After PCE Release Boosts Rate Cut Expectations - How Should We Trade?

On Friday, August 29, the US Bureau of Economic Analysis released data showing that the US core PCE price index for July (excluding volatile food and energy prices) rose 2.6% year-on-year, matching the previous value and slightly below the expected 2.7%; it rose 0.2% month-on-month, in line with expectations and the previous value. In addition, the annualized growth rate of core PCE over the three months was 1.7%, the slowest growth rate this year.

The overall PCE price index for July increased 2.5% year-on-year, in line with expectations and the previous value, with a 0.2% month-on-month increase, as expected, with a previous value of 0.1%.

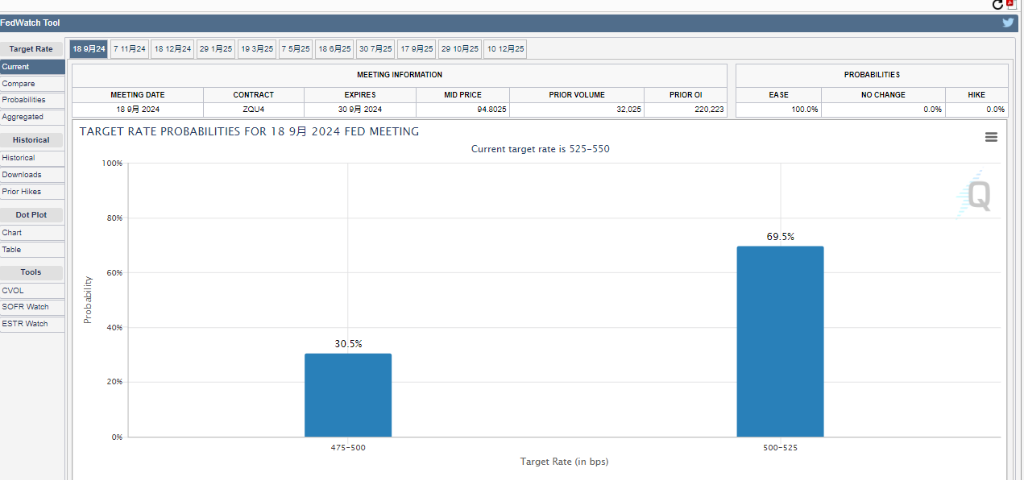

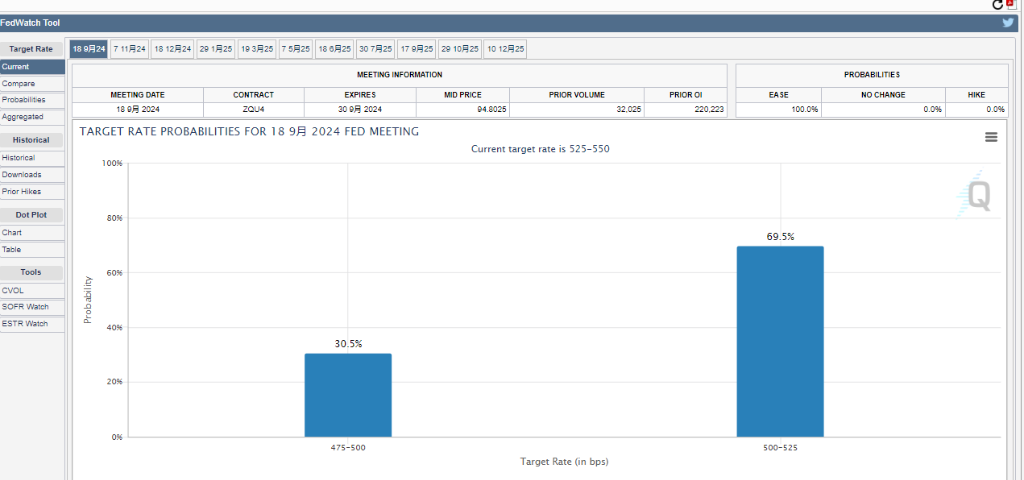

The slowdown in the growth of the July PCE index further consolidates expectations for a rate cut by the Federal Reserve at the monetary policy meeting on September 17-18. As for the size of the rate cut, the market is increasingly leaning towards a modest 25 basis point cut. The CME Group's FedWatch Tool shows that the probability of a 25 basis point rate cut in September is close to 70%, up from 67.5% before the data was released, while the probability of a 50 basis point cut continues to decline.

The current movement in US bond yields has already reflected the market's expectations of a rate cut. In terms of trading strategies going forward, we need to focus on two core points:

1. In the short term, a rate cut in September is highly likely, and the expectation of a rate cut for the year is already reflected in the yield of the 10-year Treasury bond. We need to be cautious of the impact of improving employment data and rising year-end inflation on interest rates. It is expected that the yield of the US 10-year Treasury bond is currently at a low level, with a risk of rebound in the future. Therefore, in terms of short-term strategies, considering that the TLT is already at a temporary high, it is not recommended to buy TLT now. Instead, we can consider selling put options on TLT to earn premium income and reduce the cost of purchase. If you already hold TLT, you can sell corresponding amounts of call options to earn premium income.

2. In the long term, the rate cut in the US is a long-term trend, and it is recommended to go long on TLT in the long term. Consider buying TLT at opportune times and holding it for the long term.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment