No Data

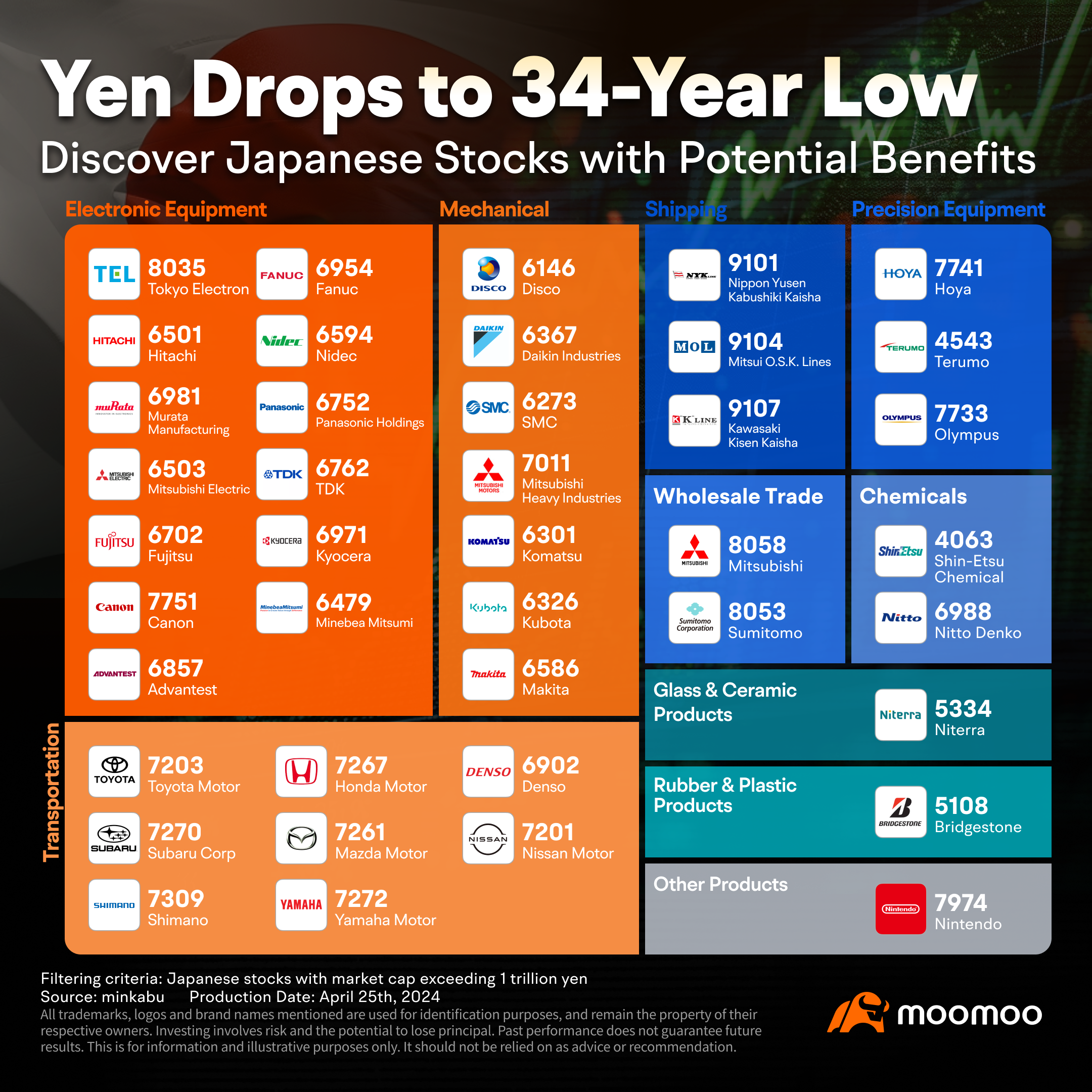

4063 Shin-Etsu Chemical

- 5329.0

- +92.0+1.76%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

List of Conversion Stocks (Part 1) [List of Parabolic Signal Conversion Stocks]

○ List of stocks that have changed to Buy Market Code Stock Name Closing Price SAR Main Board <1333> Maruha Nichiro 2952 2890 <1375> Yukiguni Maitake 1054 1011 <1720> Tokyu Construction 7206 977 <1813> Fudo Tetra 2074 1977 <1833> Okumura Corporation 3920 3785 <1835> Tokyo Steel 3300 3145 <1882> Daiwa House

ADR Japanese stock ranking - mixed highs and lows, Chicago is 140 yen higher than Osaka at 39,260 yen.

