No Data

02423 BEKE-W

- 46.100

- +1.650+3.71%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

KE Holdings (02423) rose by 5.51% and is expected to enter the market in early March. Institutions anticipate that the Real Estate market will see some recovery after the Spring Festival.

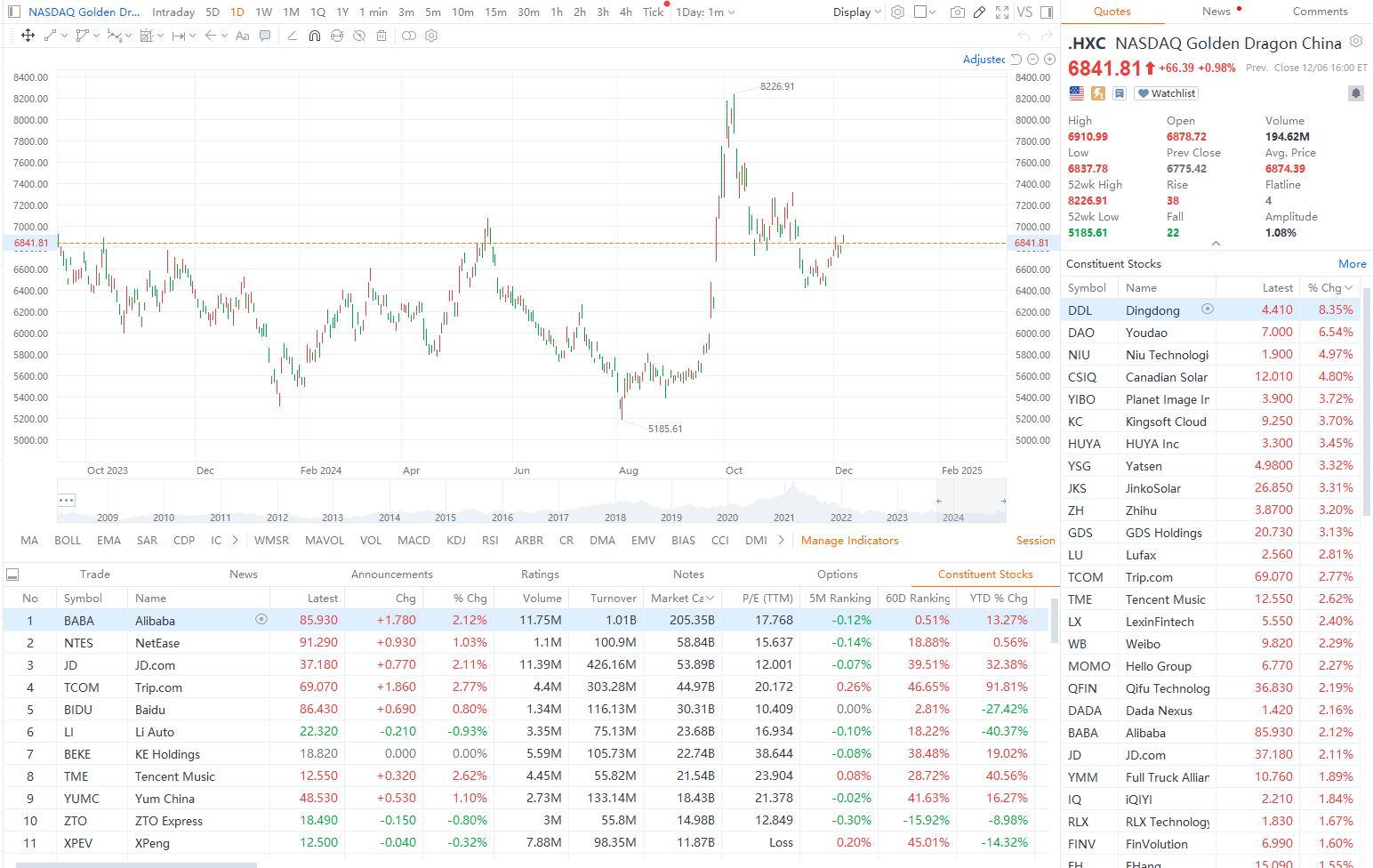

Jinwu Financial News | KE Holdings (02423) is experiencing strong fluctuations, with a 5.51% increase as of the time of writing, trading at HKD 46.9, with a trading volume of HKD 0.128 billion. According to news reports, CICC stated that KE Holdings returned to dual primary listing on the Hong Kong Stock Exchange in mid-2022 and is currently a constituent of the Hang Seng Composite Index large-cap stocks. Due to the nature of Weighted Voting Right Stocks, inclusion in Stock Connect requires additional conditions: 1) Listing for at least 6 months and 20 trading days; 2) Average Market Cap not less than HKD 20 billion and trading volume not less than HKD 6 billion over the 183 days before the assessment date, among other requirements. The bank estimates until December 31, 2024.

KE Holdings-W (02423.HK) spent 5 million USD to buy back 0.879 million shares on January 17.

Gelonghui, January 20丨KE Holdings-W (02423.HK) announced that on January 17, 2025, it spent 5 million USD to repurchase 0.879 million shares, with a repurchase price of 5.56-5.8 USD per share.

Trump Told Advisers He Wants to Visit China as President

KE Holdings-W (02423.HK) spent 5 million USD to repurchase 0.9006 million shares on January 16.

Glory Financial announced on January 17 that KE Holdings (02423.HK) spent 5 million USD to buy back 0.9006 million shares on January 16, with a buyback price per share between 5.5 and 5.59 USD.

[Brokerage Focus] Ping An Securities: As the Spring Festival holiday approaches, the real estate Industry is expected to enter a period of sluggish transactions in the short term.

Jinwoo Financial News | Ping An Securities has released its monthly report on the real estate Industry. With the approach of the Spring Festival holiday, it is expected that short-term transactions will enter a period of stagnation. In the mid-term view, the current high point of the property market in terms of volume and price has clearly receded. Coupled with the reduction of down payments and interest rates, the threshold for residents to purchase property has significantly improved. Although the existing inventory is high and expectations for housing prices and income still constrain the property market's performance, it is believed that the sharp decline in the market has passed. As more high-efficiency, high-quality products enter the market, some demand may flow back from the second-hand housing market to the new housing market, leading to a stabilization of high-quality products in the market first. The short-term focus should be on the performance from after the Spring Festival to March. On the indiv

Preview of the adjustment of the China International Capital Corporation's Hong Kong Stock Connect and the Hang Seng Index: 24 companies are expected to be included in the Hong Kong Stock Connect, while 27 may be removed.

CITIC Securities pointed out that 24 companies, such as China Resources Beverage (02460) and KE Holdings (02423), are expected to be included in the Hong Kong Stock Connect, while 27 companies may be removed.

Comments

The U.S. stock market, in its second bullish year, repeatedly shattered records. Nvidia claimed the crown, tech giants reigned supreme, and AI continued to fuel the market's ascent. Globally, interest rates took a downturn amidst ongoing g...

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...