million tons, leading to a significant decline in silicon material output from December to January. Despite the production cut being initiated, the current Industry still faces considerable inventory pressure.

The photovoltaic Industry is currently undergoing a "de-involution"! Tongwei Co.,Ltd and Daqo Energy have both announced production cuts and maintenance.

① Both Tongwei Co.,Ltd and Daqo Energy are signatories of the photovoltaic industry self-discipline agreement. According to the self-discipline agreement, photovoltaic companies will begin to manage production capacity starting next month (January 2025). ② Analysts believe that adjusting the overall industry capacity utilization rate to the Range of 50%-60% can basically match the demand for polysilicon in 2025, preliminarily achieving a supply-demand balance.

Shanghai Stock Exchange Agrees to Xinte Energy's Application for Withdrawal of A Shares Offering

XINTE ENERGY (01799.HK): Withdraws the application for the proposed issuance of A-shares.

On December 24, Gelonghui reported that XINTE ENERGY (01799.HK) announced that as of the announcement date, its proposal to issue A shares has been approved by the listing review committee of the Shanghai Stock Exchange, but it has not yet completed the registration with the China Securities Regulatory Commission. Based on the current situation in the Industry, combined with the company's actual circumstances, after sufficient communication and careful reasoning with the sponsor Institutions, the company has decided to terminate the proposed issuance of A shares and has submitted a request to the Shanghai Stock Exchange to withdraw its listing application, which has been approved. The company originally planned to raise funds through the proposed issuance of A shares to construct a facility with an annual production capacity of 0.2 million tons of high-end electronic-grade polysilicon for a green low-carbon Circular Economy.

TBEA Co., Ltd. (600089.SH): XINTE ENERGY has terminated its application for the issuance and listing of shares on the A-share market and has withdrawn the application materials.

Gelonghui reported on December 24 that TBEA Co., Ltd. (600089.SH) announced that its holding subsidiary XINTE ENERGY Co., Ltd. (hereinafter referred to as XINTE ENERGY), based on the current situation in the industry and its actual circumstances, after thorough communication and careful demonstrations with the sponsoring Institutions, decided to terminate the application for the initial public offering of RMB ordinary shares (A-shares) and the listing on the Main Board of the Shanghai Stock Exchange and withdraw the application materials.

Hong Kong stocks fluctuate | XINTE ENERGY (01799) declines nearly 5% again, planning to acquire 49% equity of Jun Dong Energy. Silicon material quickly reduces production but is difficult to deplete inventory in the short term.

XINTE ENERGY (01799) has fallen nearly 5% again, as of the time of writing, it is down 3.76%, trading at 7.67 HKD, with a turnover of 32.7379 million HKD.

Comments

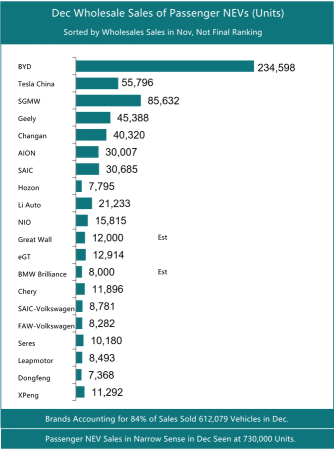

$Chongqing Changan Automobile (000625.SZ)$ $SAIC Motor Corporation (600104.SH)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$ $GWMOTOR (02333.HK)$ $BAYER MOTOREN WERK (BMWYY.US)$ $VOLKSWAGEN A G (VWAGY.US)$ $LEAPMOTOR (09863.HK)$ $DONGFENG GROUP (00489.HK)$ $Dongfeng Automobile (600006.SH)$ $XPeng (XPEV.US)$ $XPENG-W (09868.HK)$ $XINTE ENERGY (01799.HK)$ $BYD COMPANY (01211.HK)$ $BYD Company Limited (002594.SZ)$