Earnings Volatility | Walmart, Home Depot Shares Positioned for Post-Earnings Wild Swing

This week brings a quieter period for earnings reports, though there are still a few key stocks scheduled to announce their results.

Typically, implied volatility spikes before a company releases its earnings, as market uncertainty drives up demand for options from speculators and hedgers. This heightened demand inflates both the implied volatility and the price of the options.

Following the earnings announcement, implied volatility generally returns to normal levels.

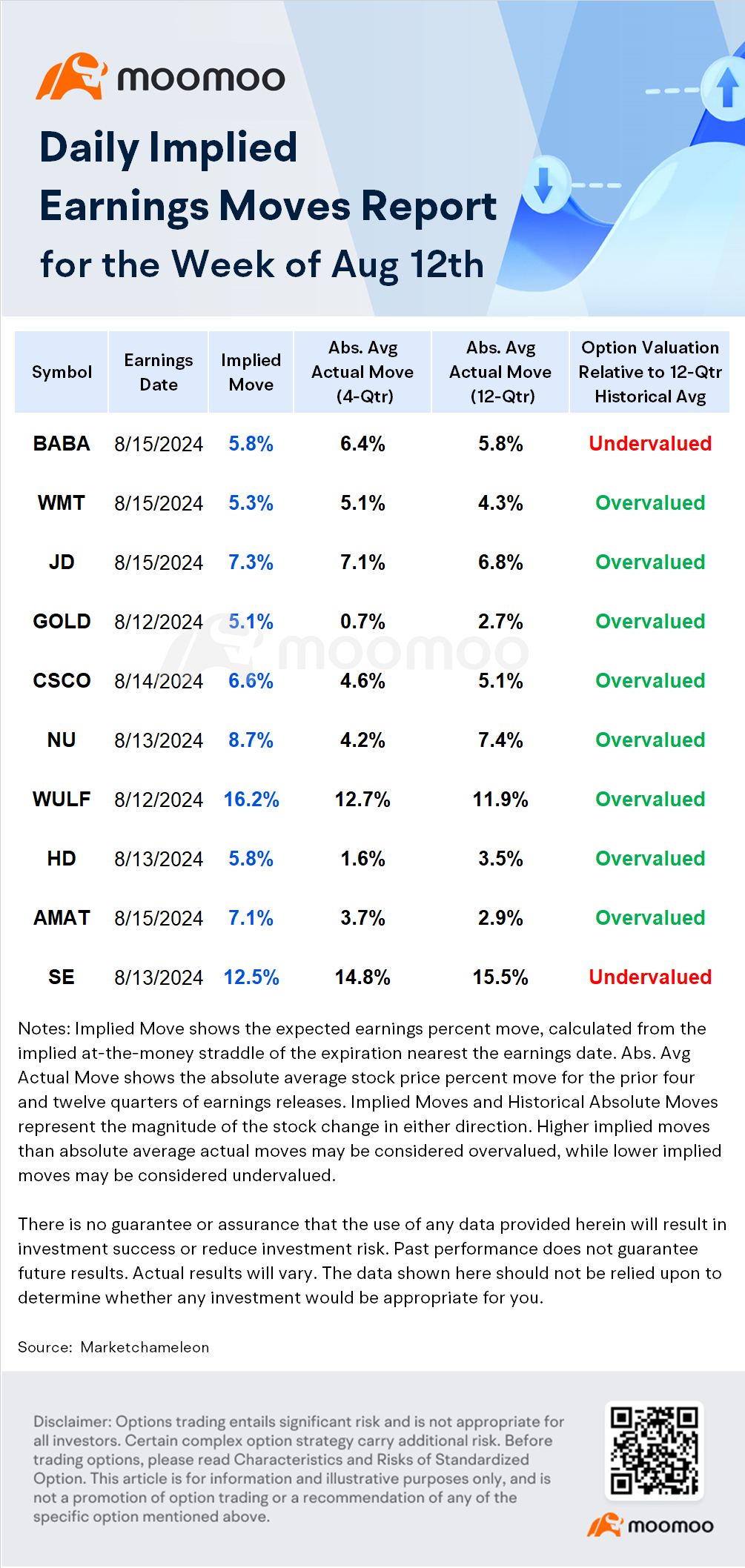

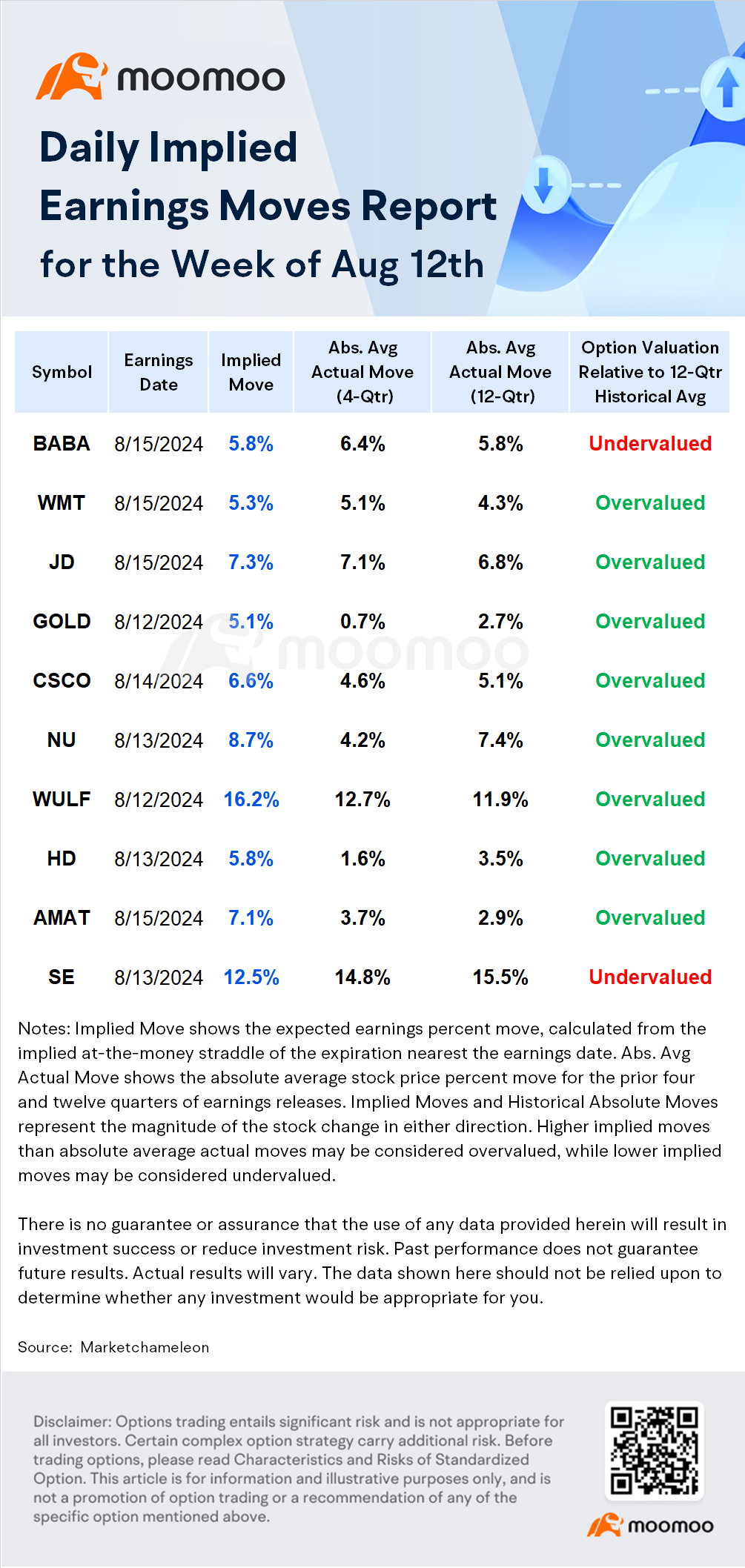

Here are the top earnings and volatility for the week:

