No Data

7201 Nissan Motor

- 443.0

- -1.8-0.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

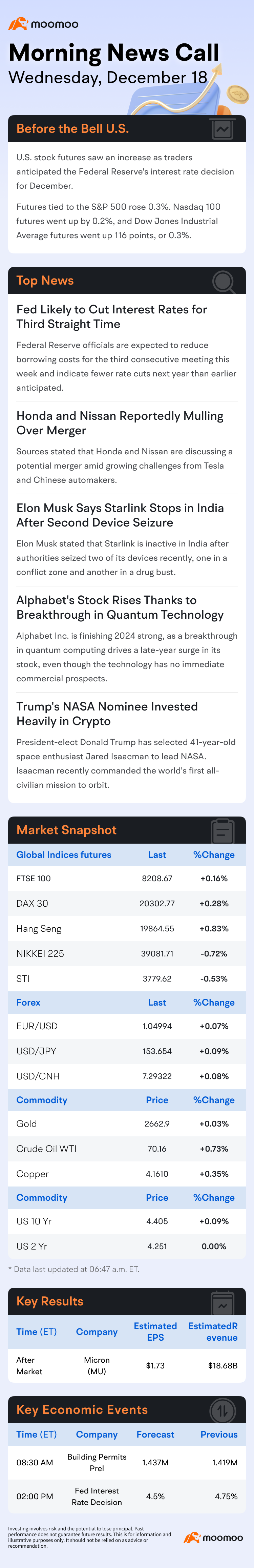

Three points to watch in next week's market: Governor Ueda's speech at the Bank of Japan, key opinions in the December Bank of Japan meeting, and the US Consumer Confidence Index.

■Financial Estimates for Stock Market Outlook Range: Upper limit 39,500 yen - Lower limit 38,000 yen. On the 20th, the U.S. stock market rose. The Dow Inc. average closed at 42,840.26 dollars, up 498.02 dollars from the previous day, and the Nasdaq finished trading at 19,572.60, up 199.83 points. The Osaka Night Session's Nikkei 225 Futures ended trading at 38,880 yen, up 170 yen from the day session closing price. In the foreign exchange market, the dollar-yen exchange rate was trading around 156.40 yen per dollar. The last major event of the year is the Japan-U.S. central bank meetings.

Domestic Stocks market outlook: After the important events in Japan and the United States, the market is expected to be centered around individual investors.

The Nikkei average fell by 768.54 yen (-1.95%) to 38,701.90 yen this week, influenced by a sharp drop in U.S. stocks caused by a "hawkish" rate cut. Amid a strong mood to gauge the results of the Federal Open Market Committee (FOMC) meeting held by the U.S. Federal Reserve on the 17th and 18th, and the monetary policy meeting by the Bank of Japan on the 18th and 19th, Japanese stocks also experienced a slight decline in response to the steep drop in U.S. stocks. The FOMC cut rates by 0.25% as expected.

Emerging Markets outlook: Attention may turn towards lightly traded ultra-low-priced stocks and biotech-related stocks.

■ Emerging Markets are left out of the investment choices. This week, Emerging Markets declined. During the same period, the Nikkei average fell by -1.95%, while the Growth Market Index fell by -2.67%, and the Growth Market 250 Index fell by -3.09%, indicating that Emerging Markets were relatively weaker. As attention turns to the central bank meetings in Japan and the United States, reports of Nissan <7201> and Honda <7267> beginning discussions on a management integration have redirected interest towards auto stocks and Auto Parts suppliers in the Main Board, leaving Emerging Markets out of the investment picture.

Former Nissan chief Ghosn: Seeking an agreement with Honda is a desperate move, and there is little chance of synergy between the two companies.

Former Nissan Auto Chairman Carlos Ghosn stated that the troubled Japanese Auto Manufacturers are seeking to reach an agreement with Honda Motor, indicating that the former is in a "panic mode." "This is a desperate move," Ghosn said on Friday, "It is not a pragmatic Trade, because frankly, it is difficult to find synergies between the two companies." Ghosn indicated that the negotiations regarding a potential merger with Honda suggest that Nissan Auto is in a "panic mode." Earlier this week, Honda confirmed that the company is considering various options, including merging with Nissan, capital alliances, or establishing a holding company. Reports indicate that Hon Hai Precision (also known as Foxconn) is currently...

The major defeat of Japanese automotive giants.

The difficulty of transformation.

Market Chatter: Foxconn Reportedly Pauses Interest in Nissan Amid Honda Merger Talks

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

🔸 Chinese Stocks Surge on Return from Holidays as Euphoria Extends. Chinese stocks listed onshore jumped as trading resumed following a week-long holiday, with encouraging home sales and consumption data giving fresh impetus to a rally sparked by Beijing’s stimulus blitz. The benchmark CSI 300 Index and SSEC Index climbed almost 11% in early trading before paring its advance. The measure h...

![Chinese Stocks Surge on Return from Holidays as Euphoria Extends [CSOP Global Market Morning Report]](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20241008/1728367312428-c514003b5c.jpeg/thumb?area=999&is_public=true)

No Data