No Data

TAK Takeda Pharmaceutical

- 13.940

- +0.050+0.36%

- 13.940

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Takeda Pharmaceutical Company Limited (TAK) Q2 2025 Earnings Call Transcript Summary

Takeda Pharmaceutical Company Limited (TAK) Q2 2025 Earnings Call Transcript

The Nikkei average started 576 yen lower, with Socionext and Fujitsu falling, etc.

[Nikkei Average Stock Price·TOPIX (Table)] Nikkei Average; 38504.35; -576.90 TOPIX; 2659.92; -35.59 [Opening Summary] The Nikkei Average on the 1st started trading with a decline of 576.90 yen to 38504.35 yen. The US stock market on the previous day of October 31 continued to decline. The Dow Jones Industrial Average closed at 41,763.46, down 378.08 points, while the Nasdaq closed at 18,095.15, down 512.78 points. The Core PCE Price Index exceeded financial estimates.

November 1st [Today's Investment Strategy]

[FISCO Selected Stocks] [Material Stocks] SCREEN Holdings <7735> 10,030 yen (10/31) Engaged in semiconductor manufacturing equipment such as wafer cleaning equipment. The earnings forecast for the fiscal year ending March 2025 has been revised upward. Operating profit is expected to be 113.5 billion yen (an increase of 20.5% from the previous year). It has been raised by about 8% from the previous forecast. This is the second upward revision of the full-year forecast for this fiscal year. The upward revision was due to factors such as the first-half operating profit of 58.2 billion yen (a 51.1% increase from the previous year), exceeding the previous forecast of 53 billion yen. "Year

Three key points to focus on in the morning session: Yen strength and US tech stock weakness are a heavy burden.

In the morning session of November 1st, the following three points deserve attention: - The strong yen and weakness in US high-tech stocks are a burden. - Canon, 3Q operating profit increased by 14.4% to 296.6 billion yen. - Points of interest in the morning session: Nidec, Nidec Machine Tools, inline gear full inspection, partnership with a Swiss company. With the strong yen and weakness in US high-tech stocks, the Japanese stock market on November 1st is likely to see a bearish trend. On October 31st, the US market saw a dow jones industrial average decrease of 378 points, and the nasdaq dropped by 512 points. Micro

Strong yen and the decline of US technology stocks are a heavy burden.

The Japanese stock market on November 1st seems to be developing a selling trend. On October 31st, the US market saw the Dow Jones Industrial Average fall by 378 points, and the Nasdaq drop by 512 points. Due to the decline of Microsoft and Meta Platforms, a wide range of tech stocks were sold. Additionally, amid reports that Iran is preparing for a large-scale retaliatory attack against Israel, concerns about the deterioration of the Middle East situation also became selling points. The Chicago Nikkei 225 futures settlement price was 38,350 yen, which was 710 yen lower than Osaka. The yen exchange rate is 1 dollar.