-Earnings Release Date: Pre-market on Aug 15

-Earnings Forecast: Q1FY2025 revenue of¥247.45 Billion CNY, up 5.68% year-over-year; EPS of¥12.19 CNY, down -8.34% year-over-year

Alibabais scheduled to report its earnings on August 15, 2024, before the market opens. Historically, the options market has shown a tendency to overestimate the stock's post-earnings movement. In the past 13 quarters, the options prices suggested an average post-earnings fluctuation of ±6.9%, which turned out to be higher than the actual average move of -6.0%. In fact, 69% of the time, the options market's predictions did not match the actual earnings movement of BABA stock. On average, the options market anticipated a ±6.6% change following the earnings announcement, whereas the real average move was somewhat lower at 5.8% (in absolute terms).

Looking at the pre-earnings period, the average expected earnings movement was ±5.9%, with actual earnings results showing an average move of ±4.3%, falling short by 1.5% from the expected figure. The average opening gap was ±4.2%, and subsequent stock drift after the market opened averaged around ±3.1%. During the trading sessions immediately following the earnings release, BABA's stock experienced significant volatility, with the most considerable upward swing reaching +15.5% and the sharpest decline hitting -12.2%. These figures illustrate the stock's dynamic behavior around earnings announcements, highlighting both the anticipation and the actual market reactions.

Amid signs of economic softening in the United States, a growing chorus on Wall Street expects the Federal Reserve to entertain the possibility of rate cuts sooner rather than later. While debate swirls around the prospect of a U.S. recession, the recent slew of weak economic indicators has fueled speculation that the Fed may pivot towards a more accommodative monetary policy. Many major financial institutions are warming to the idea of an aggressive easing cycle, with a number not ruling out the potential for rate reductions to begin as early as September.

Should the Fed initiate rate cuts, Chinese assets stand poised to benefit from a resultant liquidity boost. This could spell significant positive developments for China concept stocks and the markets in Hong Kong and mainland China, which may welcome substantial tailwinds.

In China, the technology sector—bolstered by strong balance sheets—has built up considerable cash reserves. This financial footing enables giants like Alibaba Group., $Tencent (TCEHY.US)$, and JD.com to continue delivering shareholder value amidst broader economic headwinds.

For the fiscal year 2024, Alibaba's board has greenlit a dividend payout of $4.0 billion. On the other hand, JD.com reported using $2.14 billion of its free cash flow in the first quarter, maintaining a war chest of $24.8 billion in cash and cash equivalents.

However, China's decelerating economic growth casts a shadow over the operations of these tech behemoths. For instance, Tencent's revenue streams from advertising, financial technology, and business services remain closely tied to the country's economic fortunes.

Simultaneously, Alibaba and JD.com are ramping up investments in consumer incentives and discounts in a bid to fuel sales growth, navigating a challenging landscape where economic headwinds meet corporate resilience.

-Earnings Release Date: Pre-market on Aug 15

-Earnings Forecast: Q2FY2025 revenue of $167.39 billion, up 4.43% year-over-year; EPS of $0.64, down 33.81% year-over-year

Walmart is on the calendar to release its second-quarter earnings on August 15, 2024, before trading commences for the day. In the lead-up to this, the options market has projected a post-earnings stock price movement of ±3.7%. However, the actual movement recorded was a more significant +7.0%. Over the course of the last 13 quarters, the options market has consistently overestimated the volatility of WMT's stock in relation to earnings, doing so 62% of the time. While the options market's average predicted earnings move was ±4.1%, the actual average move slightly exceeded this at 4.2% in absolute terms, indicating that WMT's stock has historically been more volatile than expected following earnings announcements.

