Bank Earnings Season Preview: Major Concerns Switch from Deposits Outflow to Credit Quality

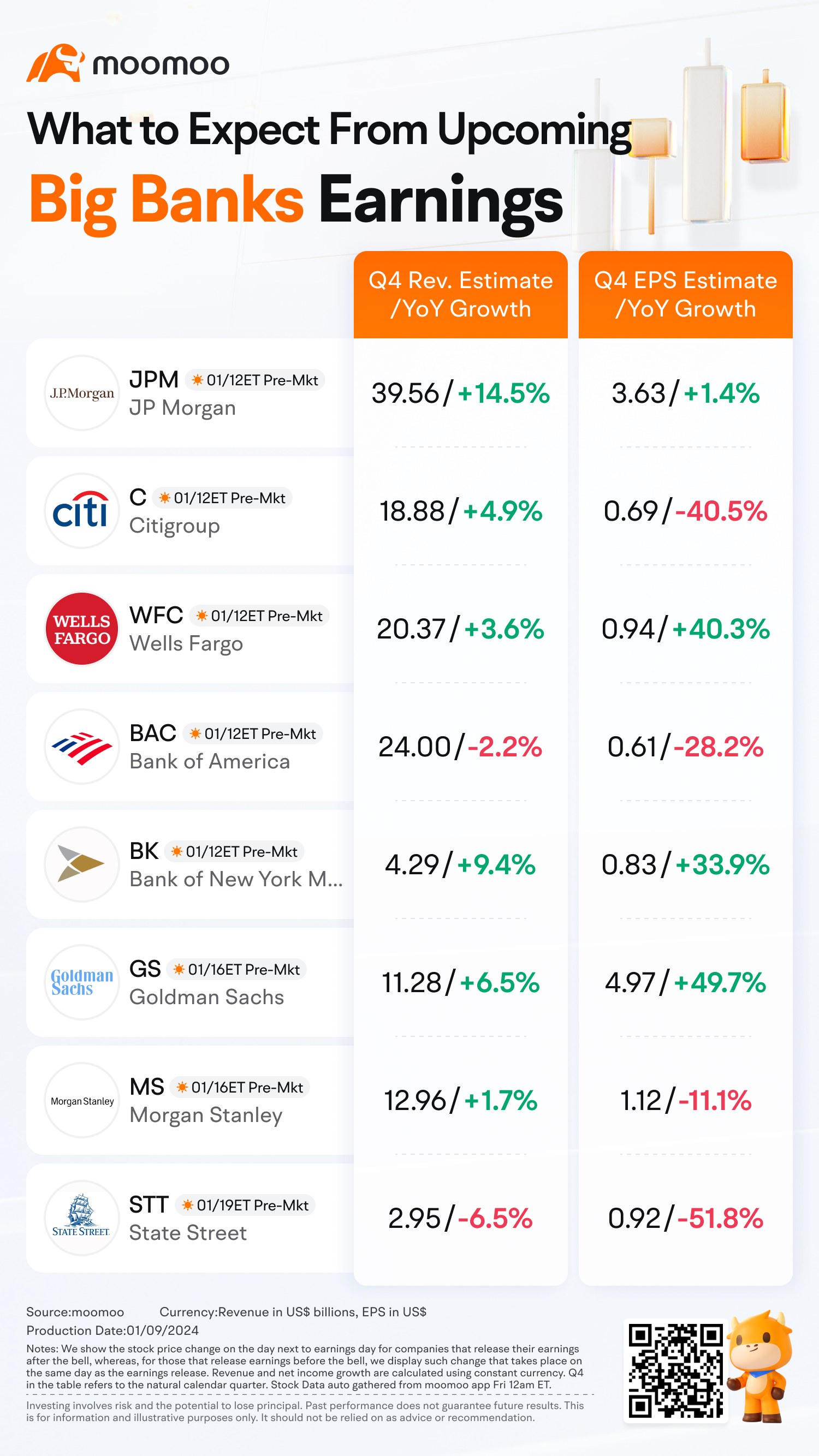

Major banks, including $JPMorgan(JPM.US$ , $Citigroup(C.US$ , $Bank of America(BAC.US$ , and $Wells Fargo & Co(WFC.US$ , will release their quarterly reports this week. Benefiting from the decline in interest rates, banks' unrealized losses narrowed accordingly, but the decline in loan yields has also brought challenges to NIM. In the article After Consecutive Interest Rate Hikes, Americans' Debt Pressure Has Even Reduced, we noted that U.S. household balance sheets are healthy, but rising delinquency rates remain an indicator to watch.

■ How is the growth of deposits?

H.8 stats released by the Federal Reserve showed that seasonally adjusted deposits increased by 0.5% in the fourth quarter (1.8% if not seasonally adjusted). Both large and small banks see deposit inflow. However, unlike small banks, the growth of large banks' deposits might be due to the slow recovery of residents' savings ratio amid downside inflation.

■ How's loan growth and its structure?

Loans increased by 0.26% in the 4th quarter, slower than the pace of deposits, reflecting banks' tightening threshold for loans before the rate fell. While the loan/deposit ratio rose to 63%, up from its recent low of 52% in Dec 2021, it is still below its pre-COVID level of 70% and the 73% figure it approximated at the start of the last Fed tightening cycle. That may give banks a higher safety cushion during downside cycles, but could be a drag on profitability.

The fall in interest rates in the fourth quarter is likely to increase demand for loans in the future, even if it won't be reflected in the latest quarterly reports soon. If interest pressure is reduced, the loan threshold may also be lowered in the future. The upcoming financial reports will reveal how cautious each bank has been with lending.

Regarding different loan types, the Fed's weekly commercial banks' balance sheet showed that credit card loans increased by 1.37%, while automobile loans and other consumer loans saw an obvious decline during Q4.

■ Will loan quality deteriorate?

It is important to observe whether there has been an increase in the overall loan default rate, which is also related to the loan structure of each bank. The increasing share of credit card loans may worsen the bank's asset quality, but as shown in the figure above, the proportion of credit cards is still controllable.

In terms of commercial real estate, we noted in our previous analysis Is it a True Revival for Regional Bank Stocks or Merely Another Deceptive Rally? that CRE remains a risk for banks. We listed some banks with a relatively high proportion of CRE, with PNC and Zions reporting an uptick in nonperforming office loans in the third quarter.

■ How are banks provisioning for loan losses?

Another important metric to watch is how banks manage their capital levels and prepare for potential losses. With the impact of Basel III, Bloomberg predicts that $125 billion in total loss-absorbing capacity (TLAC) will be eroded. Moreover, the inflation of risk-weighted assets could mean that Wells Fargo may face the most significant impact among the banks, Bloomberg analyst Arnold Kakuda warned. In the near term, higher provision for credit losses are expected as both NPA (non-performing assets) and NCO (net charge-offs) ratios increase.

■ What's the outlook for the banking sector?

JP Morgan is generally bullish on bank stocks, although it has downgraded some banks. The analyst Steven Alexopoulos noted in the latest report that “As we look to 2024, while it will almost certainly be a year filled with curve balls, it is very clear to us that twelve months from now there will likely be far less uncertainty weighing on valuations as we find today.”

Alexopoulosbelieves that while the upside potential is unlikely to be fully realized entirely in 2024, it could prove to be a 2024/2025 story (such as we had with 2009/2010), with now being the time to go against the crowd and increase exposure to a deeply out of favor sector. He thinks banks today are having strong capital levels and reserves established assuming a recession, and liquidity levels are bolstered after March Madness in 2023.

Barclays expected improved relative bank stock performance in 2024 as NII troughs amid stabilizing deposit trends and accelerating loan growth later in the year, although its report shows the earnings growth is expected to be pressured at the beginning of 2024, and end the year stronger than they start. The analyst Jason Goldberg noted that IBD fees should recover, while expenses are well controlled, and Basel endgame easement is also possible. Still, he said loan losses are expected to continue to grind higher.

Since loan interest rates and deposit interest rates move almost simultaneously, NIM may not necessarily be affected even if loan yields decline in the future. However, FFIEC data shows a surge in the number of large time deposits, which may pose risks if these deposits lock in high deposit interest rates in the coming years.

Bloomberg recently listed several regional banks that are likely to be downgraded, including Bank OZK, and First Horizon Corp, saying they could become the Fallen Angels in the bond market. This warns us that mixed signals in the complex macro environment may still bring many challenges to the sector, so banks with better risk management capabilities and more safety cushion are more likely to win in the long term.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment