No Data

6501 Hitachi

- 3739.0

- -71.0-1.86%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average fell significantly by 716 yen, marking a four-day decline, closing below 38,500 yen for the first time in a month and a half on the afternoon of the 14th.

On the 14th, the Nikkei average index fell significantly for the fourth consecutive day, closing at 38,474.30 yen, down 716.10 yen from the previous week. The TOPIX (Tokyo Stock Price Index) ended the trade down 31.54 points at 2,682.58 points. This is the first time since November 29 of last year (38,208.03 yen) that the Nikkei average closed below 38,500 yen—a month and a half later. Furthermore, U.S. tech stocks declined from the previous week to the 13th, and the impact on Japan's Semiconductors-related stocks was significant.

TiandS Research Memo (1): In the period ending September 2025, new initiatives such as M&A, establishment of subsidiaries, and business partnerships will be actively promoted.

■Summary T&S Group <4055> is an independent Software development company specializing in large-scale system development, including semiconductor factories. It provides services across the entire value chain from system requirement definition to maintenance and operation, with major clients including Toshiba Group, Hitachi Ltd Sponsored ADR <6501> Group (hereinafter referred to as Hitachi Group), and Kioxia Corporation Group. A long-standing trust has been built with these major clients.

The Nikkei average is down about 510 yen, showing a weak trend after the initial selling on the 14th morning session.

On the 14th at around 10:06 AM, the Nikkei Stock Average fluctuated around 38,680 yen, down about 510 yen compared to the previous weekend. At 10:03 AM, it reached a low of 38,654.82 yen, down 535.58 yen. In the USA, following the employment statistics for December released the previous weekend, expectations for an interest rate cut have further diminished, leading to an increase in sell-offs of technology stocks. On the 13th, the SOX (Philadelphia Semiconductor Index), which significantly affects Japanese semiconductor-related stocks, also declined. The dollar-yen exchange rate has been moving towards a stronger yen.

Hitachi to Cancel 56.2 Million Shares

ADR Japanese stock ranking - General selling is dominant, including Japan Post Bank, with Chicago down 470 yen compared to Osaka at 38,780 yen.

Japanese stocks of ADR (American Depositary Receipt) compared to the Tokyo Stock Exchange (based on 1 dollar = 157.83 yen) saw declines in stocks like Japan Post Bank (7182), Japan Post (6178), Mitsubishi UFJ Financial Group (8306), Renesas (6723), Advantest (6857), ORIX (8591), and Murata Manufacturing (6981), with a general trend of selling. The clearing price of the Chicago Nikkei 225 Futures was 38,780 yen, a 470 yen drop compared to Osaka during the day. The US stock market declined. The Dow Inc average dropped by 696.75 dollars, closing at 41,9.

Japanese stock buybacks this week (1/6~1/10)

――――1/6――――$Advantage Risk Management(8769.JP)$ will cancel 1 million shares, 5.79% of its outstanding shares, with a cancellation date of 1/31.――――1/7――――$Just Planning(4287.JP)$ will buy back up

Comments

Importance:

1. Efficiency: It can be more energy-efficient than traditional air cooling, reducing energy consumption and operational costs.

2. Heat Management: It effectively dissipates heat from densely packed components, improving reliabili...

$CSOP LOW CARBON US$ (LCU.SG)$ fall was driven by IT, industrials and financials by sector. By country, the decline was led by Japan, Australia and South Korea. By individual firms, the fall was led by Samsung Electronics, $Hitachi (6501.JP)$ and $TENCENT (00700.HK)$. Samsung ...

•LCU’s gains were primarily attributable to industrials, fin...

