August US Nonfarm Payrolls Preview | Investors Are Caught Up in Fears of a Deteriorating Job Market

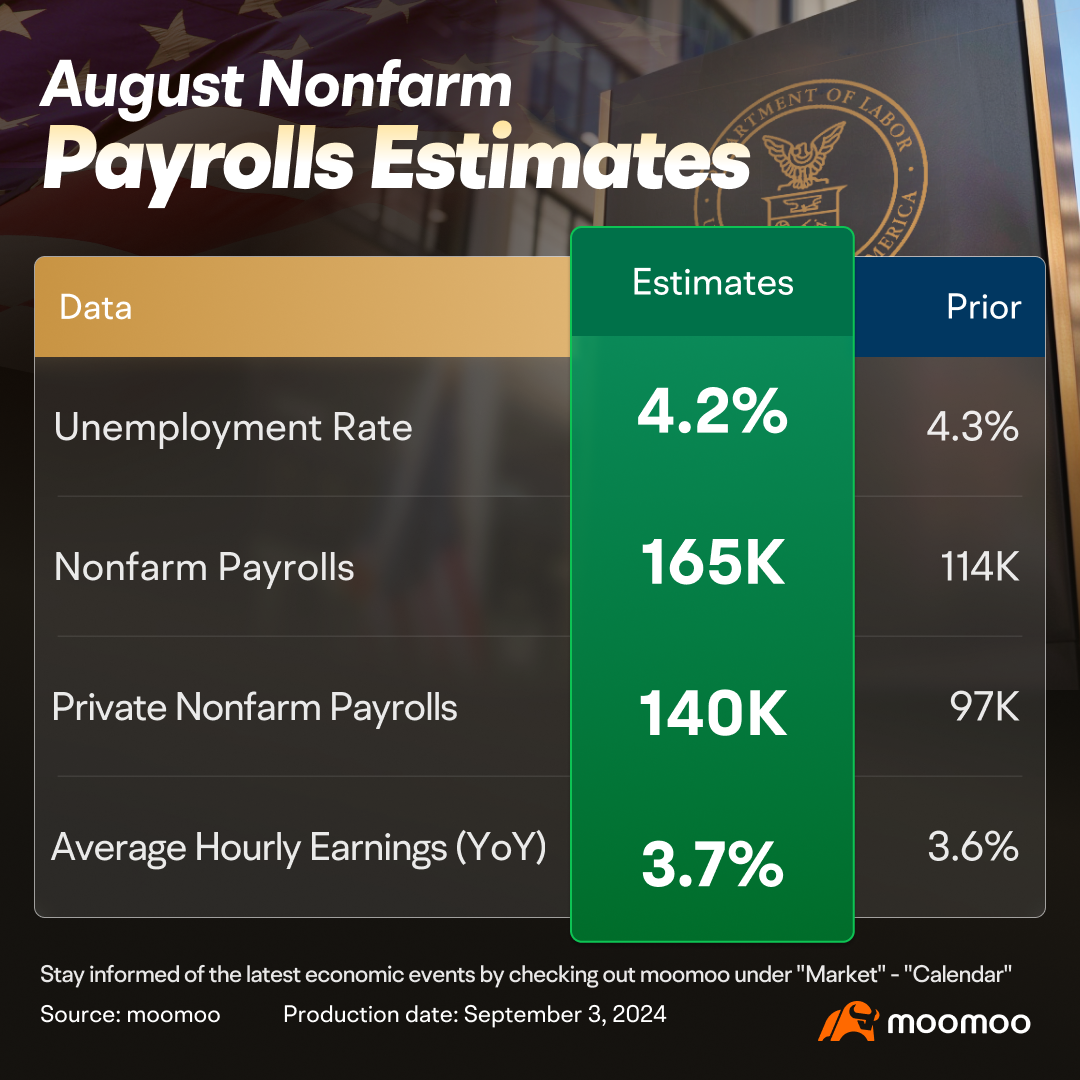

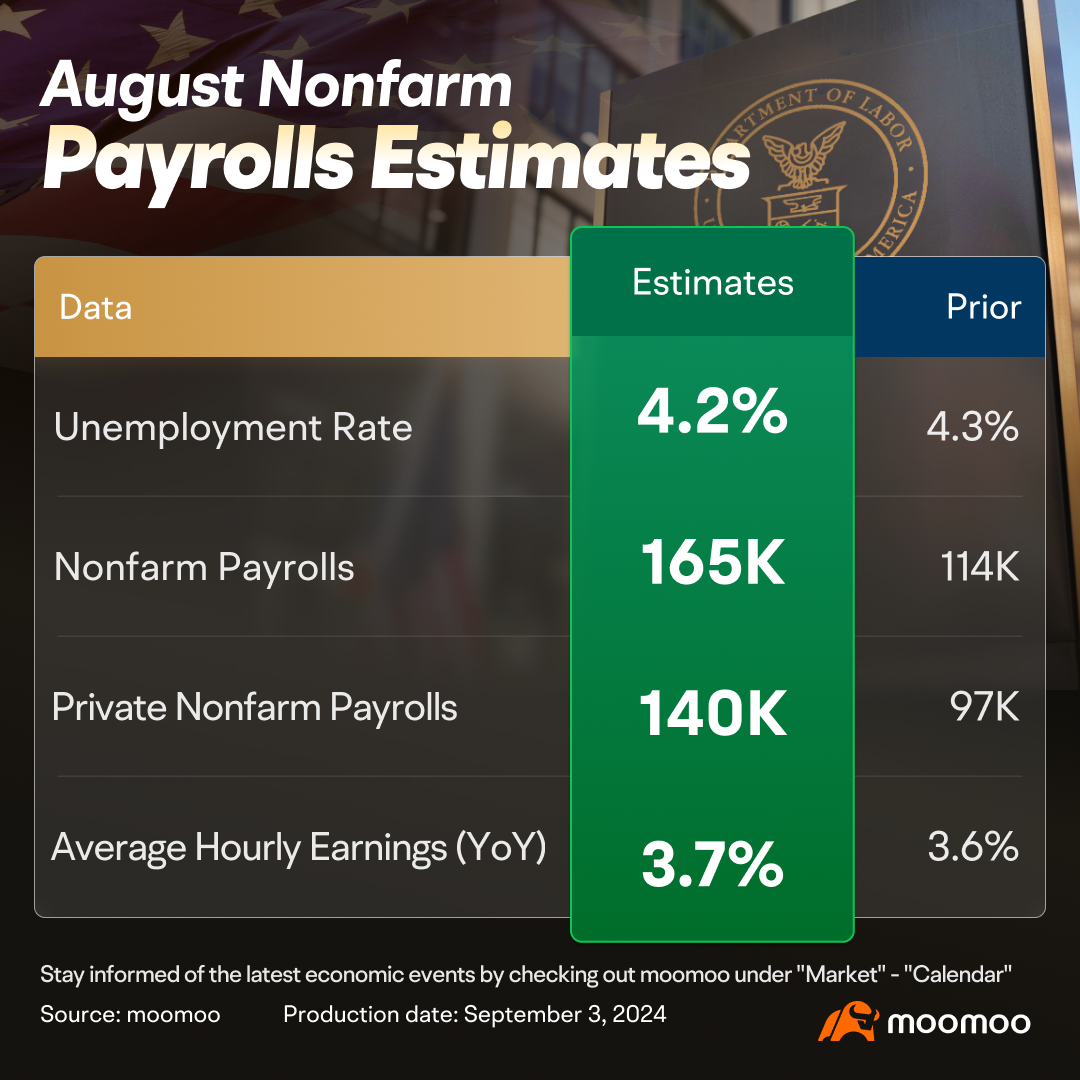

August nonfarm payrolls report will be released at 8:30 a.m. ET this Friday. The median forecast of analysts for the upcoming nonfarm employment is 165K, up from 114K in July. The unemployment rate is expected to be 4.2%, down from 4.3% in the previous month.

Most economists predict an improvement in employment for August, following the gradual dissipation of negative impacts from July's high temperatures and Hurricane Beryl. However, some analysts express differing views. Bloomberg's Anna Wong suggests that the microdata behind the household survey indicates that only a minor portion (3 basis points) of the 0.20-percentage-point increase in July’s unemployment rate can be attributed to Hurricane Beryl.

Wong pointed out that if the labor-force participation rate remains at 62.7%, the unemployment rate is expected to rise slightly from 4.25% in July to 4.34% in August, which presents a risk that the unemployment rate could round up to 4.4%.

Additionally, the reasons leading to the massive 818K downward revisions of job numbers for the April 2023-March 2024 period are still present in the current payroll figures, suggesting that the monthly job counts could be overstated by as much as 91,000.

Other factors suggesting a weakening job market include:

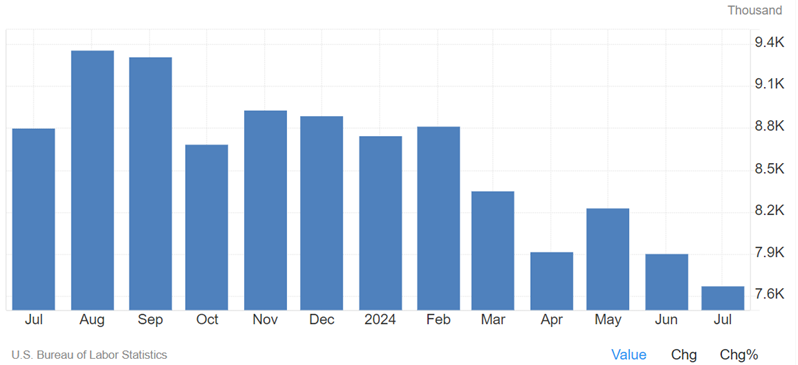

▶ The JOLTs data, newly released on Wednesday, shows that job openings in the United States decreased sharply to 7673 thousand in July, compared to 7910 thousand in June.

