Bitcoin Soars to Two-Year High: What's Next for the Crypto Market?

Following a brief dip due to profit-taking and other factors, $Bitcoin (BTC.CC)$ has embarked on a new sustained rally since February. On Tuesday, the price of Bitcoin hit $57,000, marking a new high since November 2021. Concurrently, cryptocurrency-related stocks, such as $Coinbase (COIN.US)$, $MARA Holdings (MARA.US)$, and $MicroStrategy (MSTR.US)$, have collectively gained momentum.

What's Fueling Bitcoin's Latest Price Surge?

The recent surge in Bitcoin's price can be attributed to two main factors:

1. The successful listing of ETFs has led to a robust influx of capital. This January, with the ETF giant BlackRock leading the charge, the Bitcoin spot ETF was finally approved for listing. This historic breakthrough not only bolstered the mainstream financial market's recognition of cryptocurrencies but also brought in a significant amount of new capital.

On Monday, trading volumes for the Bitcoin ETFs in the United States reached a new historical high of $2.4 billion.

According to The Block, spot bitcoin ETFs have seen an aggregate trading volume of almost $52 billion since they started trading last month. CoinShares reports that, since their inception, these products have amassed a total net inflow of $5.8 billion, a figure that includes the $7.4 billion simultaneously pulled from the Grayscale Bitcoin Trust following its transition away from a trust structure. Spencer Hallarn, global head of over-the-counter trading at crypto investment firm GSR, said,

Bitcoin continues its ascent, supported by strong ETF inflows.

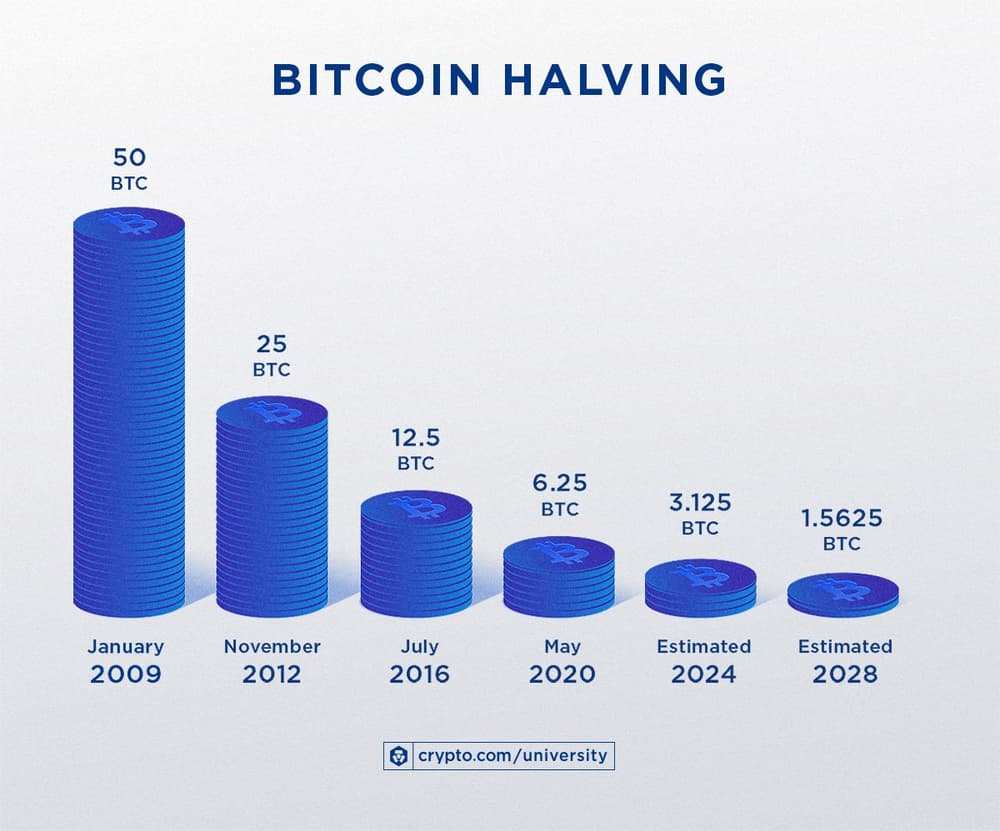

2. The market is starting to focus on the upcoming Bitcoin halving. Bitcoin is designed with a hard cap of 21 million BTC as its absolute maximum supply. Key features of Bitcoin include its predetermined supply limit and the halving of block rewards approximately every four years.

