No Data

9983 Fast Retailing

- 54690.0

- +1440.0+2.70%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Recovery to 0.04 million yen level due to expectations for the New Year market.

The Nikkei average rose significantly for the third consecutive day. It ended at 40,281.16 yen, up 713.10 yen (with an estimated Volume of 2.1 billion 30 million shares), recovering to the 0.04 million yen level for the first time in about five and a half months since July 19. The yen rate weakened to around 158 yen to the dollar in the previous day's Overseas market, leading to early buying focused on export stocks such as Automobiles, and the Nikkei average started to rise. Just before the midday close, it recovered to the 0.04 million yen level for the first time in about two weeks. Afterwards, Semiconductor-related stocks and other high-value stocks continued to rise.

Today's flows: 12/27 Fast Retailing saw an inflow of JPY¥ 8.58 billion, Toyota Motor saw an outflow of JPY¥ 10.14 billion

On December 27th, the TSE Main Market saw an inflow of JPY¥ 850.32 billion and an outflow of JPY¥ 742.74 billion.$Fast Retailing(9983.JP)$, $Advantest(6857.JP)$ and $Disco(6146.JP)$ were net buyers

The Nikkei average is up 805 points, reaching its highest level since July.

The Nikkei average is up 805 yen (as of 14:50). In terms of contribution to the Nikkei average, Fast Retailing <9983>, Advantest <6857>, and Tokyo Electron <8035> are among the top positive contributors, while Yamaha Motor <7272>, Nissan Motor <7201>, and JT <2914> are among the top negative contributors. In the Sector, Pharmaceuticals, Electric & Gas Industry, Service Industry, Electric Appliances, and Iron & Steel are showing the highest rates of increase, while Mining and Rubber Products are declining. The Nikkei average is 0.04 million.

Nikkei Average Contribution Ranking (Preliminary Close) - The Nikkei Average significantly rose for three consecutive days, with Fast Retailing boosting it by about 85 yen from one stock.

As of the market close 27 days ago, the number of rising and falling stocks in the Nikkei average was 190 up, 34 down, and 1 unchanged. The Nikkei average has risen for three consecutive days. It finished the morning session at ¥40,074.56, up ¥506.50 (+1.28%) compared to the previous day (estimated Volume of 0.9 billion 30 million shares). The US stock market on the 26th was mixed. The Dow Inc was up $28.77 at $43,325.80, while the Nasdaq ended down 10.77 points at $20,020.36. Unemployment Insurance.

Futures Buy observations and others have led to a recovery of the 40,000 yen range for the first time in two weeks.

[Nikkei Average and TOPIX (Table)] Nikkei Average; 40074.56; +506.50 TOPIX; 2794.54; +27.76 [Investment Strategy for the Afternoon Session] Many market participants expected the Nikkei Average to remain flat today due to the December rights fall (approximately 50 yen), but it unexpectedly regained the 40,000 yen level with surprising strength. Although there is a lack of notable buying observations, there is purchasing activity in major impactful stocks such as Recruit Inc. <6098> and Fast Retailing <9983>.

ADR Japanese stock rankings - mixed highs and lows, Chicago is up 210 yen from Osaka at 39,700 yen.

Japanese stocks of ADR (American Depositary Receipt), in comparison with the Tokyo Stock Exchange (calculated at 1 dollar = 157.88 yen), saw increases in Japan Post Holdings <6178>, Toyota Motor <6201>, Mitsubishi UFJ Financial Group <8306>, Tokyo Electron <8035>, Mitsubishi Corporation <8058>, Denso <6902>, etc. while Japan Post Bank <7182>, JAPAN TOBACCO INC <2914>, Nidec <6594>, Toyota Motor <7203>, Bridgestone Corporation Unsponsored ADR <5108>, Honda Motor Co., Ltd <7267>, etc. declined.

Comments

Anyone else love UNIQLO?

$Fast Retailing (9983.JP)$

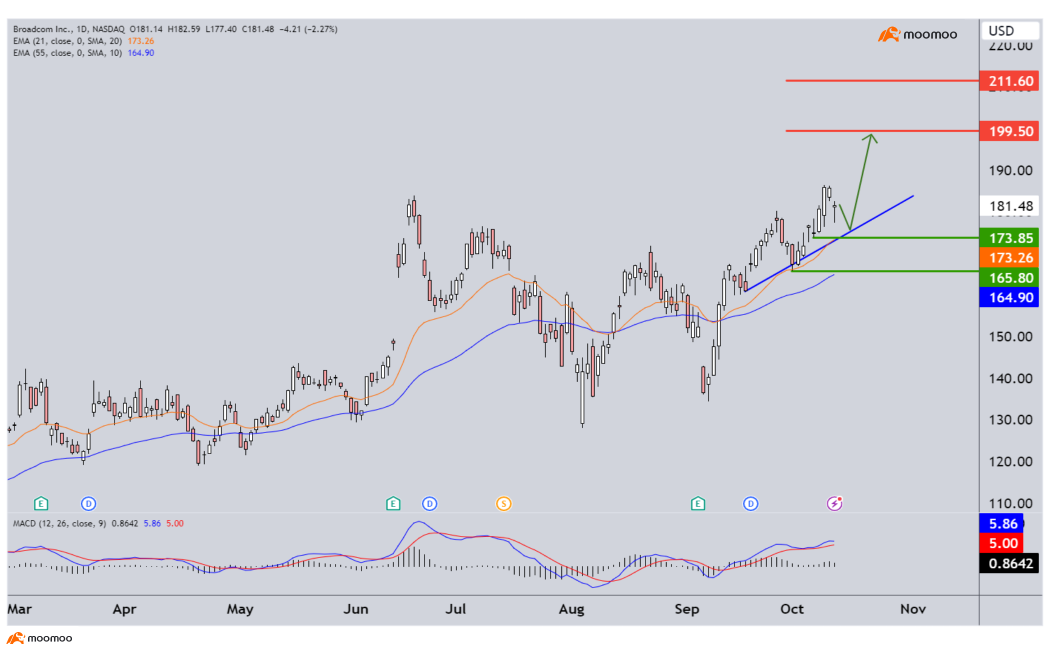

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

Pulte Group Inc (PHM US) $PulteGroup (PHM.US)$

Daily Chart -[BULLISH ↗ **] PHM shaped a bullish breakout of ascending wedge. As long as price is holding above 136.28 support, a further push higher towards 152.00 resistance is expected. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below 136.28 support will open a drop towards next support at 129.80...

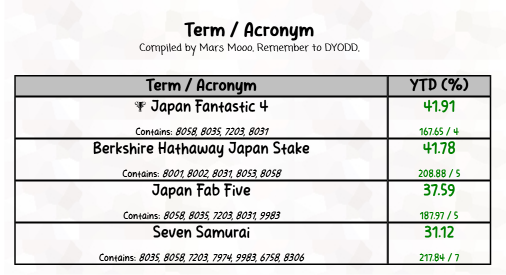

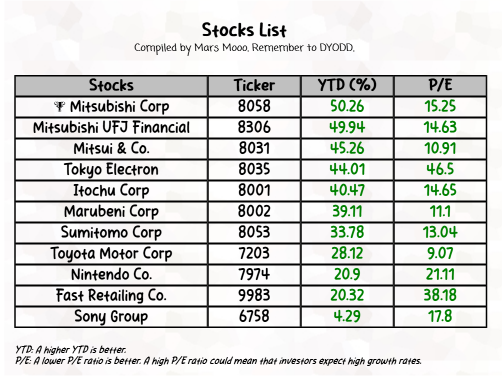

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when makin...

Let's take ...