No Data

7741 Hoya

- 19530.0

- -685.0-3.39%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock ranking ~ Japan Post and others generally showing a slight buy advantage, Chicago is 175 yen higher than Osaka at 38,885 yen ~

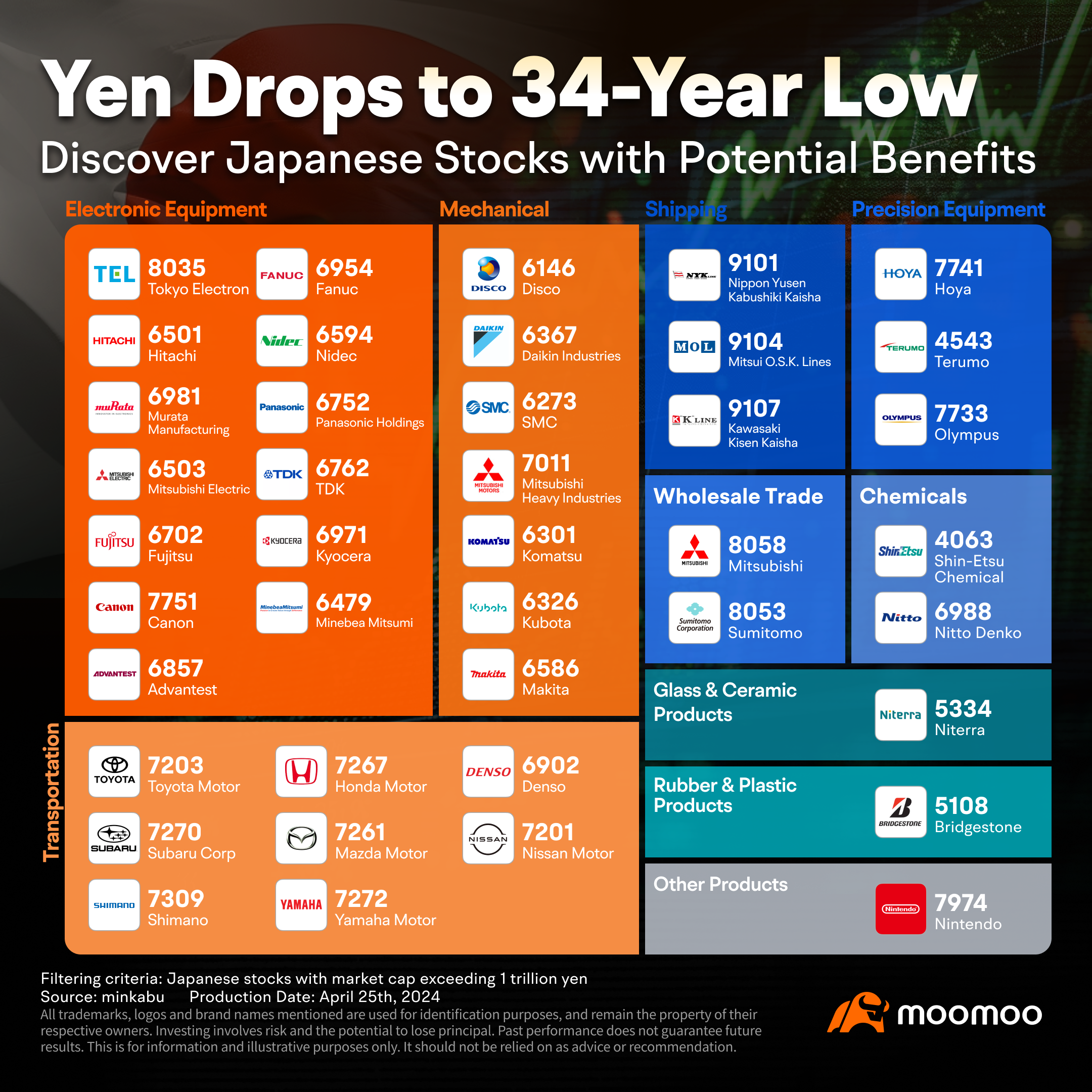

Japanese stocks for ADR (American Depositary Receipt), compared to the Tokyo Stock Exchange (calculated at 156.15 yen per dollar), include Japan Post Holdings <6178>, Tokyo Electron <8035>, Toyota Industries <6201>, Honda Motor Co. <7267>, Mitsui & Co. <8031>, Disco <6146>, SoftBank Group <9984>, etc. The stocks that rose include Japan Post Bank <7182>, Seven & I Holdings <3382>, Mitsubishi Corporation <8058>, Nidec <6594>, Kddi Corporation <9433>, JAPAN TOBACCO INC <29.

Stocks that moved the day before part 2 Veru Inc, Hamee, GFA ETC.