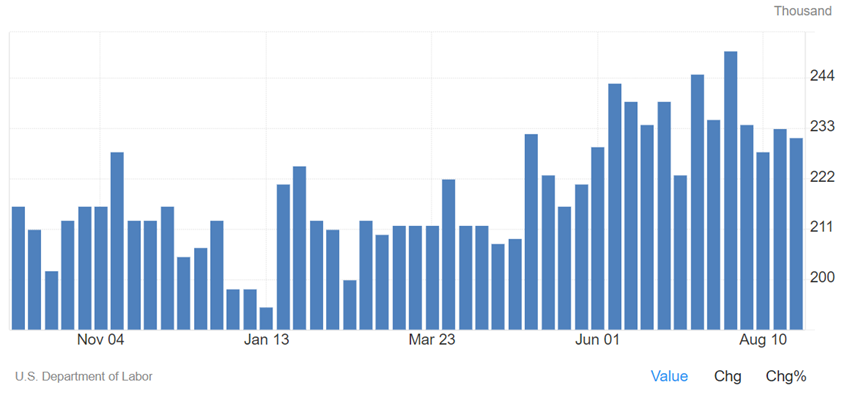

▶ The number of individuals filing for unemployment benefits in the US reached 231,000 for the period ending August 24th. This number stays significantly higher than the averages recorded earlier in the year, further emphasizing the continuing trend of a weakening labor market.

▶ The weak ISM manufacturing survey for August is a reminder that manufacturing employment – another highly cyclical sector – will also weigh on payrolls. This sector is expected to produce an average drag of about 30k per month over the next 12 months, according to Anna Wong.

▶ There has been a sharp increase in bankruptcies and a slowdown in the rate of business formation.

In addition, analysts expect the following noticeable changes in the job market in August:

■ Indicators from the housing sector suggest impending job cuts in construction

The leading indicator for construction employment– housing permits minus housing completions – has significantly declined since a local peak in September 2023, accelerating this spring. This trend highlights an increase in the completion of homes, particularly multifamily units, even as the demand for housing declines amidst an affordability crisis.

▶ From a supply perspective, the completions of privately-owned housing in July were 14% higher than the previous year. Specifically, single-family housing completions increased by 4%, and completions in buildings with five or more units surged by 49%.

▶ Conversely, July's housing permits, which serve as a gauge for future demand, were 7% lower than last year. Single-family authorizations decreased by 2%, and multifamily authorizations fell by 15%.

▶ Despite a rise in new home sales in July, the housing supply would last 7.5 months at the current sales rate, a marked increase from the pre-pandemic level of 5.8 months.

When housing supply outpaces demand, it typically leads to job reductions in the construction sector. Historically, this indicator has preceded changes in construction payrolls by approximately seven months, suggesting that the impact of this downturn could appear in the construction sector's nonfarm payrolls very soon, potentially as early as August.

■ Hiring in the education sector is likely heading into a notable downdraft

The education sector at the local government level, appears poised for a downturn in hiring. A closer look at the microdata from July's household survey reveals an unusually high number of temporary layoffs in this sector, exceeding typical seasonal expectations and consistent across various states.

This outlook is influenced by the upcoming expiration of the Elementary and Secondary School Emergency Relief (ESSER) fund at the end of September. This federal aid, which increased support for public schools by 57% above pre-pandemic levels, has been a significant bolster during the pandemic. Additionally, a gradual decline in state budgets over the past year and a decrease in student enrollment in local public schools are exacerbating the situation.

■ What's the implication for the Fed?

Investors who were caught up in last month's "nonfarm payroll panic" might be particularly sensitive to the upcoming August data. Even though the unemployment rate might slightly decrease from 4.3% to 4.2%, a level of 4.2% would still trigger the so-called Sam's Rule for determining a recession.

In addition, although nonfarm hourly wages are estimated to have increased by 3.7%, up from last month's 3.6%, a rapid decline in job vacancies could mean that the pricing power in the job market is gradually shifting from employees to employers, limiting the potential for future wage increases. The stock market tumble on Monday also reflected investors' concerns about employment data.

Since the nonfarm statistics on Friday is the last employment report before the next FOMC meeting, it will directly influence the extent of the rate cut in September. Currently, most people expect a 25-basis point rate cut in September. CME FedWatch shows a 53% probability of a 25-basis point cut. However, if the released data is even worse than expected or continues last month's weak trend, it could increase the likelihood of a 50-basis point rate cut in September.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RDK79 : Not a ‘fear’, expected reality.

FYI: August private payrolls rose by 99,000, smallest gain since 2021 and far below estimates, ADP says. Further supports desired Fed rate cut.

XJ3005 : We shall see.

GreenDay : Are they going to tell the truth or do we get screwed on revisions.

Laine Ford : . maybe

单日转向 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

龙邦第一财子 : thank you

EZ_money : how dumb. why did they raise rates? to slow down the economy because of inflation. now when rate hikes are showing signs of working finally and possibly rate cuts because of job losses we have fear. except job losses are expected when you hike rates that high