Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi, mooers! Q4 earnings season is looming. Are you ready for it? ![]()

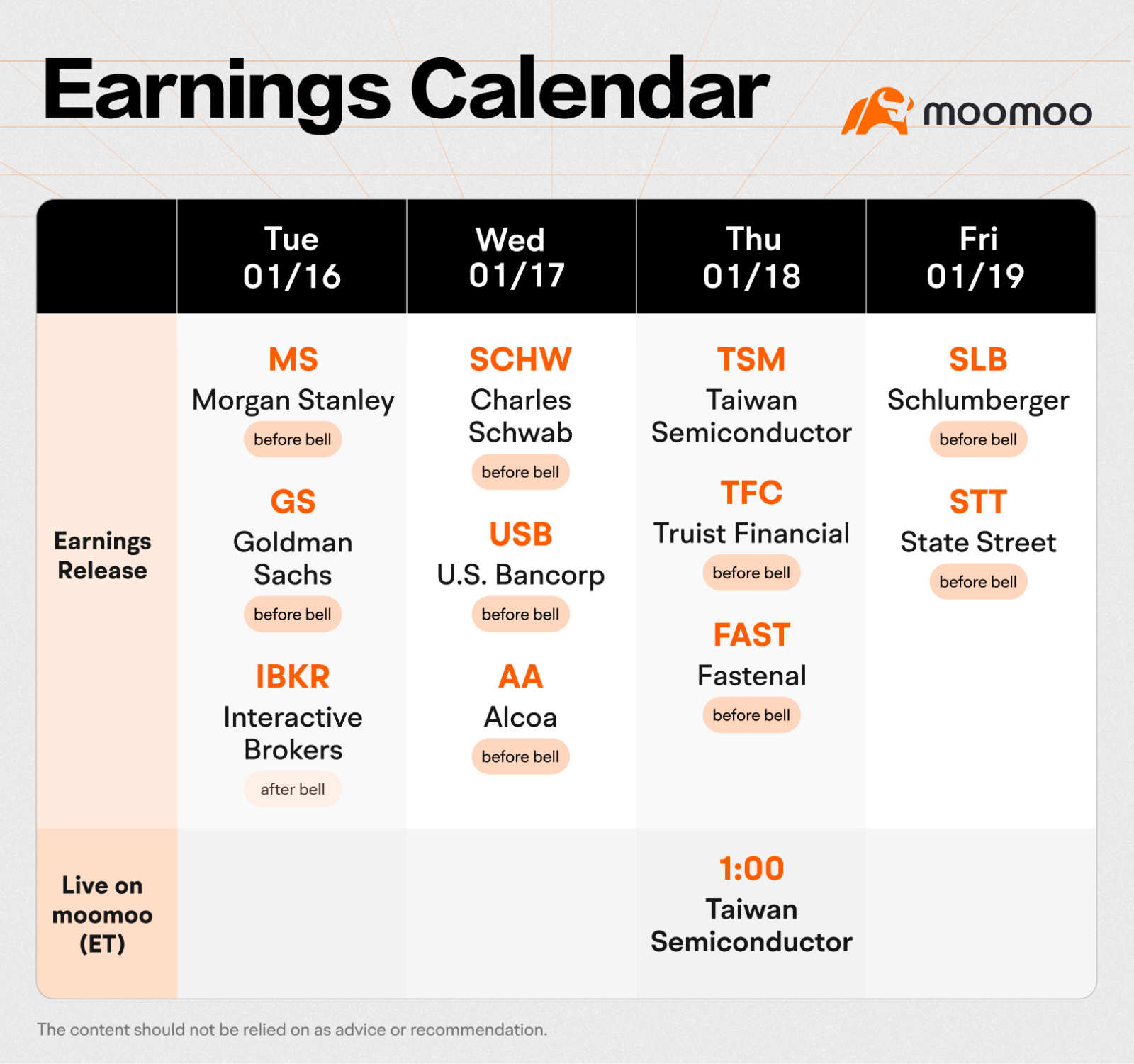

This week, various companies including $Morgan Stanley (MS.US)$ , $Goldman Sachs (GS.US)$ , and $Taiwan Semiconductor (TSM.US)$ are releasing their quarterly earnings. How will the market react to the companies' results? Let's make a guess! ![]()

