No Data

6902 Denso

- 2094.0

- +13.5+0.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Sanwa Technos Research Memo (2): For the interim period ending in March 2025, there will be a decrease in sales and profits, but each stage's profits will exceed the Financial Estimates.

For the second quarter of the fiscal year ending in March 2025, the consolidated performance showed a revenue of 69,426 million yen, which is a 21.9% decrease compared to the same period last year. Operating profit decreased by 52.1% to 1,650 million yen, ordinary profit decreased by 54.6% to 1,681 million yen, and the net profit attributable to shareholders of the parent company decreased by 58.7% to 1,271 million yen. Despite these decreases in revenue and profit, each profit stage exceeded the forecasted figures.

Hagiwara Electric HD Research Memo (1): A semiconductor trading company with the Toyota Group as a major customer.

■Summary: Hagiwara Electric Holdings <7467> is a trading company based in Nagoya specializing in Semiconductors, Electronic Components, and Electronic Equipment, as well as a manufacturer of its own products. About 89% of its revenue (for the fiscal year ending March 2024) is from Automotive-related companies, with major clients including DENSO <6902> and other members of the Toyota Group. In recent years, there has been a focus on the solution business. 1. Performance for the second quarter of the fiscal year ending March 2025: The consolidated performance for the second quarter of the fiscal year ending March 2025 shows that revenue was 131,

Three key points to watch in the morning session - attempts to rebound led by technology Shareholders.

In the trading session before the 24th, I want to focus on the following three points. ■ A rebound led by technology stocks is expected. ■ SHIMAMURA, 3rd quarter operating profit increased by 2.0% to 46.5 billion yen. ■ Key material from the morning session: Honda is in discussions to integrate with NISSAN MOTOR CO, aiming for final agreement in June next year. ■ A rebound led by technology stocks is expected. The Japanese stock market on the 24th seems likely to be in a strongly stagnant phase, but the strong inclination for buying on dips will likely be conscious. In the US market on the 23rd, the Dow Jones Industrial Average rose by 66 dollars, and the Nasdaq is at 1.

Honda, Denso, etc. [List of stock materials from the newspaper]

*HONDA <7267> is in discussions to merge with NISSAN MOTOR CO, with a final agreement aimed for June next year (Nikkei Industrial Daily, page 1) - ○ *Alps Alpine <6770> has increased the sensitivity of its 'Magnetic Sensor' by 10 times, investing 15 billion yen for mass production (Nikkei Industrial Daily, page 1) - ○ *Obayashi Corporation <1802> has appointed Toshimi Sato as President, aiming to expand business areas Overseas ETC (Nikkei Industrial Daily, page 3) - ○ *Toyota Industries <6201> has resumed domestic shipments of forklifts, starting with diesel models (Nikkei Industrial Daily, page 3) - ○ *JR Kyushu <9142> is withdrawing from the Japan-Korea high-speed ferry service, ceasing operations.

Today's flows: 12/23 Disco saw an inflow of JPY¥ 8.81 billion, Mitsubishi Heavy Industries saw an outflow of JPY¥ 9.26 billion

On December 23rd, the TSE Main Market saw an inflow of JPY¥ 687.2 billion and an outflow of JPY¥ 648.65 billion.$Disco(6146.JP)$, $Toyota Motor(7203.JP)$ and $Advantest(6857.JP)$ were net buyers of

Regarding organizational changes and personnel transfers.