The Japanese stocks of American Depositary Receipts showed an increase compared to the Tokyo Stock Exchange (converted at 1 USD to 157.15 JPY), including Toyota Industries <6201>, Japan Post Holdings <6178>, SoftBank Group <9984>, Itochu Corporation <8001>, and Advantest <6857>, while others like Japan Post Bank <7182>, Nidec <6594>, Orion Land <4661>, FANUC CORP <6954>, and Honda Motor <7267> experienced declines, resulting in a mixed overall performance. Chicago Nikkei 225 Futures are clear.

The impact of rising U.S. tech stocks is limited, leading to a shift towards value stocks.

The Nikkei Average fell. It closed at 39,036.85 yen, down 124.49 yen (Volume estimated at 1.8 billion and 40 million shares). Following the rise in US stocks the previous day, buying began to lead, and shortly after the opening, it increased to 39,245.75 yen. However, with the Christmas holiday approaching, the movements of Overseas investors were sluggish, and there was no active push for higher prices. Subsequently, the focus shifted to profit-taking rebalance movements, and by the end of the first half, it dropped to 38,995.76 yen, approaching the key level of 39,000 yen.

The Nikkei average is down 109 yen, and tonight's U.S. market will have shortened trading.

The Nikkei average is down 109 yen (as of 2:50 PM). In terms of contribution to the Nikkei average, Fast Retailing <9983>, SoftBank Group <9984>, TDK <6762> are among the top negative contributors, while Honda <7267>, Shin-Etsu Chemical <4063>, and Tokyo Electron <8035> are among the top positive contributors. In the Sector, Nonferrous Metals, Service Industry, Information & Communications, Precision Instruments, Electric Appliances are among the highest declines, while Electric & Gas Industry, Marine Transportation, Transportation Equipment, Iron & Steel, and Silver.

The Nikkei average is down 104 yen, with a mood of postponing aggressive buying.

The Nikkei average is down 104 yen (as of 1:50 PM). In terms of contributions to the Nikkei average, First Retailing <9983>, TDK <6762>, and SoftBank Group <9984> are among the top negative contributors, while Honda <7267>, Shin-Etsu Chemical <4063>, and Tokyo Electron <8035> are among the top positive contributors. In terms of sectors, Nonferrous Metals, Services, Information & Communications, Precision Instruments, and Oil & Coal Products are experiencing the highest rates of decline, while Marine Transportation, Electricity & Gas, Transportation Equipment, and Iron & Steel are also affected.

The Nikkei average started lower by 118 yen in the afternoon session, with Furukawa Electric and Rakuten among those that declined.

[Nikkei Stock Average・TOPIX (Table)] Nikkei Average; 39042.59; -118.75 TOPIX; 2725.89; -0.85 [Afternoon Market Overview] The afternoon Nikkei Average started at 39042.59 yen, down 118.75 yen from the previous day, slightly widening the decline from the previous closing (39055.35 yen). During lunchtime, the Nikkei 225 Futures fluctuated in a range of 39000 yen - 39090 yen. The dollar-yen exchange rate was 1 dollar = 157.00-10 yen from around 9 AM.

