US Stock MarketDetailed Quotes

SNPS Synopsys

- 447.990

- -5.520-1.22%

Close Mar 18 16:00 ET

- 451.000

- +3.010+0.67%

Pre 08:00 ET

69.27BMarket Cap33.16P/E (TTM)

454.590High445.020Low1.02MVolume448.810Open453.510Pre Close457.92MTurnover0.66%Turnover Ratio30.87P/E (Static)154.62MShares624.80252wk High7.44P/B68.78BFloat Cap425.73052wk Low--Dividend TTM153.54MShs Float629.380Historical High--Div YieldTTM2.11%Amplitude10.875Historical Low448.875Avg Price1Lot Size

Synopsys Stock Forum

$Synopsys (SNPS.US)$ This stock just provides further evidence that the semiconductor related sotcks are not overvalued. The forward P/E is about 30, EPS growth is low-double-digit, a wide moat, little capex. This is even more appealing than MSFT. I put a limit buy order at 420.

2

2

$Synopsys (SNPS.US)$

Vector Informatik and Synopsys Announce Strategic Collaboration to Advance Software-Defined Vehicle Development

Vector Informatik and Synopsys Announce Strategic Collaboration to Advance Software-Defined Vehicle Development

$Synopsys (SNPS.US)$

Can Synopsys Clear All Regulatory Hurdles for Its Ansys Deal After UK Approval?

Can Synopsys Clear All Regulatory Hurdles for Its Ansys Deal After UK Approval?

$NVIDIA (NVDA.US)$ 🚨🚨🚨🚨🚨

“Markets on Edge: AI Boom, Capital Flight from China, and the Trade War Shake-Up”

Market Sentiment Analysis – February 14, 2025

Executive Summary

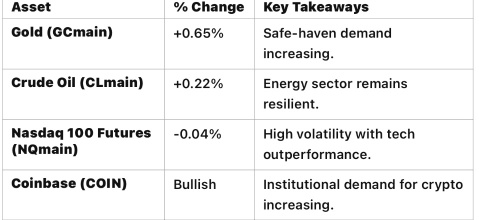

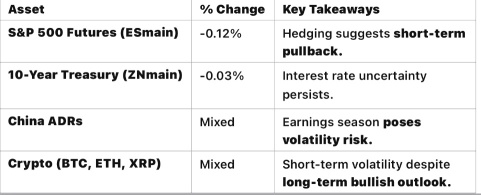

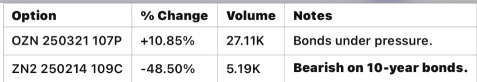

Today’s market sentiment is defined by a mix of geopolitical tensions, AI-driven optimism, and capital shifts:

• AI and MedTech stocks continue to gain traction, fueling growth in the tech sector.

• U.S.-China trade tensions escalate, with China seeing a record $168 billion capital outflow and retaliatory measures against U.S....

“Markets on Edge: AI Boom, Capital Flight from China, and the Trade War Shake-Up”

Market Sentiment Analysis – February 14, 2025

Executive Summary

Today’s market sentiment is defined by a mix of geopolitical tensions, AI-driven optimism, and capital shifts:

• AI and MedTech stocks continue to gain traction, fueling growth in the tech sector.

• U.S.-China trade tensions escalate, with China seeing a record $168 billion capital outflow and retaliatory measures against U.S....

+1

3

$Synopsys (SNPS.US)$ Synopsys Expands the Industry's Highest Performance Hardware-Assisted Verification Portfolio to Propel Next-Generation Semiconductor and Design Innovation. Industry Leaders Including AMD, Arm, NVIDIA, and SiFive are Deploying Synopsys' Prototyping and Emulation Technologies ... good Job ![]()

![]()

![]()

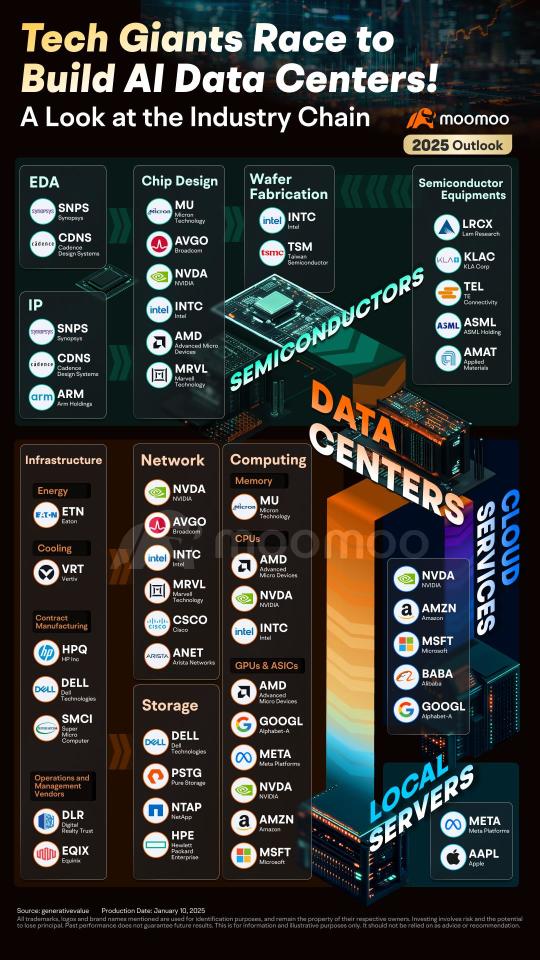

Since last year, major tech companies have been rushing to invest in AI-powered data centers. This year, they are increasing their efforts and spending even more.

Recently, U.S. President Donald Trump announced a $20 billion plan to build new data centers nationwide. A report from ABI Research predicts that by the end of 2024, there will be 5,697 public data centers worldwide, mostly in the Asia-Pacific, Europe, and No...

Recently, U.S. President Donald Trump announced a $20 billion plan to build new data centers nationwide. A report from ABI Research predicts that by the end of 2024, there will be 5,697 public data centers worldwide, mostly in the Asia-Pacific, Europe, and No...

19

3

16

$Synopsys (SNPS.US)$ We are very pleased that today the CMA has taken the important step of provisionally accepting our proposed remedies in Phase 1 rather than referring the transaction to Phase 2. We will maintain our constructive and collaborative engagement with the CMA as it completes its process....

2

The rise of artificial intelligence (AI) has placed the semiconductor ecosystem at the core of this technological revolution. While AI demonstrates boundless potential, its advancement depends heavily on the support of semiconductor technology. The semiconductor industry is not just about providing chips—it serves as the foundation of AI development, transforming visionary concepts into tangible reality ✨.

At the heart of AI lies its com...

At the heart of AI lies its com...

46

12

29

$Synopsys (SNPS.US)$ wtf, started strong and went down hill

1

No comment yet

Buy Monopoly Only : Wrong. How did you arrive at 30. Look at its capital expenditure acquisition scale, why it needs to continuously acquire every year, because of Moore's Law, it must constantly innovate or it will be eliminated.

韭菜变主力 OP Buy Monopoly Only : FY2025 concensus EPS is expected to be about 14.94.