Rewards

(Vote will close at 9:00 AM ET Jan 18)

Book live earnings conference on moomoo:

TSMC Q4 2023 earnings conference call (January 18 at 1:00 AM ET)

Note:

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

1. Rewards will be distributed within 5-7 working days after the result's announcement.

2. Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

3. The selection is based on post quality, originality, and user engagement.

Disclaimer: This material is for informational use only and is not a recommendation of any investment and should not be used as the primary basis of any investment decisions. There is no assurance that any estimates or price targets mentioned will occur. Investing involves risks. Past performance is not indicative of future results. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. For AU users: AFSL 224663. All investments carry risks. Consider FSG before applying. Data and information displayed in these images are obtained from independent third-party sources. They do not constitute any financial advice, recommendation or solicitation to acquire or dispose financial products. All contents such as comments and links posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. The reward selection shall be made upon moomoo's sole discretion and determination. Points may be redeemed only through the moomoo app and have no other value. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

CᖇYᑌI᙭ : $Morgan Stanley (MS.US)$ For the win!

102362254 : The market is always full of surprises, but based on the latest earnings reports and estimates, we can make some educated guesses. For $Morgan Stanley (MS.US)$, the market may react positively, as the company beat the consensus EPS estimate by $0.05 and reported net revenues of $12.7 billion, down only 12% from a year ago.

For $Goldman Sachs (GS.US)$, the market may react negatively, as the company missed the consensus EPS estimate by $0.39 and reported net revenues of $10.59 billion, down 16% from a year ago.

For $Taiwan Semiconductor (TSM.US)$, the market may react neutrally, as the company met the consensus EPS estimate and reported net revenues of $17.28 billion, down 10.1% from a year ago. Of course, these are just guesses, and the market may have other factors to consider.

ZnWC : I chose Taiwan Semiconductor to be the biggest gains in intraday trading on the day of earnings release.

TSMC is the world's second most valuable semiconductor company. It was also the first foundry to market 7-nanometre and 5-nanometre (used by the 2020 Apple A14 and M1 SoCs, the MediaTek Dimensity 8100, and AMD Ryzen 7000 series processors) production capabilities, and the first to commercialize extreme ultraviolet (EUV) lithography technology in high volume.

According to Barron, TSMC reported a drop in sales for December but beat expectations for the quarter overall. TSMC like Nvidia —have struggled to meet demand for AI chips. TSMC management has confirmed plans to double advanced chip-packaging capacity, called CoWoS, by the end of 2024. CoWoS is needed to make Nvidia’s highest- performing AI chips.

I expect TSMC Q4 earnings to meet expectations and the stock will boom when demand for AI chips expands.

小trader : Based on the recent earnings reports of other banks, it appears that along with some other banks, Morgan Stanley is well-positioned to benefit from the substantial demand for investment banking services. Morgan Stanley's revenue sources are prominently derived from trading operations and asset management, and although these areas are susceptible to market changes, the company's diverse revenue streams contribute to its resilience in unpredictable financial markets.

Despite the inherent volatility in market-sensitive segments, I believe that Morgan Stanley's adept management of debt and its consistently strong financial performance make it an appealing investment prospect.

mr_cashcow : $Taiwan Semiconductor (TSM.US)$ began shipping chips that were fabricated using its industry-leading "N3" node. Nearly all of the company's N3 capacity has been filled by high-end chip designers such as Apple, NVIDIA and even Intel. As high-performance computing, particularly related to AI in both data centers and edge devices, continues to build momentum, the company will be a key supplier for many years to come. Hence I believe after their earning call their stock will![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) hopefully

hopefully![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Sauce: yahoo finance

ohTHATguy : Don’t like big banks they are financial arm of the all the evil in this world. Taiwan Semiconductor will out do the devils partners