Stock Name <Code> 20-Day Closing Price ⇒ Day-on-Day Comparison Tanpaku Co. <9743> 978 -42 Strong sense of completion in the movements due to good earnings evaluation. Rakuten Bank <5838> 4385 -143 Pressured by the decline in bank stocks. Kyushu Electrical Utilities <9508> 1333 -4311 Below the November low, with cutting losses becoming dominant. IHI <7013> 8347 -257 SMBC Nikko Securities has downgraded the investment rating. HOYA <7741> 19530 -685 Softness in Semiconductors stocks leads to dominant selling on rebounds.

Nikkei Average Contribution Ranking (Close) ~ The Nikkei Average fell for the sixth consecutive day, with SoftBank Group and Advantest contributing to a decrease of about 73 yen from the two stocks.

As of the close on the 20th, the number of rising and falling stocks in the Nikkei average was 105 that rose, 115 that fell, and 5 that remained unchanged. The US stock market was mixed on the 19th. The Dow Inc rose by $15.37 to close at $42,342.24, while the Nasdaq dropped by 19.93 points to close at 19,372.77. After the opening, there was an increase. The sudden drop the previous day following the Federal Open Market Committee (FOMC) indicating a slowdown in the Federal Reserve's (FRB) pace of additional interest rate cuts was not sustained.

The Nikkei average fell for the sixth consecutive day, closing at a low due to the decline in financial stocks.

On the 19th, the U.S. Stocks market was mixed. The Dow Inc. rose by $15.37 to close at $42,342.24, while the Nasdaq fell by 19.93 points to end at $19,372.77. After the opening, the market experienced an upward movement. The sharp drop the previous day, due to the indication from the Federal Reserve Board (FRB) of a slowdown in the pace of additional interest rate cuts during the Federal Open Market Committee (FOMC), was seen as an overreaction, leading to a wave of buying. The domestic Gross Domestic Product (GDP) for the July to September period was revised upward, and new unemployment Insurance claims were announced in the morning.

JP Movers | Sumitomo Realty & Development Rose 5.49%, Leading Nikkei 225 Components, Disco Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Sumitomo Realty & Development(8830.JP) being the top gainer today, rising 5.49% to close at 4781.0 yen. In addition, the top loser was Toppan Holdings(7911.JP),falling 7.29% to end at 3855.0 yen.

The Nikkei average fell by 62 yen, with attention on the US PCE Index ETF and others.

The Nikkei average is down 62 yen (as of 14:50). In terms of contribution to the Nikkei average, SoftBank G <9984>, Advantest <6857>, and HOYA <7741> are among the top negative contributors, while TDK <6762>, Recruit HD <6098>, and Toyota <7203> are among the top positive contributors. In terms of sectors, the Banking Sector, Other Products, Air Transportation, Precision Instruments, and Electricity & Gas sector are seeing significant declines, while Real Estate, Oil & Coal Products, Transportation Equipment, and Construction are also mentioned.

Comments

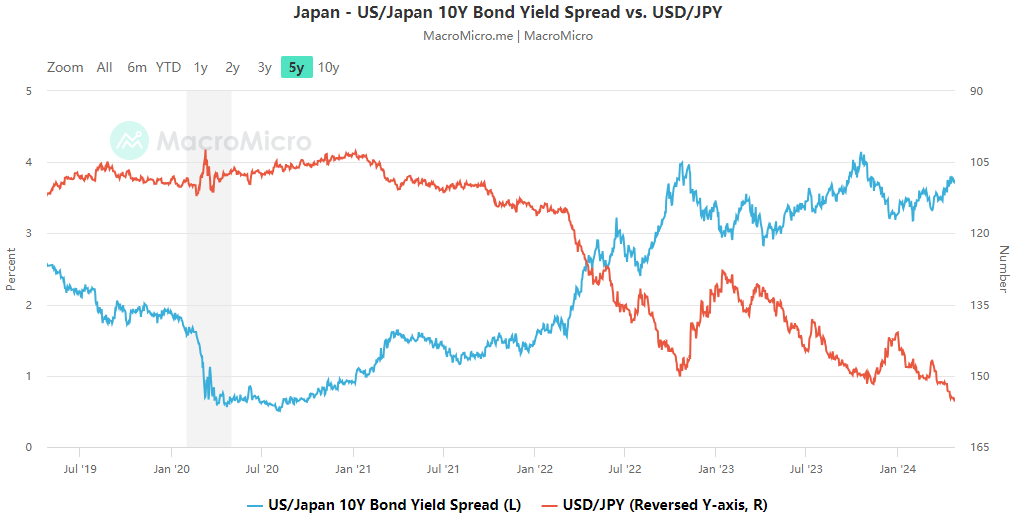

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

No Data