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

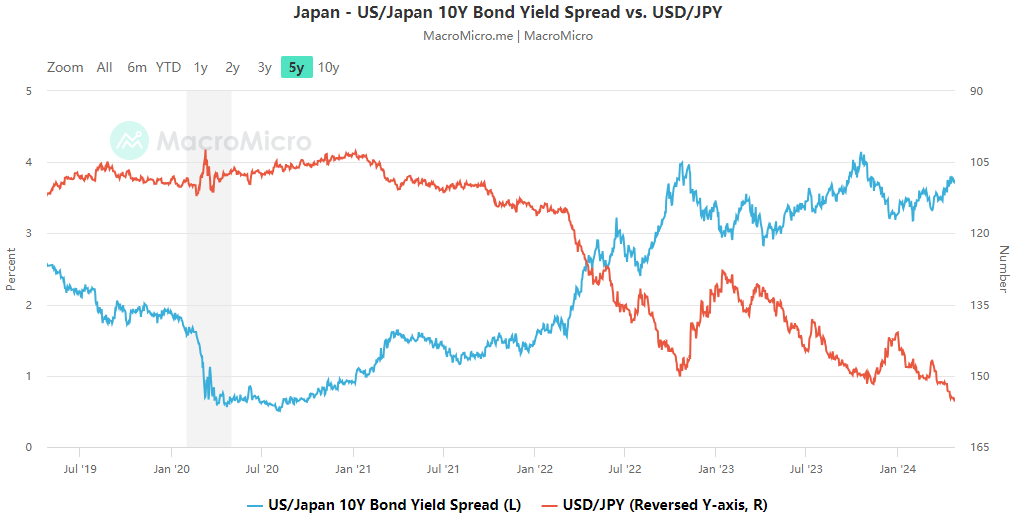

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

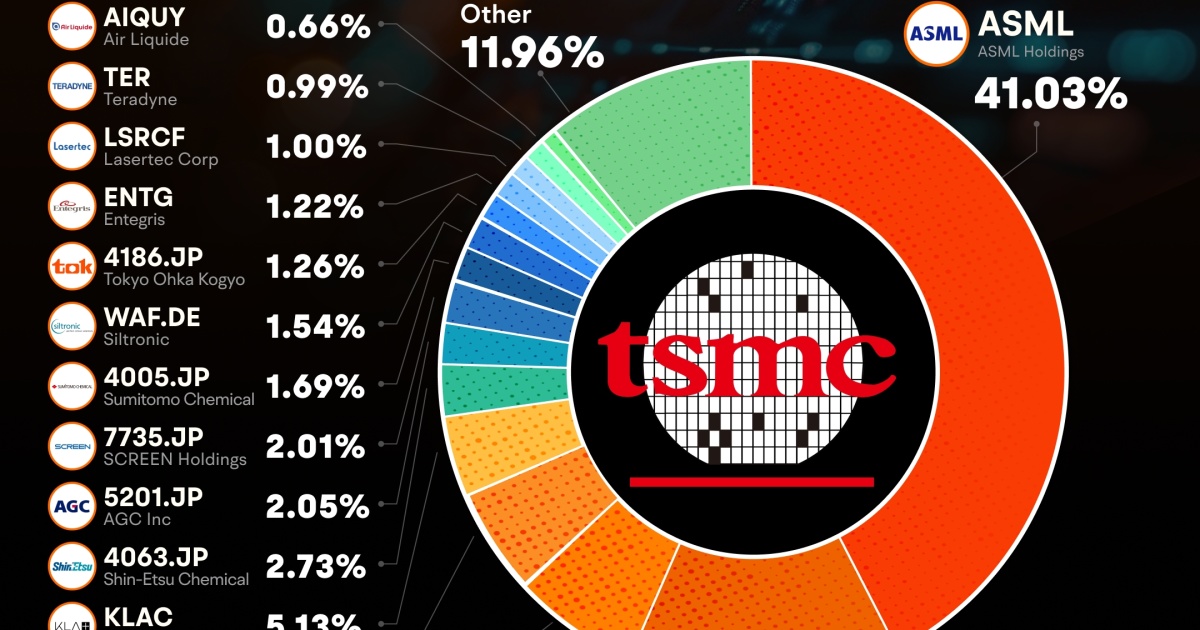

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...