Are Financials and Utilities Poised to Benefit Regardless of the Election Outcome?

As the U.S. election approaches, the dollar and U.S. bond yields continue to rise. Investors are weighing the global macroeconomic outlook under a new administration and monitoring the risks associated with the U.S. fiscal deficit. For Wall Street, the quadrennial U.S. political showdown is also a test for the financial markets.

U.S. Treasury yields edged up last week, with the benchmark 10-year Treasury yield holding steady at 4.20%, having risen more than 60 basis points over the past five weeks. Institution investors believe that part of the recent increase can be explained by a reduction in market bets on significant Fed rate cuts following better-than-expected U.S. economic updates, including labor and retail sales data. Another factor driving the yield rise is the return of the term premium, which is linked to concerns about U.S. government spending as the election approaches.

The U.S. Treasury reported that the fiscal deficit reached $1.8 trillion for the current fiscal year. Notably, spending on net interest payments for public debt increased by 34%, reaching a record $882 billion, which is directly related to the interest rate levels at the tail end of the Federal Reserve's current tightening cycle.

Regardless of Who Wins the Election, Are Financials and Utilities Set to Benefit?

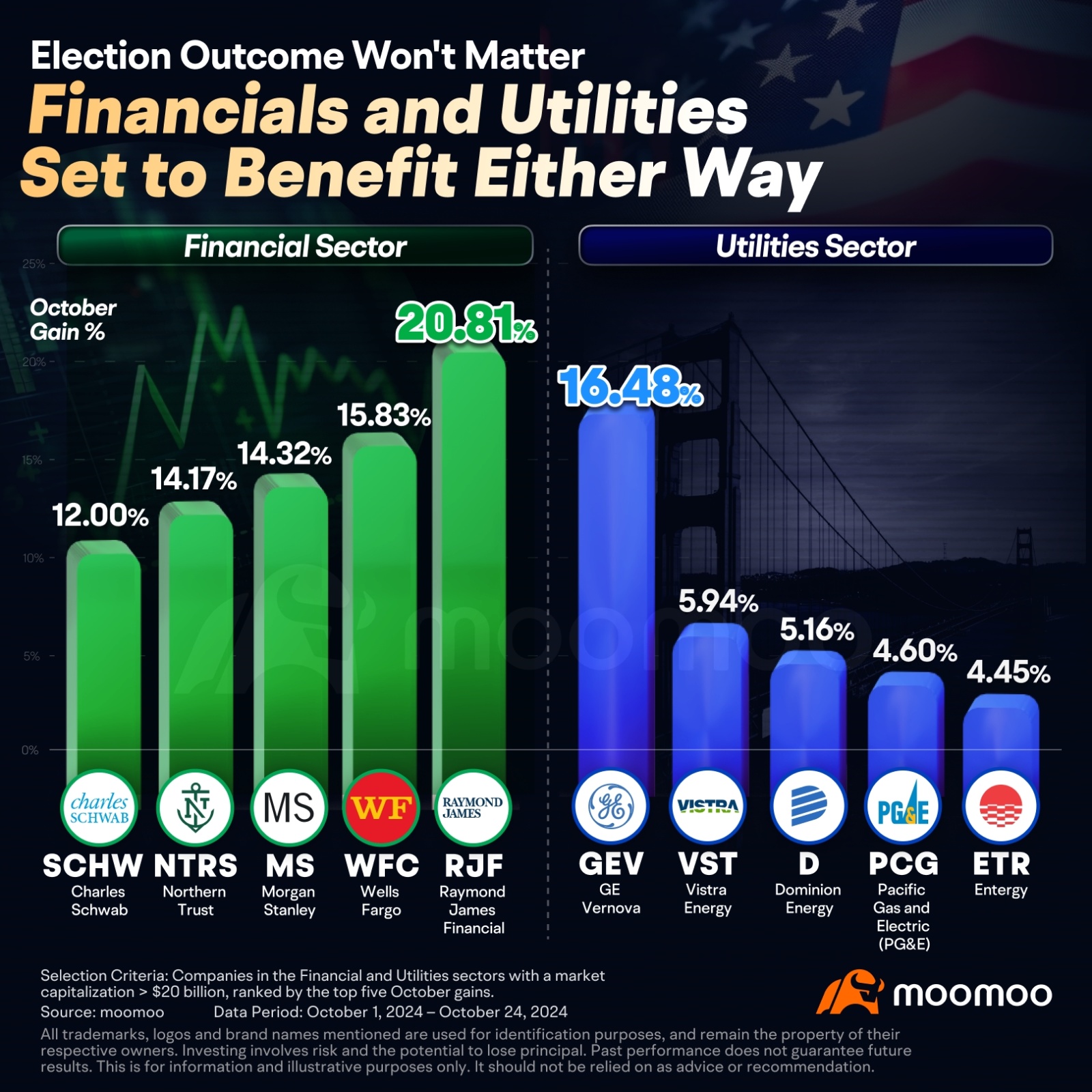

Amid election-driven uncertainty, investors are turning to resilient sectors like financials and utilities to hedge against market volatility. The S&P 500 Financials Index has gained nearly 4% this month, making it the top-performing sector, with banks such as Wells Fargo and Morgan Stanley posting strong earnings. Wells Fargo, in particular, has surged almost 16%.

In the utilities sector, defensive qualities and renewed interest in AI-powered electricity have fueled gains. GE Vernova rose over 16% in October, while Vistra Energy's stock has soared nearly 230% year-to-date, reflecting strong demand in the power generation industry.

Kurt Reiman, Chief Investment Officer at UBS Global Wealth Management, suggests that both financial and utilities sectors are well-positioned to perform regardless of the election outcome. Financial stocks are attractively valued and have thrived under the current Democratic administration, with potential to continue this trend if Harris wins. Under Trump, the sector could benefit from his deregulatory policies.

Meanwhile, utilities offer a defensive investment option with strong dividends and stable performance, further boosted by surging energy demand linked to AI advancements, which have fueled growth in the sector over the past two years.

Source: moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

莉莉家的回本梦终人 : If it's really that good, does it mean that Buffett is blind and sold bank stocks too early?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

71425974 : STOP

Name Unimportant : Dems= Banks, M.I.C (war for profit), Gas

Reps.= Banks, Tech, Utilities, Crypto

Laine Ford : good stock to have