No Data

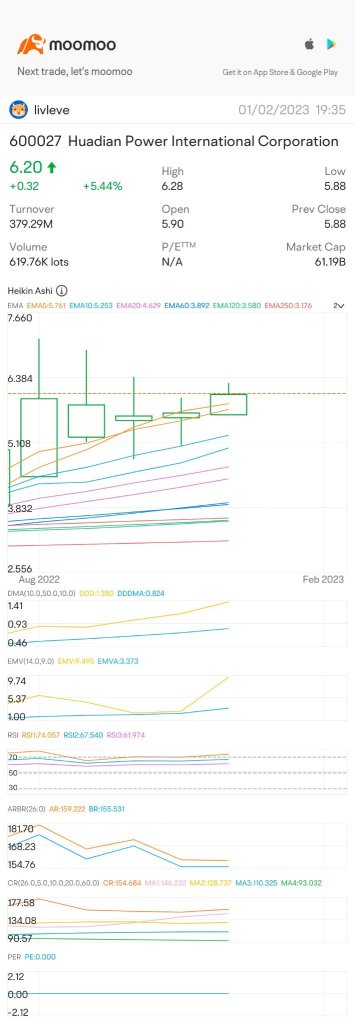

600027 Huadian Power International Corporation

- 4.91

- -0.14-2.77%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks fluctuated | Electric Power stocks collectively declined. Long-term contract electricity prices were signed in Guangdong, Jiangsu and other regions. Institutions claim that electricity price risks are expected to be cleared.

The Electric Power stocks fell collectively. As of the time of reporting, Huadian Power International Corporation (01071) dropped by 3.75% to HKD 3.59; CHINA LONGYUAN (00916) fell by 3.28% to HKD 5.6; CHINA RES POWER (00836) decreased by 2.76% to HKD 16.94; Huadian Power International Corporation (00902) declined by 2.5% to HKD 3.9.

Many Still Looking Away From Huadian Power International Corporation Limited (HKG:1071)

Guosheng Securities: The installed capacity of new energy continues to expand, emphasizing the investment value of flexible adjustment power sources.

The installed capacity of the New energy Fund continues to expand, the pressure on the grid's absorption increases, and the importance of flexible adjustment resources has greatly increased.

China Galaxy Securities: Spot market pricing is based on supply and demand, and mergers and acquisitions of Electrical Utilities central enterprises are expected to accelerate.

China Galaxy Securities believes that, from the perspective of underlying pricing logic, spot electricity prices are mainly influenced by fuel costs and the supply and demand of Electrical Utilities. Against the backdrop of a downward shift in coal price fundamentals, it is expected that thermal power companies in provinces with a high proportion of market coal and strong layout demand will have supported profits in 2025.

HUADIAN POWER (01071) has completed the issuance of 2.2 billion yuan in medium-term notes.

HUADIAN POWER (01071) has announced that the company recently completed the...

Huadian Power International Corporation (600027.SH): Completed the issuance of 2.2 billion yuan medium-term notes.

On December 25, according to Gelonghui, HUADIAN POWER (600027.SH) announced that the company has recently completed the issuance of the 9th phase of medium-term notes for the year 2024 ("this issue of Bonds"). The amount issued for this issue of Bonds is 2.2 billion yuan, with a term of 3 years, a face value of 100 yuan, and a coupon rate of 1.83%. The funds raised from this issue will be used to repay the expiring debts of the company and its subsidiaries within the consolidated financial statements and to supplement working capital.

Comments

Investors Could Be Concerned With Huadian Power International's (HKG:1071) Returns On Capital

Investors Could Be Concerned With Huadian Power International's (HKG:1071) Returns On Capital