No Data

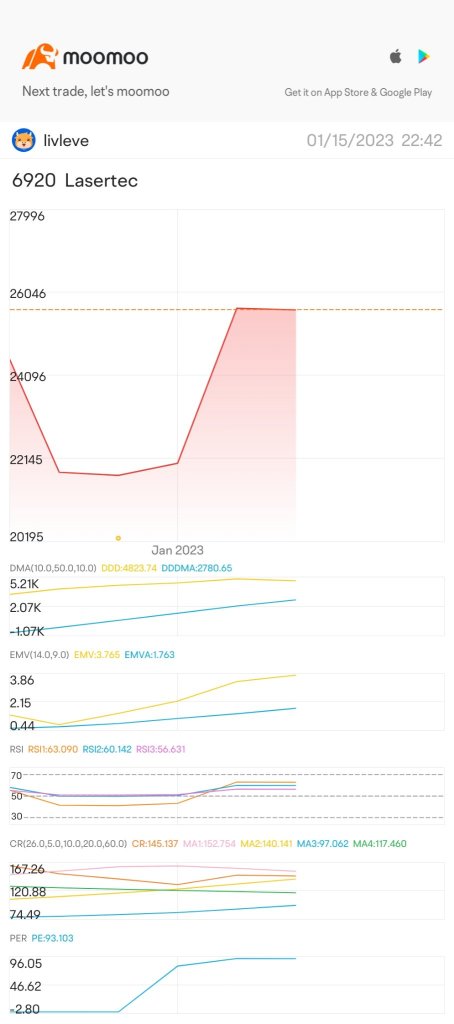

6920 Lasertec

- 15700.0

- +215.0+1.39%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

JP Movers | Nissan Motor Rose 23.70%, Leading Nikkei 225 Components, Advantest Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Nissan Motor(7201.JP) being the top gainer today, rising 23.70% to close at 417.6 yen. In addition, the top loser was Sumitomo Pharma(4506.JP),falling 4.46% to end at 579.0 yen.

Today's flows: 12/18 Nissan Motor saw an inflow of JPY¥ 20.47 billion, SoftBank Group saw an outflow of JPY¥ 7.59 billion

On December 18th, the TSE Main Market saw an inflow of JPY¥ 782.73 billion and an outflow of JPY¥ 799.86 billion.$Nissan Motor(7201.JP)$, $Disco(6146.JP)$ and $Mitsubishi Motors(7211.JP)$ were net

Nikkei Average Contribution Ranking (pre-close) ~ The Nikkei Average has fallen for four consecutive days, and SoftBank Group has pushed it down by about 66 yen for one stock.

As of the close on 18 days ago, the number of rising and falling stocks in the Nikkei average was 116 stocks up, 108 stocks down, and 1 stock unchanged. The Nikkei average has declined for four consecutive days. It ended the morning trading at 39,281.06 yen, down 83.62 yen (-0.21%) from the previous day (with an estimated Volume of 1.1 billion 60 million shares). On the 17th, the US stock market fell. The Dow Inc. decreased by 267.58 dollars to 43,449.90 dollars, and the Nasdaq dropped by 64.83 points to 20,109.06.

The Nikkei average started 187 yen lower, with declines in Sony Group Corp, Advantest, ETC.

[Nikkei Average Stock Price・TOPIX (Table)] Nikkei Average; 39176.88; -187.80 TOPIX; 2722.24; -5.96 [Opening Overview] On the 18th, the Nikkei Average started trading at 39176.88 yen, down 187.80 yen, marking four consecutive declines. The previous day, on the 17th, the US stock market fell. Dow Inc decreased by 267.58 dollars to close at 43449.90 dollars, while Nasdaq finished down 64.83 points at 20109.06. With long-term interest rates remaining high, after opening...

Three points to focus on in the first half of the market - short-term trading is the main focus while waiting for the results of the FOMC.

In the trading session before noon on the 18th, I would like to focus on the following three points. ■ Short-term trading is the focus while waiting for the FOMC results. ■ Estelle, 2Q operating loss, deficit narrowed by ▲0.317 billion yen. ■ Materials of interest in the morning session: Toyota's Lexus "UX" production has ended, focusing on next-generation EVs. ■ The Japanese stock market on the 18th is likely to exhibit a strong sense of stagnation. In the US market on the 17th, the Dow Jones Industrial Average fell by 267 points, while the Nasdaq dropped by 64 points. Morning updates...

Toyota Motor, Sumitomo Pharma, etc.

*Toyota <7203> ends production of the Lexus 'UX' and focuses on next-generation EVs (Nikkankogyo, page 1) - ○ *Honda <7267> aims to double hybrid vehicle production by 2030, targeting global sales of 1.3 million units per year (Nikkankogyo, page 1) - ○ *Sumitomo Pharma <4506> and Sumitomo Chemicals establish a new company for regenerative and cell medicine, aiming for a scale of 350 billion yen in the late 2030s (Nikkankogyo, page 3) - ○ *Tokyo Gas <9531> signs an agreement with McDonald's to supply renewable energy to 75 stores in the Kanto area (Nikkankogyo, page 3) - ○ *Japan Escon <8892> Mitsubishi Chemicals.

Comments

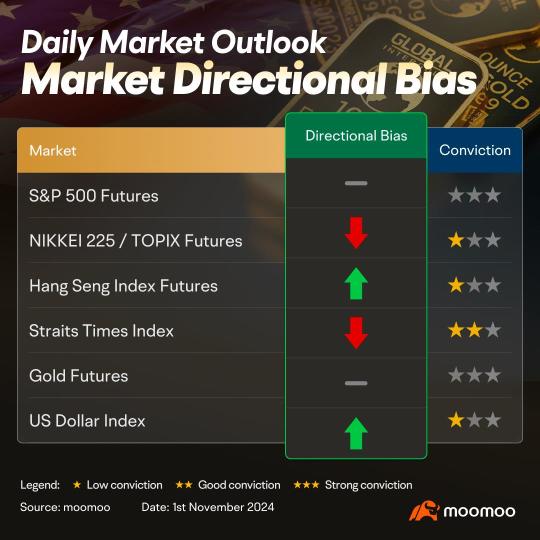

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are mixed, with MACD advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support could open next drop towa...

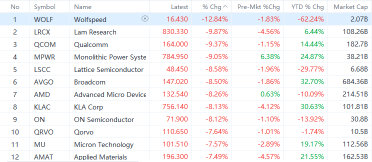

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.6...

Cui Nyonya Kueh :

SS5GG Cui Nyonya Kueh : How did this emoji come about?

Long kuku bird ❤ :

Cui Nyonya Kueh Long kuku bird ❤ :

172727077 :