Money Never Sleeps: What's Behind the Surging Performance of PE Giants Amid Rising Interest Rates?

Private Equity (PE) firms' earnings performance is closely related to the capital markets. The increased market volatility and high-interest-rate environment in recent years have compressed valuations in the primary market, posing challenges to traditional PE firms. However, many companies have actively transformed and expanded their stable sources of income. How has the PE industry transformed?

■ Private credit has become the new pillar for private equity firms.

Private equity giants such as Blackstone, KKR, Bain Capital, and Carlyle are all making significant forays into the private credit business, and it is becoming one of their most profitable sectors. In September last year, Blackstone established a new division, BXCI, which invests across the credit market, including direct lending, opportunistic credit, CLOs, high yield, and asset-based lending. As of the end of the first quarter of 2024, Blackstone's credit platform had assets exceeding $400 billion. According to Blackstone's earnings report, for the 12 months ending in March this year, Blackstone's credit business outperformed its private equity platform, generating a total return of about 17%.

Some firms provide loans for new business models. Last year, the private credit funds managed by KKR purchased a portfolio of Buy Now, Pay Later (BNPL) loan receivables initiated by PayPal in France, Germany, Italy, Spain, and the UK, worth up to 40 billion euros.

The difference between private credit and most bank loans is that private credit usually has more flexible terms that can be customized based on the borrower's specific needs, including interest rates, repayment methods, collateral requirements, etc. Moreover, compared to traditional bank loans, private credit typically has a faster decision-making process to meet the funding needs of borrowers. BlackRock's Edwin Conway mentioned that "ongoing regulatory changes and liquidity concerns affect the traditional loan market, and banks are no longer underwriting large leveraged buyouts or lending to small enterprises, opening the door for non-bank lenders to fill the void."

For private equity firms, credit investment can serve as an effective way to diversify investment portfolios, helping to reduce the volatility of the overall investment portfolio, with shorter duration and more stable returns. Andrew Tan, CEO of Muzinich Asia Pacific, stated that the yield on private loan returns is approximately 10% to 18%, typically for three-year transactions.

■ PE institutions have increased their equity investments in infrastructure in recent years

Due to the stable cash flows of infrastructure and its natural inflation-hedging characteristics, PE is increasing equity investments in the infrastructure sector. Infrastructure assets can offer higher return than fixed income and longer duration than private credit.

For example, Canadian investment company Brookfield, a global infrastructure expert and the largest clean energy investor in the PE market, has invested in 211 solar facilities and installed 7.73 MW of solar power capacity so far. The Financial Times has reported that Microsoft has committed to supporting renewable electricity developments by Brookfield Asset Management with an estimated value of $10 billion, as the surge in interest for generative artificial intelligence raises alarms over its substantial energy consumption. The initiative is expected to bring 10.5 gigawatts of power generation capacity, sufficient to supply energy to approximately 1.8 million homes. The company also signed an agreement with Intel to fund the expansion of its Arizona industrial properties.

KKR is another representative private equity firm that specializes in infrastructure investment. The company, which has numerous investment experts, creates added value for investors through its extensive global network and sophisticated operational models.

■ PE companies are starting to enter the insurance business

Due to changes in population demographics, governments around the world are underprepared for pension obligations. The reduction of defined benefit plans has allowed the pension business of private institutions to develop.

Compared to traditional insurance companies, PE giants not only have stronger investment capabilities but are also adept at managing products with long closed periods. Therefore, many companies have begun to venture into the insurance business to supplement the traditional pension system.

Apollo stated in its first-quarter report that retirement issues are becoming increasingly prominent and will be an important driver of the company's business growth. The company is well-known for its retirement services. The sector contributes more than half of Apollo's net profit.

■ More PE firms are expected to join the S&P 500

Currently, there are three PE companies included in the S&P 500 index. Bloomberg's analyst Paul Gulberg noted Apollo may be next of the group for inclusion in the S&P 500 now that eligibility has been broadened to allow multiple share-class structures. With a market capitalization of $64 billion, Apollo is positioned to rank within the top 150 constituents by size, and Ares is poised to emerge as a potential competitor.

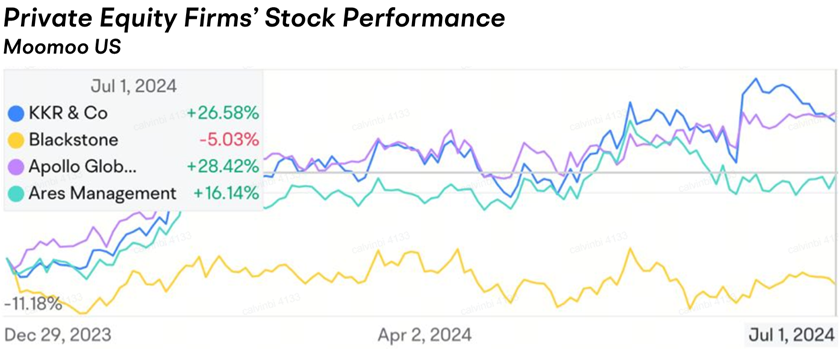

■ What is the outlook for major PE institutions?

Blackstone: Since Blackstone's real estate sector has a higher proportion than its peers, the current high interest rates have a greater impact on the company. Still, Blackstone is growing past a $1 trillion managed-assets goal. Analysts see management fees may climb by high-single digits in 2024 and accelerate after that, according to Bloomberg polls. Consensus incorporates an influx of $150 billion this year and $190 billion the following year. While realized performance could see improvement later in the current year, it may take a while to return to peak levels, depending on transaction volumes. Fee-related earnings (FRE) are anticipated to experience approximately a 20% increase in 2024.

KKR: The company delivered higher fee-related earnings (FRE) and strong margin in Q1. Management suggested more pipelines may open in 2Q. Bloomberg's Gulberg noted that “KKR showed early progress to 2026 goals. The realization pipeline can yield over $400 million of net fees. The company has $44 billion of committed capital not yet paying fees. At a 90-bp rate, that equates to $400 million in annual fees, or 14% incremental to 2023 fees.”

Risk Disclosure: PE institutions face the risk of difficulties in exiting projects; the risk of capital gains tax levied, and the risk of the real estate's continued downturn.

Source: Bloomberg, KKR, Blackstone, Brookfield

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment