No Data

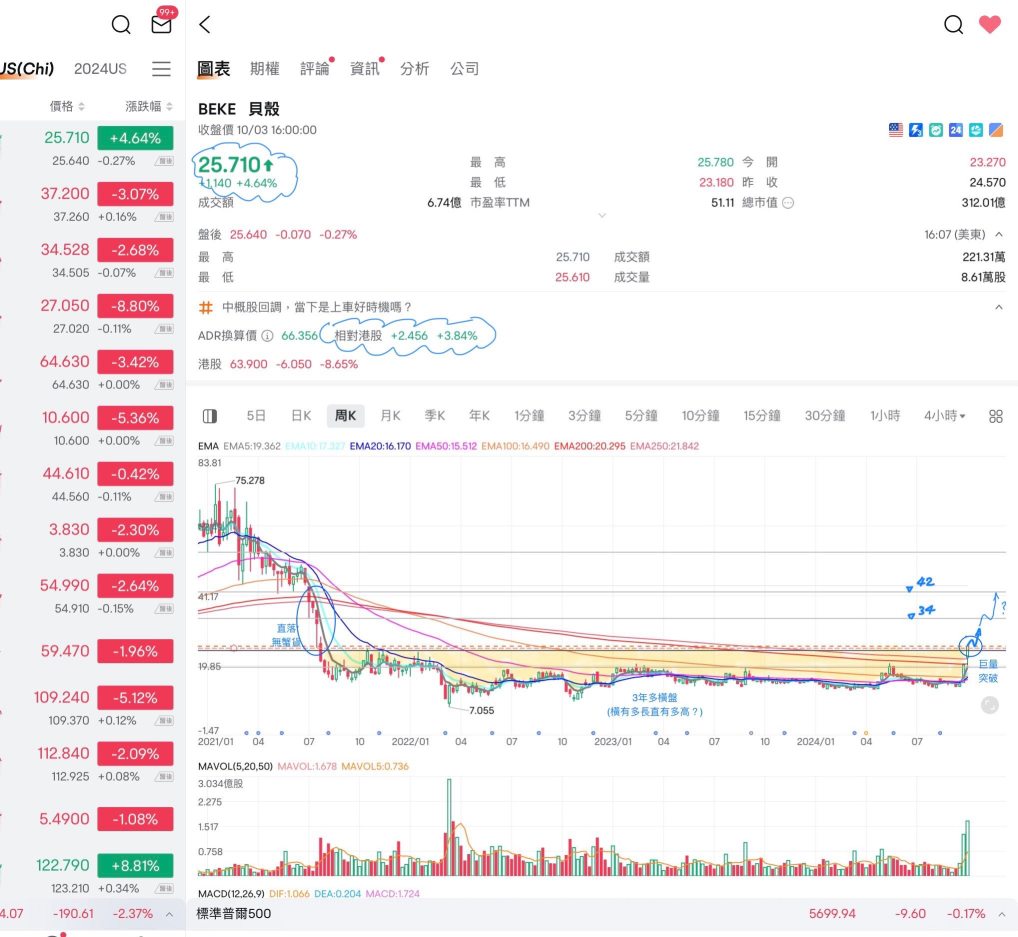

BEKE KE Holdings

- 20.470

- -0.080-0.39%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stock market anomaly | ke holdings-W (02423) rose more than 4% intraday in October, real estate sales data improved, second-hand real estate trade volume and penetration rate continued to rise.

Ke Holdings-W (02423) rose more than 4% intraday, as of the time of publication, up 3.61% to HKD 53.15, with a trading volume of 35.3003 million Hong Kong dollars.

Guosen: Marginal improvement in real estate sales volume and price from January to October 2024, development investment has not yet improved.

Observing the sales scale relative to the historical same period, the sales volume and sales area of commodity housing in October are equivalent to 62% and 54% of the same period in 2019, still at a relatively low level, but have improved compared to the previous low point. The effects of a series of demand-side bullish policies introduced at the end of September are more pronounced.

Zhongtai: Policies stimulating the real estate industry to stabilize and rebound significantly in sales.

In October, the industry's sales growth rate showed a significant rebound, and market sentiment stabilized. On one hand, the effects of continuously easing policies began to emerge; more importantly, the Politburo meeting proposed the idea of "stopping the decline and stabilizing," allowing for the restoration of market confidence.

Open Source Securities: Several departments have issued announcements to increase tax incentives, which may promote the improvement of housing demand release.

The overall coverage of the deed tax policy is relatively wide, after implementation, it will further reduce the tax and fee costs for residents' home purchases, promote the release of demand for improved housing; at the same time, for first-tier cities, the deed tax incentives are even greater, with the highest reduction reaching 2 percentage points.

Kaiyuan Securities: The real estate industry's monthly sales improved as expected, and the decline in funds returned by real estate companies significantly narrowed.

From January to October, the national sales area of commodity housing was 0.779 billion square meters, a year-on-year decrease of 15.8% (1-9 months -17.1%), with the sales area of residential properties decreasing by 17.7% year-on-year; From January to October, the sales of commodity housing reached 7.69 trillion yuan, a year-on-year decrease of 20.9% (1-9 months -22.7%), with the sales revenue of residential properties decreasing by 22.0% year-on-year.

Hold positions exposure, Wall Street tycoons increase their holdings of assets in China.

David Tepper, a well-known hedge fund mogul on Wall Street, boldly proclaimed at the end of September to "buy everything in china assets." The latest hold position data has been released! The mogul has put his words into action, significantly increasing his holdings in chinese assets to nearly 40%. In the third quarter, information released by Tepper's Appaloosa Management showed that investments in chinese stocks increased from 26% at the end of the previous quarter to 38%. This renowned hedge fund figure greatly increased his holdings in several U.S.-listed chinese stocks during the third quarter, including nearly doubling his position in pdd holdings shares, while also adding to his positions in jd.com and ke holdings. Meanwhile, Tepper slightly reduced his holdings in baidu, alibaba, and china.

Comments

Salesforce Inc (CRM US) $Salesforce (CRM.US)$

Daily Chart -[BULLISH ↗ **]CRM US is pushing higher after breakout out of an ascending wedge pattern. With 284.70 as support, a further push higher towards 1st resistance at 307.45 then next resistance at 317.30 is expected. Technical indicators are advocating for a bullish scenario.

Alternatively: A daily candlestick closing below 284.70 support will see a deeper pullb...

More stabilisation to the property Market will translate into better sales activities on KE holdings app and website portal

Analysis

Price Target

No Data

Business Data

No Data

noworries99 : Good opportunity to buy more lol. BEKE has got nothing to do with trump or international trades