MY Stock MarketDetailed Quotes

1066 RHBBANK

- 6.460

- 0.0000.00%

15min DelayNot Open Dec 30 16:50 CST

28.16BMarket Cap9.74P/E (TTM)

6.480High6.420Low3.82MVolume6.480Open6.460Pre Close24.68MTurnover6.83052wk High0.15%Turnover Ratio4.36BShares5.11652wk Low0.663EPS TTM16.61BFloat Cap6.830Historical High9.86P/E (Static)2.57BShs Float0.302Historical Low0.655EPS LYR0.93%Amplitude0.40Dividend TTM0.89P/B100Lot Size6.19%Div YieldTTM

RHBBANK Stock Forum

6

4

$RHBBANK (1066.MY)$ sideways for another day

2

RHB reiterates a "BUY" rating on Gamuda with a target price of MYR11.67, offering 22% upside and a 2% FY25F yield. The company is favored for its steady job wins and increasing higher-margin domestic projects, supporting a three-year earnings CAGR of 21% (FY24-27F).

Gamuda's 1QFY25 core net profit of MYR200m (+6.5% YoY) made up 19% of RHB's estimates. Results are deemed in li...

5

4

$RHBBANK (1066.MY)$

Stop it 🥶

Stop it 🥶

5

$RHBBANK (1066.MY)$ No sign of bottom yet, too early to enter

1

3

$RHBBANK (1066.MY)$ Correction more, need a re-entry chance.

4

$RHBBANK (1066.MY)$

RHB Bank Bhd looks poised to continue its uptrend in share price after falling from a high of RM6.83 in late Nov. Investors are probably positive on the banking group’s strong 3QFY24 results.

3QFY24's core net profit (CNP) of RM833m increased by 15% quarter-on-quarter.It was driven by robust net income growth, up 3.9%qoq, coupled with controlled OPEX increase and lower provisions.

It’s 9MFY24's CNP of RM2.3 billion was up by...

RHB Bank Bhd looks poised to continue its uptrend in share price after falling from a high of RM6.83 in late Nov. Investors are probably positive on the banking group’s strong 3QFY24 results.

3QFY24's core net profit (CNP) of RM833m increased by 15% quarter-on-quarter.It was driven by robust net income growth, up 3.9%qoq, coupled with controlled OPEX increase and lower provisions.

It’s 9MFY24's CNP of RM2.3 billion was up by...

25

1

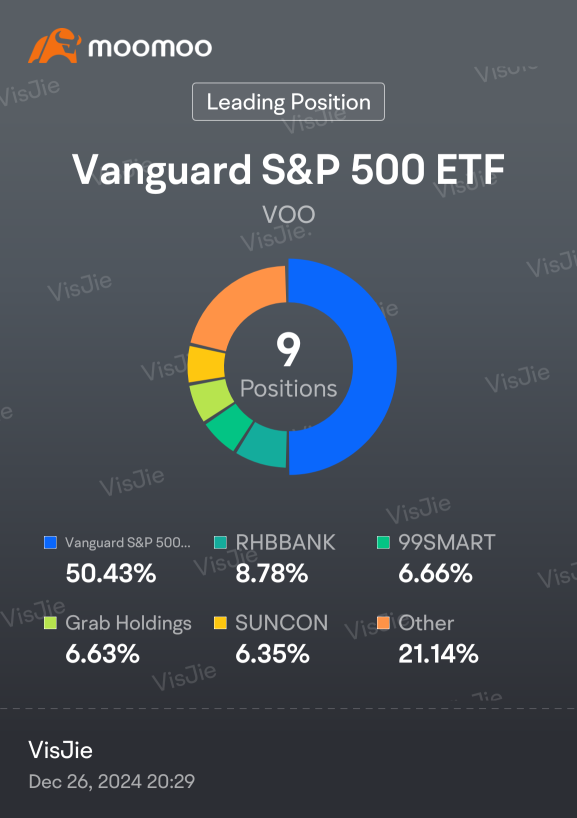

No comment yet

80008000 : What’s that

VisJie OP 80008000 : Position

105523135 : I don't see it among the 99 shareholders.

glenda yung : Nice. Having half in the diversified index fund is great, I always stay invested in this too. What are in the Other category?