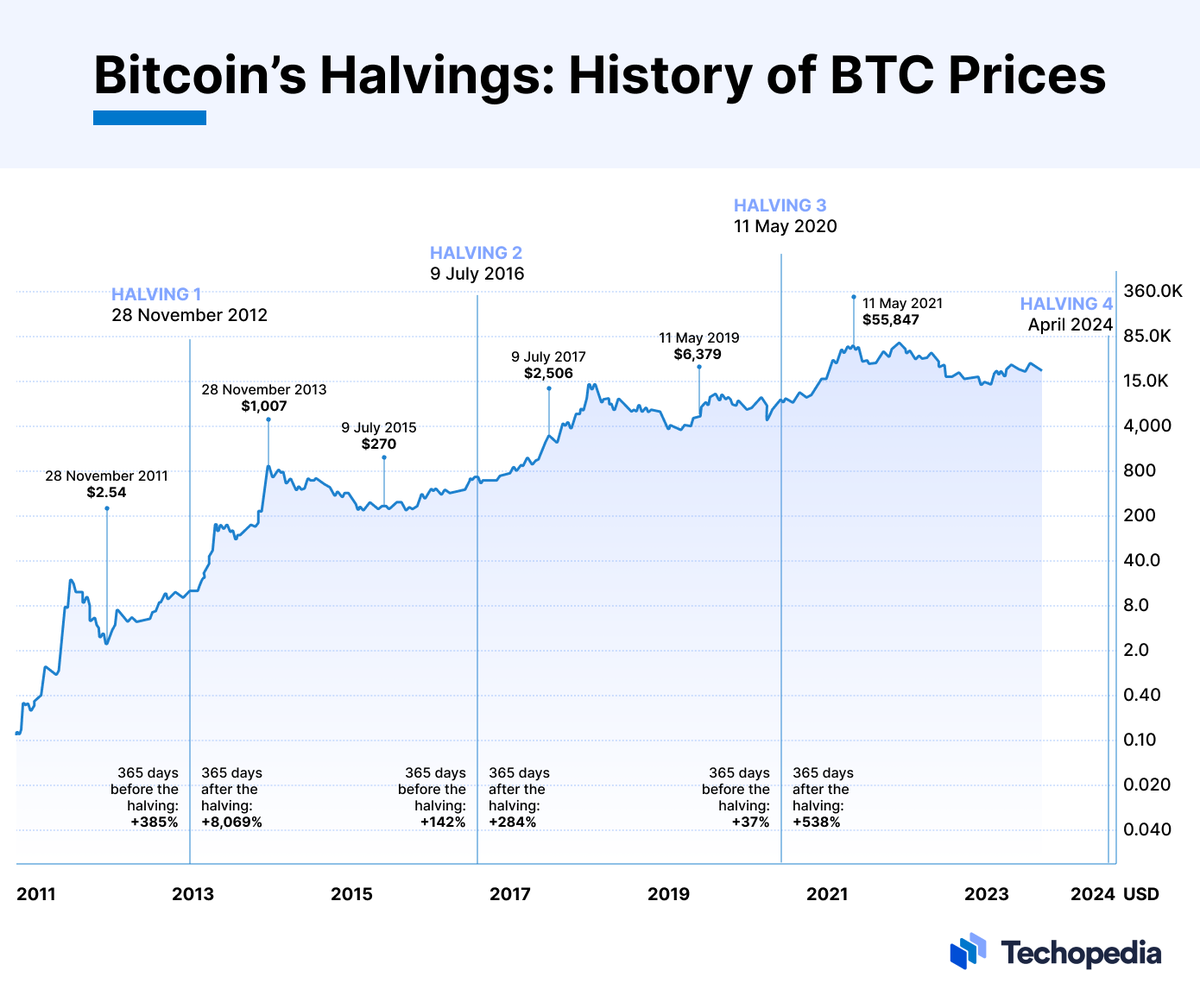

The first Bitcoin halving occurred in 2012 when the price was at $12. Subsequent halvings took place in 2016 and 2020. After each halving, the price of Bitcoin typically saw significant increases within 6 to 12 months, repeatedly setting new records.

This year marks the fourth Bitcoin halving, which is expected to occur in mid to late April. At that time, the block reward will be reduced from 6.25 Bitcoin per block to 3.125 Bitcoin per block.

How Does Bitcoin Halving Affect Different Market Players?

For Bitcoin Investors: The halving event reduces the Bitcoin block reward to half of its previous amount, simultaneously halving the rate at which new bitcoins are generated. The slowed supply and increased scarcity could potentially boost the price of Bitcoin, thereby stimulating trading activity within the cryptocurrency market.

For Bitcoin Miners: Miners' income is composed of both block rewards and transaction fees. The halving directly cuts the block reward in half, which means that miners will see their block reward income decrease, assuming mining power remains constant.

For Speculators: Bitcoin halving is traditionally seen as a bullish event for the market. Following each halving, the market often experiences a bullish phase, creating a strong FOMO (Fear Of Missing Out) sentiment that attracts more speculators looking for short-term gains, hoping to capitalize on the anticipated price movements.

What Is the Outlook for Cryptocurrency?

Analysts at Bernstein believe bitcoin can reach a new all-time high price later this year, and said in a note,

We think the best days of bitcoin are ahead, and the ETF-led bitcoin market is poised for what we expect to be a FOMO rally.

Analysts led by Nikolaos Panigirtzoglou at JPMorgan said that three key upcoming events in the cryptocurrency space that could drive retail investor excitement and FOMO. These events are the Bitcoin halving, the Ethereum network upgrade, and the decision by the SEC regarding the Ethereum spot ETF application. They suggest that the market has largely priced in the first two events, whereas the likelihood of the third event happening stands at about 50%.

Investors should also be mindful of the risks associated with investing in Bitcoin. Currently, the Crypto Fear & Greed Index has climbed to its highest point since 2021. Meanwhile, crypto-assets lack intrinsic economic value or underlying assets. Their common utilization for speculative purposes, coupled with significant volatility, substantial energy demands, and associations with funding illegal activities, render them highly risky instruments.

Source: The Block, CoinMarketCap, CoinGlass, Yahoo Finance, Bloomberg, TheStreet, CoinLive

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Silverbat : Might see new highs in 2024

103899097 :

limpc : Good info. Looking forward to april

srimoen : love like this for crypto style, 5 years tradition to be true and historical report can be right for calculation predict. thank you for this![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) n' waiting more for next years.

n' waiting more for next years.

Anna Hicks : What’s the least amount that I can start with investing in Bitcoin?