Recent IPOs

- 530.783

- +6.365+1.21%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Is it really heading towards 5? The yield on 30-year U.S. Treasury bonds has reached 4.86%, setting a new high in over a year.

At the beginning of the new year, while market participants are speculating how many times the Federal Reserve can lower interest rates, a scene that worries many cross-asset market traders is still "playing out"; the yield on long-term USA bonds has not stopped its march towards 5.

Trump stirs the market, the dollar finally falls, but U.S. long-term bond yields hit a 14-month high.

Due to reports that Trump's tariff policy was not as strong as expected, the dollar temporarily fell by 1%, but after Trump refuted the claims, it recovered nearly half of its losses. The US bond market began to price in the possibility of Trump continuing to disrupt the financial markets, with the yield on the 30-year US Treasury bond rising by 5 basis points to 4.86% during the session, reaching the highest level since November 2023.

Bitcoin To $200,000 As Crypto Enters 'Infinity Age' In 2025, Bernstein Predicts

Elon Musk's Push For Crypto-Powered 'Everything App' Reflected In 'X Money' Leak As Bitcoin Hovers Around $100K

Investors Dump Long-Dated Treasury ETF At Record Pace Ahead Of Trump's White House Return

What does a 1.7% yield on a 10-year government bond signify?

Xinda Securities believes that the recent pricing of the 10-year government bond yields reflects the potential for a decline in the OMO rate next year. Based on the economic outlook and monetary policy environment for 2025, it is anticipated that a reduction of 50 basis points in the OMO rate may be necessary to achieve a marginal easing similar to that of 2024, which suggests that the 1.7% yield on the 10-year government bonds does not appear to be overly priced.

Comments

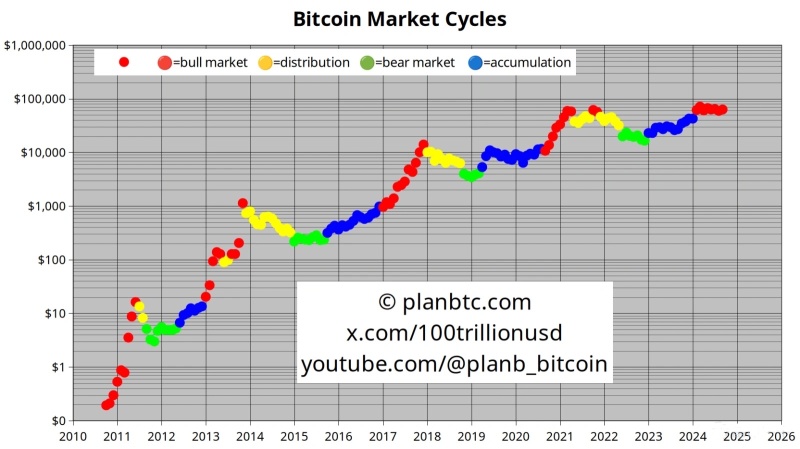

Where are we in this Bitcoin bull cycle? Let’s take a closer look at some key indicators.

PlanB’s Stock-to-Flow Model (S2F)

PlanB’s S2F model rose to fame during the 2019-2021 bull...