No Data

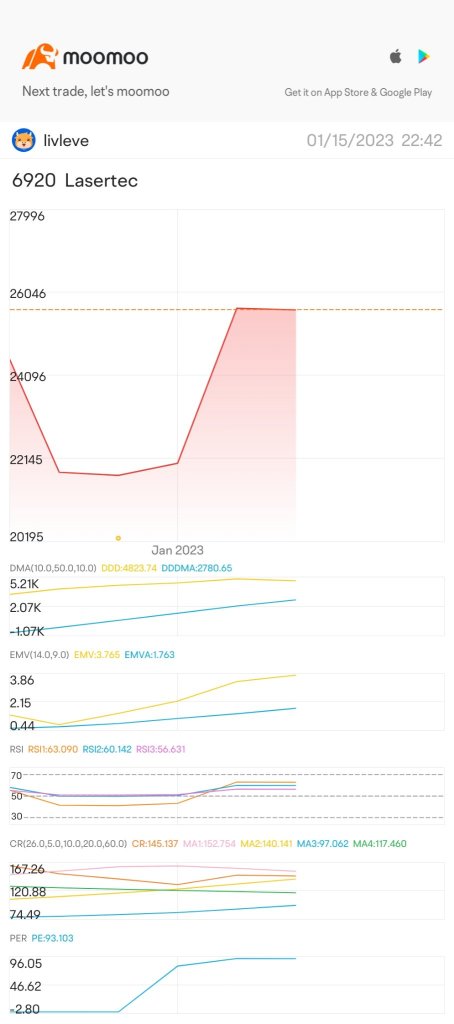

6920 Lasertec

- 14510.0

- +145.0+1.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

After the Sell leading, there is a movement to buy dips with a short-term bottom awareness.

The Nikkei average made a slight rebound, closing at 36,819.09 yen, up 25.98 yen (with an estimated Volume of 1.8 billion 80 million shares). The trading began with selling due to concerns over worsening economic sentiment caused by President Trump's high tariff policies, which pushed the index down to 36,658.86 yen shortly after the trading started. However, the previous day's drop had seen the index dip below the critical 36,000 yen mark for the first time in six months, prompting views that a near-term bottom had been reached, which supported the market, and buying aimed at a self-rebound also entered afterwards.

The Nikkei index is up by about 50 yen, with stocks like LINE and Yahoo, Concordia, and Mitsubishi Heavy Industries ranking among the highest in price increases.

On the 12th at around 11:08 AM, the Nikkei Stock Average is trading approximately 50 yen higher than the previous day, near 36,745 yen. At 9:25 AM, it reached 36,956.33 yen, up 163.22 yen. Following the decline in US stocks on the 11th local time, selling was ahead in the morning. However, the excessive caution eased after US President Trump indicated on the 11th that he would review the additional tariffs on Canada and Ukraine accepted the US-proposed ceasefire plan with Russia for 30 days.

The Nikkei average is up 50 yen, showing strong performance after the shift to an upward trend = 12 days ago.

At around 10:06 AM on the 12th, the Nikkei average stock price fluctuated around 36,845 yen, up about 50 yen from the previous day. At 9:25 AM, it hit 36,956.33 yen, up by 163.22 yen. On the 11th, U.S. President Trump announced that a 25% additional tariff would be imposed on Iron & Steel and Aluminum imported from Canada. With the previous increase combined, the tariff rate will rise to 50%, raising concerns about the impact on the U.S. economy, leading to a continued decline in U.S. stocks. President Trump has indicated a plan to review the additional tariffs.

The Nikkei average is down about 470 points, with the trading volume led by LaserTech, IHI, and Disco.

As of just after 2 PM on the 11th, the Nikkei average stock price is fluctuating around 36,560 yen, down about 470 yen from the previous day. In the afternoon session, trading started with a slight Buy dominance. While caution is warranted due to selling waiting for a rebound, there seems to be a movement to pick up dips and Buy aimed at the rebound from a sharp drop, which is helping to reduce the extent of the decline. The foreign exchange market is currently wavering around 147.50 yen per dollar. Volume leaders just after 2 PM in the Main Board market include NTT <9432.T>, Mitsubishi UFJ <8306.T>, and Yu-chi.

The Nikkei Average dropped about 590 points, with major negative contributions from SoftBank Group, Tokyo Electron, and Recruit Holdings.

As of 12:46 PM on the 11th, the Nikkei Stock Average is around 36,440 yen, down about 590 yen from the previous day. In the afternoon session, trading began slightly favoring Buy, and there was a movement to reduce the decline. After that, it fluctuated around the previous day's closing value. The foreign exchange market is in a range with 1 dollar at around 147.10 yen. The contribution of the stocks included in the Nikkei index shows negative contributions from SoftBank Group <9984.T>, Tokyo Electron <8035.T>, and Recruit Holdings <6098.T> at the top. On the positive side, Yokogawa Electric

Although high-tech stocks are steady, there is a stagnation around 37,000 yen.

The Nikkei average rebounded, ending the trade at 37,028.27 yen, up 141.10 yen (Volume approximately 1.7 billion shares). It started with buying due to the rise in US stocks at the end of the previous week, but comments from President Trump led to uncertainty, and there were moments when the Nikkei average turned down to 36,705.02 yen. However, due to the continuous drop in stock prices, there were movements to pick up dips, and the yen, which was close to falling below 147 yen per dollar for a time, stabilized in the late 147 yen range, resulting in a buying movement.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are mixed, with MACD advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support could open next drop towa...

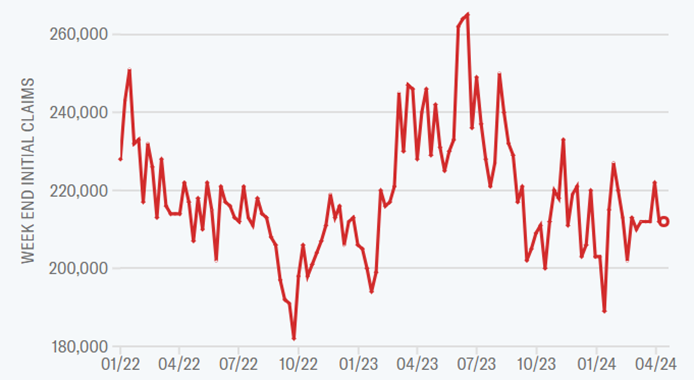

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.6...

Cui Nyonya Kueh :

SS5GG Cui Nyonya Kueh : How did this emoji come about?

Buy n Die Together❤ :

Cui Nyonya Kueh Buy n Die Together❤ :

172727077 :