Comments

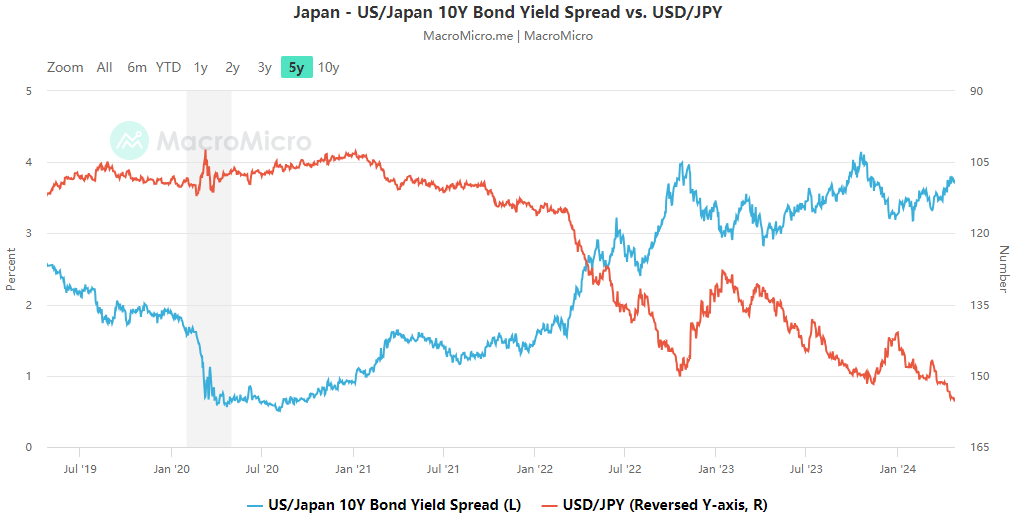

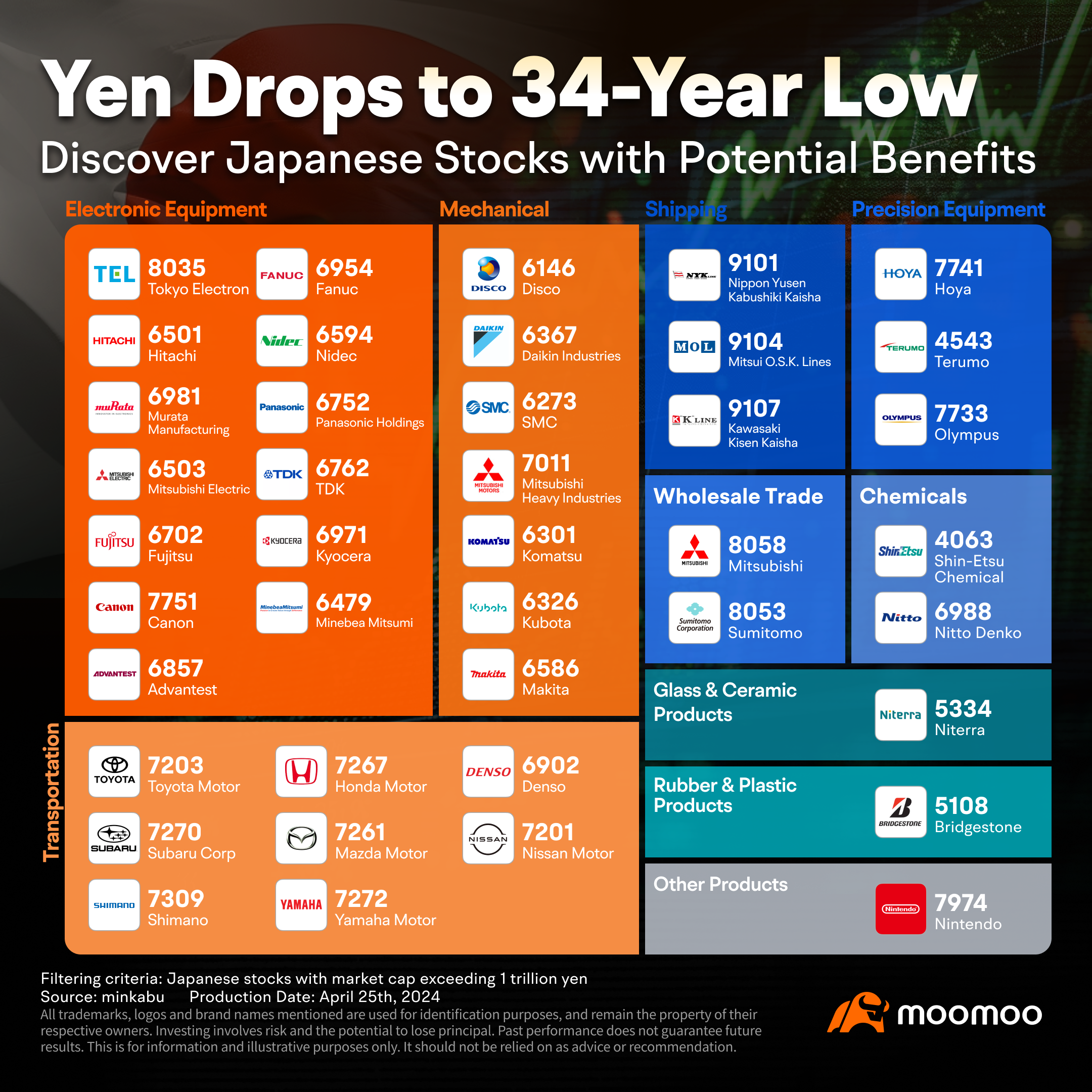

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...