Comments

AC Immune SA - AC Immune to Receive Upfront Payment of $100 Mln Upon Closing

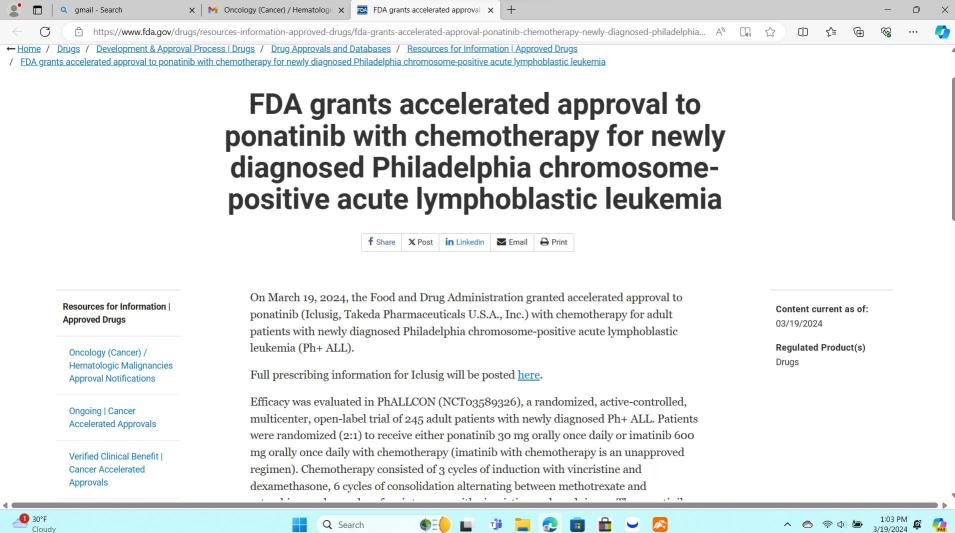

The NT1 trial TAK-861-2001 evaluating TAK-861 in 112 patients demonstrated statistically significant and clinically meaningful improvement in objective and subjective measures of wakefulness compared to placebo at week 8 including on the primary endpoint Maintenance of Wakefulness Test (MWT) (p < 0.001).

Plans To Initiate Global Phase 3 Trials Of TAK-861 In Narcolep...

Analysis

Price Target

No Data

No Data

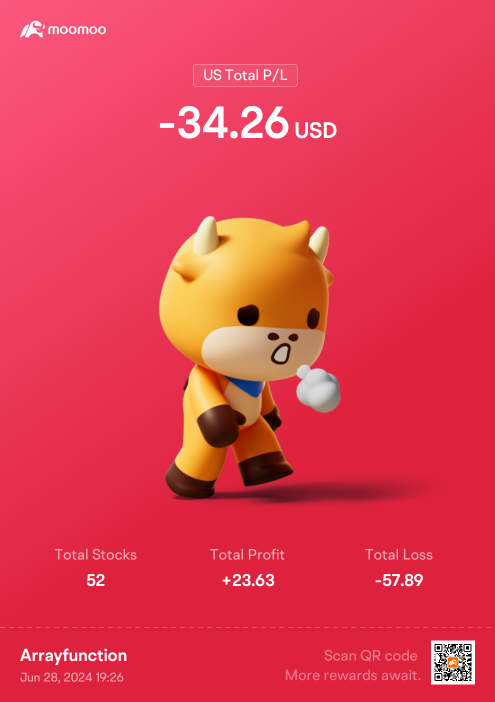

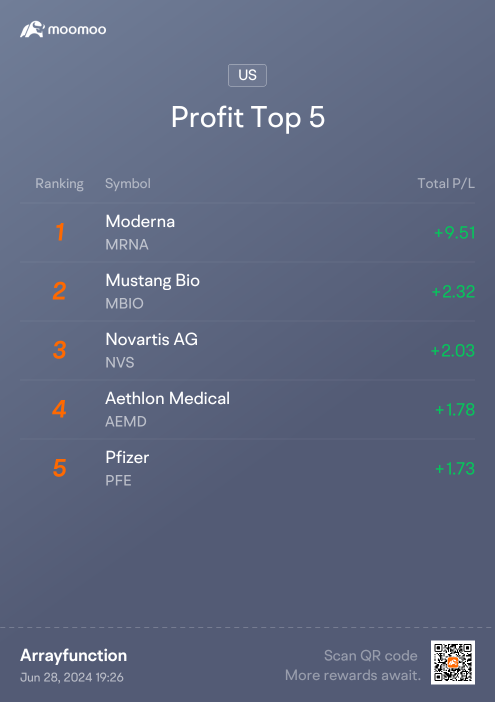

Greenhorn Dav : learn from mistakes n improve...U can do it

Arrayfunction OP Greenhorn Dav : Thanks for the encouragement! So a big thanks to anyone else out there reading this too!

So a big thanks to anyone else out there reading this too!

One thing I forgot to mention is how much I have always appreciated the Moomoo community. I can't remember a single time I had a negative interaction with another user. Reflecting now, that played a huge role in making me feel like I belong here and kept any big loss or dumb play make me hit the eject button.

Of all the places on the internet, who would have thought it'd be a group of stock traders where everyone gets along and respects one another?