No Data

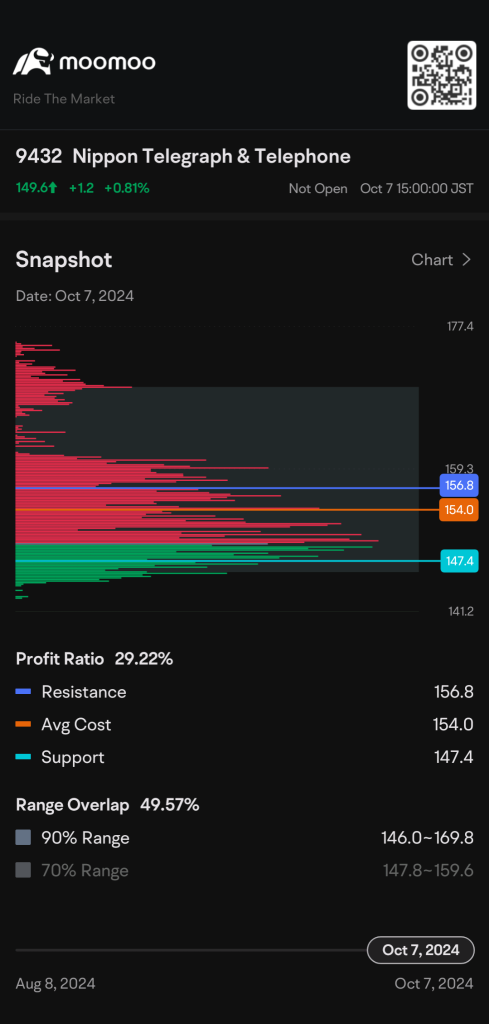

9432 Nippon Telegraph & Telephone

- 157.7

- +2.4+1.55%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Defense spending is increasing, and Japan's total budget for 2025 will reach a record 115 trillion yen.

In the new budget proposal, the spending items with the largest increase include: a significant increase of over 10% in defense spending, reaching 8.5 trillion yen; and an approximately 7% increase in allocations to local governments. Due to record high tax revenues, the scale of newly issued government bonds will decrease by nearly one-fifth, down to 28.6 trillion yen.

Three key points to watch in the first half of the session - Expectations for inflow of funds as the market effectively enters 2025.

In the trading session 27 days ago, three key points should be noted: ■ Expectation of capital inflow due to the effective entry into the 2025 market ■ Okaya Steel, 3Q operating profit increased by 4.6% to 25.8 billion yen ■ Noteworthy materials in the morning session: Toho Gas, developing the first burner in Japan that burns hydrogen using indirect and thermal storage methods. In the Japanese stock market on the 27th, although the number of market participants is limited, a strong buying willingness is expected. Following Christmas, the US market on the 26th saw the Dow Jones Industrial Average rise by 28 dollars, na

Today's flows: 12/25 Nissan Motor saw an inflow of JPY¥ 7.75 billion, Japan Tobacco saw an outflow of JPY¥ 4.37 billion

On December 25th, the TSE Main Market saw an inflow of JPY¥ 591.39 billion and an outflow of JPY¥ 624 billion.$Nissan Motor(7201.JP)$, $Fast Retailing(9983.JP)$ and $Honda Motor(7267.JP)$ were net

Today's flows: 12/24 Nissan Motor saw an inflow of JPY¥ 4.33 billion, Honda Motor saw an outflow of JPY¥ 16.54 billion

On December 24th, the TSE Main Market saw an inflow of JPY¥ 582.9 billion and an outflow of JPY¥ 641.95 billion.$Nissan Motor(7201.JP)$, $Mitsubishi(8058.JP)$ and $Mitsubishi Motors(7211.JP)$ were

Tobishima Holdings Research Memo (5): Construction business and growth business are directed towards the infrastructure anti-aging industry.

■ The future outlook for Tobishima Holdings <256A> (1) Construction business a) "Short-term" perspective The company will deepen its construction business. It believes that due to the aging population, the economy itself will shift towards a circular model, and consequently, the demand for renovation will increase compared to new construction. Therefore, in the short term, the policy is to increase the proportion of renovation. On the other hand, it will promote labor-saving in the construction process through a review of operations utilizing digital technology. Furthermore, this labor-saving will yield...

ADR Japanese stock rankings - Honda Motor Company and overall buying prevailing, Chicago is up 115 yen from Osaka at 39,305 yen.

Japanese stocks for ADR (American Depositary Receipt) show an increase compared to the Tokyo Stock Exchange (calculated at 1 dollar to 157.16 yen), including Honda Motor Co., Ltd. <7267>, Japan Post Holdings Co., Ltd. <6178>, Toyota Industries Corporation <6201>, Tokyo Electron Ltd. <8035>, Advantest Corporation <6857>, Disco Corporation <6146>, Hitachi Ltd Sponsored ADR <6501>, and a general trend of Buy was dominant. The settlement price for Chicago Nikkei 225 Futures was 39,305 yen, which is 115 yen higher than the Osaka daytime rate. The U.S. stock market continues to rise, with the Dow Inc average up by 66.69 dollars.

Comments

Do you find it

Yes?

No worries!

Why not try these methods to get rewards bigger

To get rewards bigger than the yield coupon, Mooers may exchange 400 coins for 1000 MooMoo points.

Let's assume Mooers managed to collect 4000 coins. This would mean that Mooers could exchange f...

As strong as the U.S. economy, Japan Property is probably the best investment in 2023.

Why? Here are 4 reasons as follows:

Besides, even Warren Buffett, via Berkshire Hathaway ( $Berkshire Hathaway-A (BRK.A.US)$ , $Berkshire Hathaway-B (BRK.B.US)$ , $Warren Buffett Portfolio (LIST2999.US)$ ) has increased his holdings of Japanese stocks.

Also, the Nikkei 225 ( $Nikkei 225 (.N225.JP)$ ) YTD performance is 28.51%, much higher than S&P 500 ( $S&P 500 Index (.SPX.US)$ ) YTD of ...

It is also the largest publicly traded company in Japan after $Toyota Motor (7203.JP)$ and $Sony Group (6758.JP)$.

It has a great track record in dishing out dividends. And judging by its stability, it could be one of the stocks that Japanese investors might consider in curating their first stock portfolio.

Here are some important points I picke...