No Data

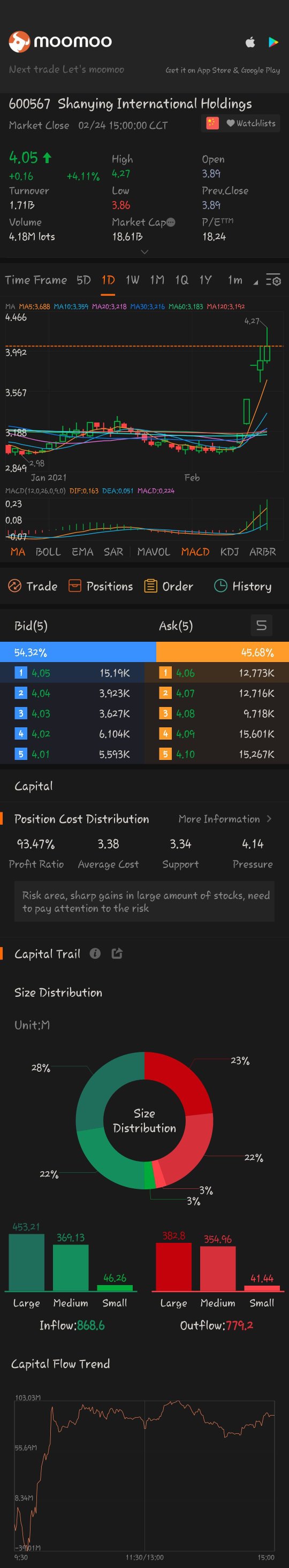

600567 Shanying International Holdings

- 2.06

- +0.03+1.48%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Shanying International Holdings (600567.SH): has repurchased a total of 6.50% of its shares.

On December 24, Gelonghui reported that Shanying International Holdings (600567.SH) announced that as of December 23, 2024, the company's share repurchase plan has been completed. The company has repurchased a total of 355,797,532 shares through centralized bidding, accounting for 6.50% of the company's total share capital. The highest transaction price was 2.15 yuan/share, the lowest transaction price was 1.36 yuan/share, and the average transaction price was 1.69 yuan/share, with a total amount of funds paid of approximately RMB 600,536,111.43 (excluding commission and other transaction fees).

Shanying International Holdings Co.,Ltd (SHSE:600567) Soars 26% But It's A Story Of Risk Vs Reward

Some Investors May Be Worried About Shanying International HoldingsLtd's (SHSE:600567) Returns On Capital

gf sec: The leading papermaking company is reducing production, and the industry is likely to welcome a short-term turning point.

Chenming (000488.SZ) monthly production reduction is expected to have a certain impact on domestic paper prices, short-term supply shrinkage, demand remains unchanged, expected to stop the current downward trend of paper prices, bullish for the industry sentiment to recover.

Hong Kong stock industry concept tracking | Paper companies have set off a new round of price increases, signaling the industry's bottoming out and rebound (with concept stocks).

Since October, many papermaking companies have carried out one or more rounds of price increases. Recently, more companies have announced price adjustment plans for their multiple facilities, leading to paper enterprises in various regions following suit. The entire papermaking industry has ignited a new wave of price hikes.

Shanying International HoldingsLtd (SHSE:600567) Takes On Some Risk With Its Use Of Debt

Comments

Investors in Shanying International HoldingsLtd (SHSE:600567) From Five Years Ago Are Still Down 52%, Even After 5.1% Gain This Past Week

Investors in Shanying International HoldingsLtd (SHSE:600567) From Five Years Ago Are Still Down 52%, Even After 5.1% Gain This Past Week