Earnings Volatility: Apple Shares Poised for Outsized Post-Earnings Move

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Earnings Date: 2/1 After Market Close

-Implied Move: 3.7%

-Absolute Average Actual Move for the past 4 Quarters: 3.1%

-Absolute Average Actual Move for the past 12 Quarters: 3.4%

-Earnings Normalized Estimate: USD $2.106

-Revenue Estimate: USD 118.26 billion

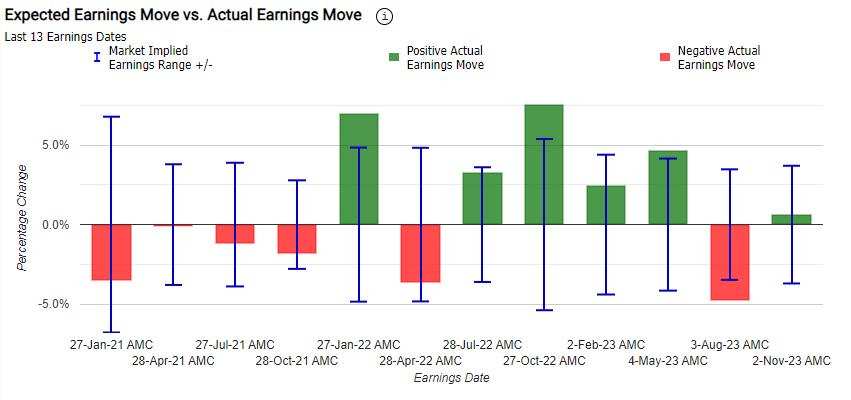

According to recent data from Market Chameleon, options for Apple are overvalued with the implied move of 3.7% slightly higher than the average actual move for the past 4 quarters (3.1%) and its average actual move for the past 12 quarters(3.4%). The options market overestimated AAPL stocks earnings move 62% of the time in the last 13 quarters. The predicted move after earnings announcement was ±4.3% on average vs an average of the actual earnings moves of 3.6% (in absolute terms).

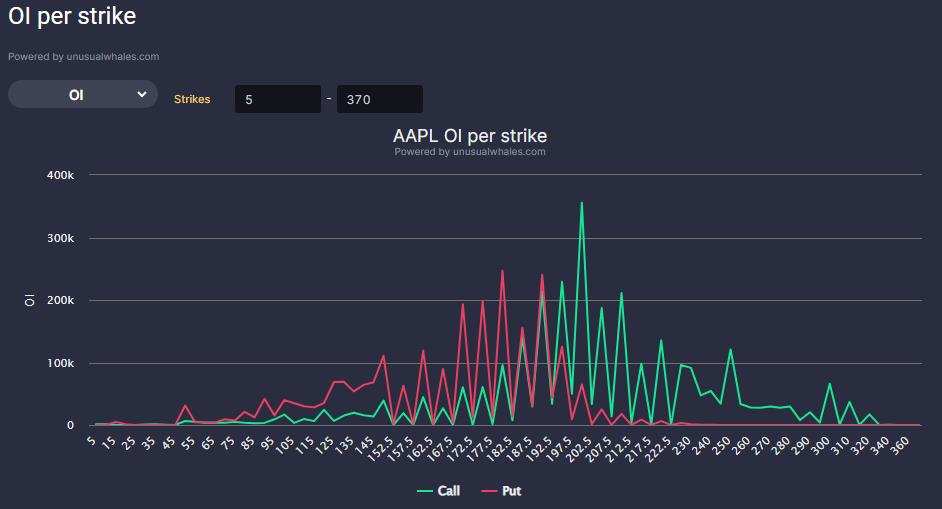

The Apple stock options market shows a call option wall at $200 and put option walls at $190 and $180, reflecting concentrated trading interest. The most notable open interest is in the March 15, 2024, $210 call options.

Earnings Catalyst

IPhone Revenue

Apple dethroned Samsung Electronics as the world's leading smartphone vendor in 2023, ending the South Korean company's 13-year reign at the top of the market, according to a report by International Data Corp. (IDC) on Jan. 15th.

Industry analysts noting a significant drop in enthusiasm for Apple's latest hardware in the crucial global market. Despite these challenges, Apple's strategic use of discounts and promotions has softened the impact, allowing the iPhone to maintain its lead in shipments for both the fourth quarter and the entirety of 2023, according to IDC.

Apple's performance, characterized by a modest 2.2% year-over-year decline, stands out positively against the backdrop of an overall 5% decrease in smartphone shipments and steeper declines faced by local competitors such as Honor Device Co. and Vivo, which both saw double-digit drops.

"While the Chinese smartphone market remains challenged, it is moving towards recovery," with growth in the fourth quarter marking the end of 10 straight quarters of year-over-year decline, IDC said. High-end consumers in first- to third-tier cities were key drivers in the growth, while demand for lower-range products remained weak, it said.

Vision Pro

In term of the first new product line in years, Apple Vision Pro's first-weekend sale surprised the analysts at Wedbush, with sales numbers estimated to be more than double what was expected.

"Fast forward to pre-orders hitting the Apple website this past Friday, and based on our initial reads/delivery times, it looks like close to 180,000 Vision Pro units were sold over the weekend in a very impressive Cupertino launch."

Because of the steep $3,500 price tag and Apple's emphasis on encouraging developers to use the visionOS platform in the first place, the brokerage noted in a recent note that Benzinga was able to assess that the consensus estimate was between 70,000 and 80,000 units.

Third Party App and Payments

Apple's service revenue is facing new challenges as regulatory pressures, particularly from the EU's Digital Markets Act and South Korean legislation in this quarter, force it to open up its iOS ecosystem to third-party payment systems and alternative app stores.

The tech giant is adapting to the regulations by allowing iPhone and iPad users to download software from other app marketplaces and enabling service providers to bypass Apple's in-app payment methods in favor of competing platforms.

Although Apple will still collect a commission—now at 26% for transactions in South Korea using third-party payments—this is a small shift from the 15-30% range previously charged for transactions using its own payment system.

Additionally, new devices will prompt users to select their preferred browser upon setup, challenging Safari's default status. These changes, aimed at preventing Apple's gatekeeping dominance, may impact the robust revenue stream historically generated by its tight control over the App Store and in-app purchases.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

samuelcferguson : yes