No Data

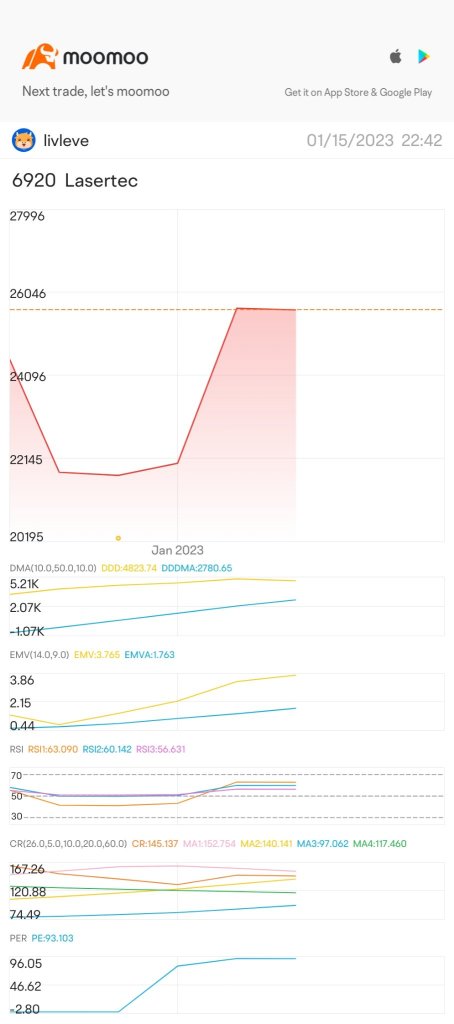

6920 Lasertec

- 13890.0

- +250.0+1.83%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Today's flows: 03/06 Mitsubishi Heavy Industries saw an inflow of JPY¥ 36.07 billion, Advantest saw an outflow of JPY¥ 6.34 billion

On March 6th, the TSE Main Market saw an inflow of JPY¥ 933.18 billion and an outflow of JPY¥ 898.27 billion.$Mitsubishi Heavy Industries(7011.JP)$, $IHI(7013.JP)$ and $Seven & i Holdings(3382.JP)$

The Nikkei average is up about 80 yen, with Socionext, Yokogawa Electric, and Laser Tech among the top gainers in the selected stocks.

On the 5th at 11:02 AM, the Nikkei average stock price fluctuated around 37,410 yen, about 80 yen higher compared to the previous day. At 9:15 AM, it reached 37,536 yen and 23 sen, up 205 yen and 05 sen with the yen appreciating by 31 sen. On the local 4th, US stocks fell due to concerns about the impact on the US economy following the Trump administration's implementation of tariffs on Canada and Mexico and additional tariffs on China. However, after President Trump warned against the weakening of the yen the previous day, there was a reaction where the dollar-yen exchange rate shifted towards a stronger yen.

The Nikkei average is down about 1,180 yen, with trading volume led by Fujikura, Disco, and Advantest.

On the afternoon of the 28th, around 2 PM, the Nikkei average stock price fluctuated near 37,070 yen, down about 1,180 yen from the previous day. The market opened in the afternoon with a strong sell-off, expanding the decline. At 12:50 PM, there was a moment when it reached 36,840 yen, down 1,416.05 yen. After the sell-off subsided, it appears that the decline has narrowed due to a sense of overselling in the short term. The foreign exchange market was stable at around 149.70 yen per dollar. The top stocks by volume in the afternoon around 2 PM (Main Board) included NTT <9432.T>.

Stocks that moved or were traded in the first half of the session.

* Tohoku Electric Power <9070> 7870 - The movement continues to align with the TOB price due to the announcement of the implementation of an MBO. * GMO Internet <4784> 1362 +141 Especially with no new materials, it seems to be influenced by supply and demand factors at the end of the month. * Aichi Steel <5482> 7220 +460 Announced the implementation of a Share Buyback in off-hours trading. * Hokuriku Electric Power <9505> 833.2 +44.4 Adjusted financial estimates and dividends upward. * SRE HD <2980> 3180 +100 The sale price has also been determined, and buybacks are underway.

Petroleum resources, light industry, etc. (additional) Rating

Upgraded - Bullish Code Stock Name Brokerage Firm Previous Changed After-------------------------------------------------------------<268A> Rigaku Nomura "Hold" "Buy" <3626> TIS GS "Hold" "Buy" <4528> Ono Pharmaceutical City "3" "2" <6752> Panasonic HD Morgan Stanley "Equal Weight" "Over Weight" <7735> Screen Morgan Stanley "Equal Weight" "Over Weight"

Rating information (Target Price change - part 2) = SUMCO, Chugai Pharmaceutical, ETC.

◎ Mizuho Securities (three levels: Buy > Hold > underperform) SUMCO <3436.T> -- "Buy" → "Buy", 2300 yen → 2100 yen UBE <4208.T> -- "Buy" → "Buy", 3600 yen → 3000 yen M3 <2413.T> -- "Hold" → "Hold", 1600 yen → 1900 yen ◎ Morgan Stanley MUFG Securities (three levels: Overweight > Equal Weight > Underweight) Chugai Pharmaceutical <4519.T> -- "Overweight"

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are mixed, with MACD advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support could open next drop towa...

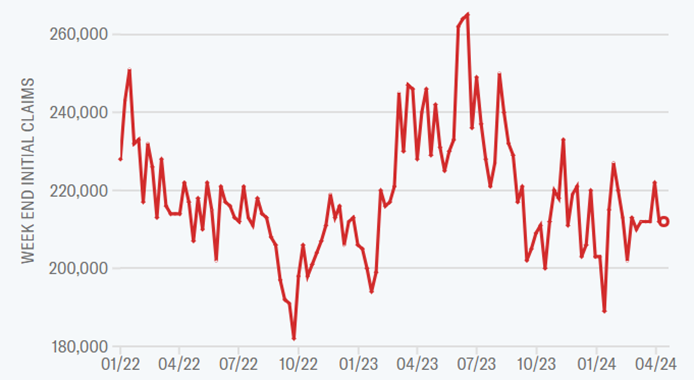

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.6...

Cui Nyonya Kueh :

SS5GG Cui Nyonya Kueh : How did this emoji come about?

Buy n Die Together❤ :

Cui Nyonya Kueh Buy n Die Together❤ :

172727077 :