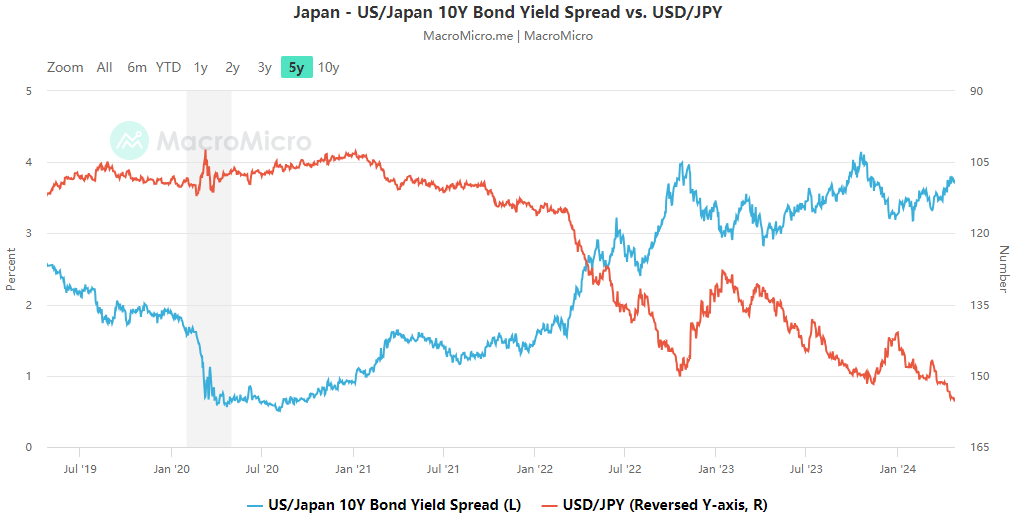

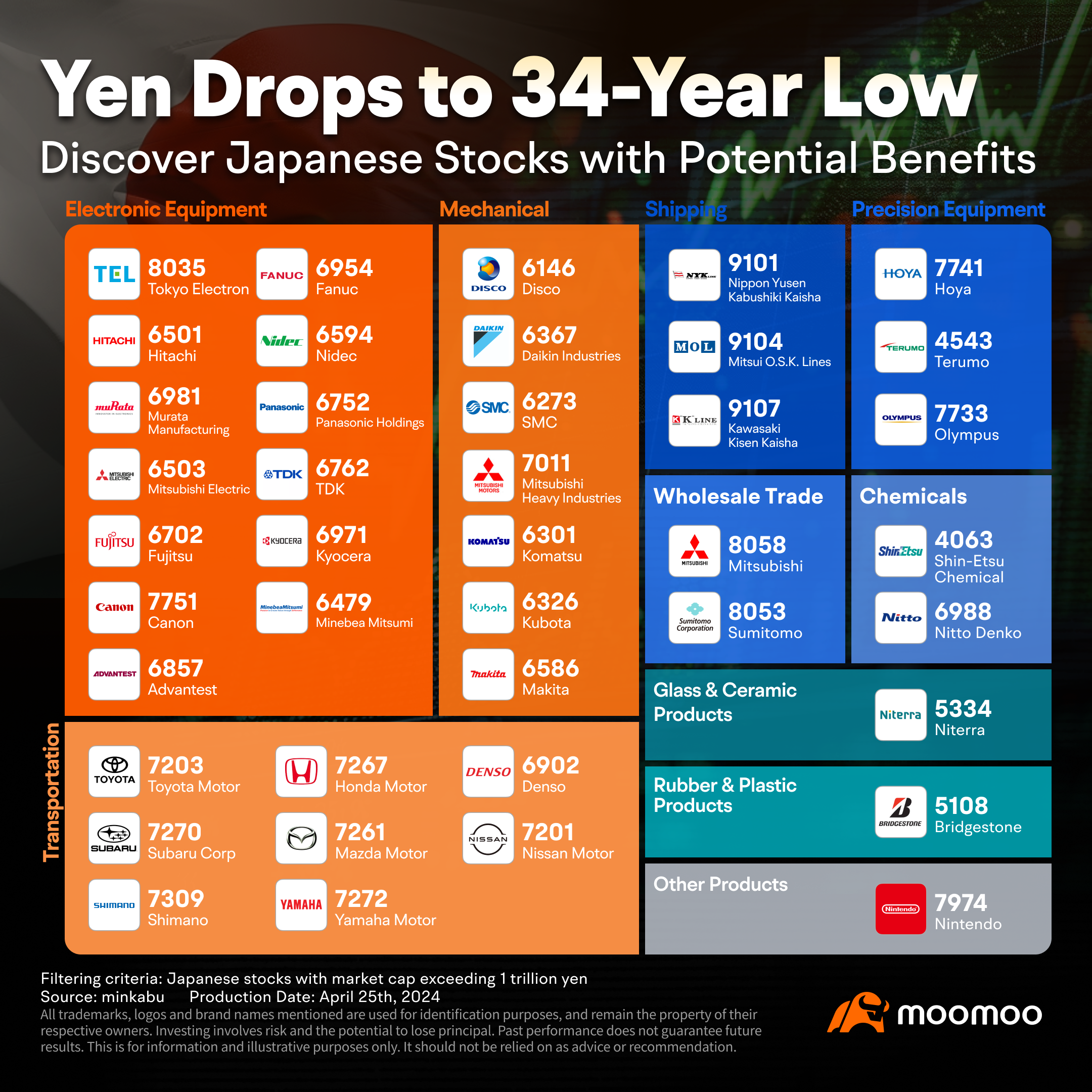

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

10baggerbamm : Elon Musk already alluded to building data centers in space. no need for any cooling...