No Data

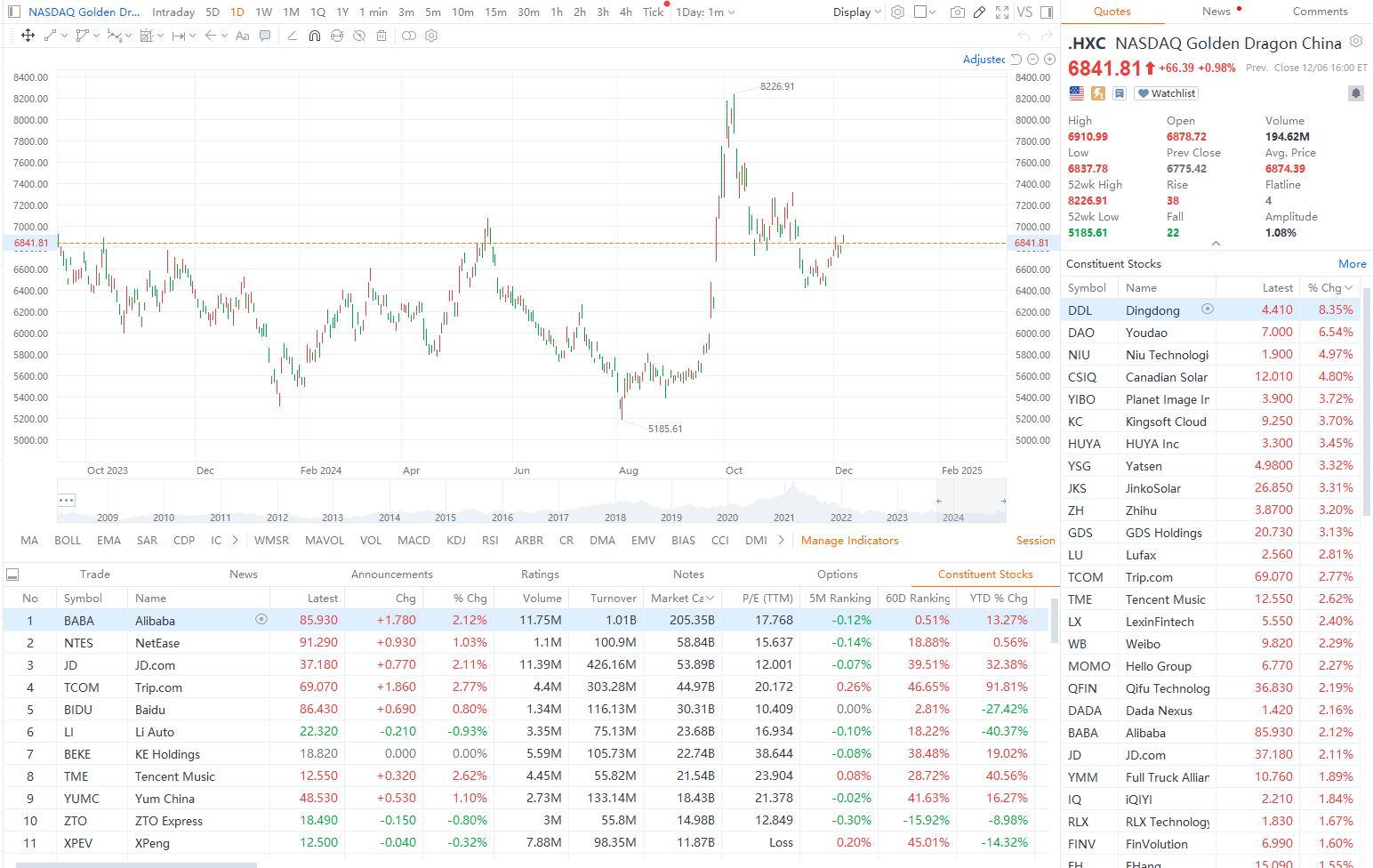

ZTO ZTO Express

- 19.030

- -0.520-2.66%

- 19.300

- +0.270+1.42%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Research Reports: CITIC Securities gives ZTO Express a Target Price of $25.70 and suggests focusing on its long-term investment value.

China International Capital Corporation stated in a report that the demand in the express delivery industry will maintain high growth in the fourth quarter of 2024. The firm believes that under the new strategy, ZTO Express is expected to return to the path of market share expansion, giving it a Target Price of $25.70. Considering the trends of parcel light-weighting, the development of live e-commerce, and the increase in return rates, it is anticipated that the express delivery industry's volume will continue to maintain double-digit growth through 2025. Looking ahead to 2025, as the company previously stated in the third-quarter earnings meeting that "leading in business volume is the cornerstone of our business," the firm believes that the company will change its conservative strategy on market share competition in 2024 to achieve greater than industry volume growth.

Here's Why You Should Give ZTO Express Stock a Miss Now

Here's Why ZTO Express (Cayman) Inc. (ZTO) Is a Strong Momentum Stock

Volume increases and prices remain low as the express delivery industry competes to reduce costs. The application of autonomous vehicles and Drones is expected to accelerate next year | Year-end review.

① Since the beginning of the year, the growth rate of express delivery volume has exceeded 20%; the operating situation of "the two logistics giants and one delivery company" in the first 11 months shows volume increase and low prices, with ZTO achieving year-on-year revenue growth per package in Q3. ② Industry insiders say that the growth rate of express delivery volume will still be double-digit in the next 1-2 years. It is expected that next year, Drones and unmanned vehicles will accelerate their application in various express delivery scenarios, further reducing social Logistics costs.

Will Weakness in ZTO Express (Cayman) Inc.'s (NYSE:ZTO) Stock Prove Temporary Given Strong Fundamentals?

[Brokerage Focus] China Post Securities indicates that price competition may benefit the healthy development of the Industry, Bullish on the continuous growth of express company Business volume driving revenue scale.

Jinwu Financial News | According to a research report from Zhongyou Securities, all express companies reported their operational data for November, showing that the overall Business volume continues to maintain high growth, although unit prices have declined year-on-year. Leading companies indicated in their third-quarter reports that they would ensure their market share, which may suggest that moderate price competition will continue, potentially benefitting the long-term health of the Industry. The firm remains Bullish on the continued growth of Business volume among express companies, which will drive revenue scale while improving unit profitability through cost reduction and efficiency enhancement. Current valuations for various express companies are at relatively low levels, with a top recommendation for ZTO Express (02057), followed by S.F. Holding (06936), YTO Express Group, STO Express Co.,Ltd., and with attention on Yunda Holding.

Comments

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...

During a session led by Premier Li Qiang, The State Council passed a policy document last Friday that seeks to expand export growth through the growing sector of international e-commerce. The...

The Alliance aims to accelerate the implementation of foundation models in the logistics field, and assist the logistics industry to increase efficiency, reduce costs and innovate its business through AI.

$ALIBABA GROUP HOLDING LTD (BABAF.US)$ $Alibaba (BABA.US)$ $BABA-W (09988.HK)$ $ZTO EXPRESS-W (02057.HK)$ $YTO INTL EXP (06123.HK)$ $STO Express Co.,Ltd. (002468.SZ)$ $Deppon Logistics (603056.SH)$