US Stock MarketDetailed Quotes

PHUN Phunware

- 5.6000

- -0.8200-12.77%

Close Nov 8 16:00 ET

- 5.7800

- +0.1800+3.21%

Post 20:01 ET

65.74MMarket Cap-591P/E (TTM)

6.4200High5.5000Low7.24MVolume5.8600Open6.4200Pre Close42.46MTurnover64.06%Turnover RatioLossP/E (Static)11.74MShares24.495052wk High2.26P/B63.27MFloat Cap2.850052wk Low--Dividend TTM11.30MShs Float27500.0000Historical High--Div YieldTTM14.33%Amplitude2.8500Historical Low5.8660Avg Price1Lot Size

Phunware Stock Forum

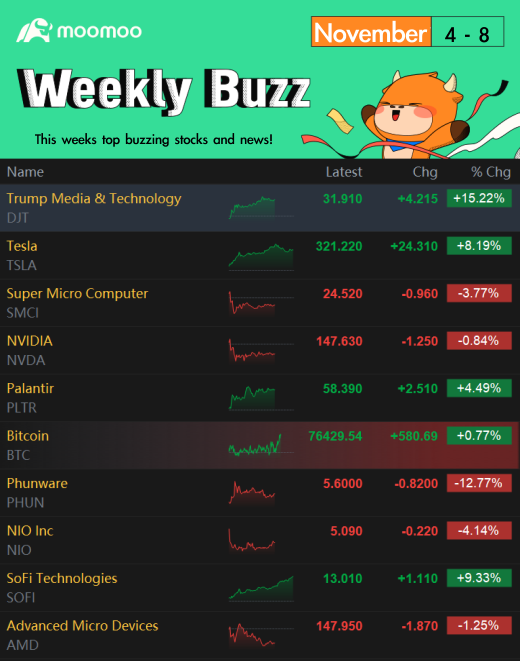

Happy weekend, investors! Welcome back to Weekly Buzz, where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

+10

54

23

$Phunware (PHUN.US)$ Dump my Phun shift to DJ T earlier.Now see some profit.

2

1

$Phunware (PHUN.US)$ Luckily DJT is up.If not this down worse.

4

$Phunware (PHUN.US)$ Cut loss 10K

2

4

4

$Phunware (PHUN.US)$ thank God I am out of this shit…

3

6

No comment yet

Analysis

Price Target

No Data

Heat List

Overall

Symbol

Latest Price

% Chg

No Data

HuatLady : With Trump's recent victory, the market surged with DJI and S&P 500 soaring. However stock markets often defy the prevailing news narrative, moving in unexpected directions. Numerous factors can emerge to test investors' wisdom and intuition.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

For short-term gains, I am considering investing in the oil and gas sectors given Trump's support for domestic production. This makes companies like $Exxon Mobil (XOM.US)$ and $Chevron (CVX.US)$ worth a closer look. Meanwhile, I could lock in some profits and park partial funds in Cash Plus Fund on Moomoo's.

Despite these short-term opportunities, I am committed to staying focused on a long-term strategy of diversifying into high quality stocks.

102362254 : With the GOP now in Congress and Trump in the presidency, I’m sticking to my long-term investing approach. Market shifts are expected, but I’ll focus on diversification, especially through ETFs, to capture potential growth across sectors while managing risk. ETFs remain a great choice for exposure to various sectors without the need to constantly adjust positions

HuatEver : Now that the election results are clear, I'm staying focused on my Regular Savings Plan (RSP). Contributing consistently helps me build wealth over time without trying to time the market. The RSP’s disciplined approach keeps me on track, taking advantage of market fluctuations and compounding, which supports my long-term goals regardless of political shifts![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...