In anticipation of earnings disclosures, the average expected move for WMT's stock was ±3.8%, which was precisely in line with the actual average movement observed. The stock typically experienced an opening gap of ±3.1%, and after the market opened, an average stock drift of ±1.7% was noted. Furthermore, when examining the stock's performance during regular trading hours post-earnings release, WMT saw its most substantial increase to a high of +11.1%, and on the downside, the most pronounced drop to a low of -11.9%. These figures underscore the stock's tendency to exhibit pronounced fluctuations following the earnings announcement, providing valuable insights for traders and investors.

Here are the options for the company that saw the largest increase in open interest last Friday.

-Earnings Release Date: Pre-market on Aug 13

-Earnings Forecast: Q2FY2025 revenue of $42.74 billion, down 0.41% year-over-year; EPS of $4.54, down 2.42% year-over-year

The Home Depot is set to report its second-quarter earnings on August 13, 2024, before the start of trading. Historically, the options market has anticipated a larger movement in HD's stock price around earnings announcements than what has actually occurred. On average, the market predicted a ±5.8% shift, but the actual movement turned out to be more moderate at ±2.5%. Typically, the stock experienced an initial opening gap of ±2.0%, followed by an average drift of ±1.6% once the market opened.

This pattern of overestimation has been observed consistently, with the options market predicting higher volatility than reality in 58% of the last 12 quarters. For the post-earnings period, the options market forecasted an average move of ±4.4%, while the actual average move was a milder 3.5% in absolute terms. Within regular trading hours following earnings releases, HD's stock has seen significant price swings, with the most considerable increase reaching +7.0% and the deepest drop being -11.5%. These figures suggest that while the stock does exhibit movement following earnings reports, the market's expectations often exceed the actual volatility of HD's stock price.

In a recent intereview, Michael Lasser, a food retail analyst at UBS US hardline and broadline, predicted that Home Depot's sales would be lower than anticipated and that the business would thus likely adopt a "more conservative stance on the outlook for the back half of the year." He points out that the housing market is still being pressured by high mortgage rates and insufficient inventory, which is why the home repair industry is comparatively weak.

He adds, "If you're a consumer and you're thinking about financing a big-ticket remodel, you're inclined to wait at this point until the financing of that project is going to become a little bit less expensive. All of that means the conditions are set for an upturn. That's probably going to occur in 2025, and we'll hear that from Home Depot when it reports next week."

Here are the options for the company that saw the largest increase in open interest last Friday.

-Earnings Release Date: Pre-market on Aug 15

-Earnings Forecast: Q2FY2024 revenue of¥291.67 billion CNY, up 1.3% year-over-year; EPS of¥4.85, up 16.88% year-over-year

JD.com is slated to unveil its second-quarter earnings on August 15, 2024, before the market opens, with its last earnings report having been shared on May 16, 2024, BMO (Before Market Open). In recent history, the options market has had a tendency to predict more significant volatility in JD's stock price post-earnings than actually occurs. For the upcoming earnings, the options market forecasted a swing of ±8.3%, whereas the stock actually moved by just +1.9%. This pattern of overestimation has been consistent, with the options market overshooting the actual earnings movement in 69% of the past 13 quarters.

On average, the options market has predicted a post-earnings move of ±7.5%, while the actual numbers tell a different story, showing an average move of 6.4% in absolute terms. This discrepancy points to a general trend of overestimation by the options market regarding JD's post-earnings stock volatility.

In the periods leading up to JD's earnings reports, the options market's average expected move was ±7.7%, but the actual price movement averaged at a lower ±5.5%, falling 2.1% short of expectations. The stock typically saw an opening gap movement of ±4.8%, and after opening, a further average drift of ±3.2% was observed.

Moreover, in the trading sessions that followed earnings releases, JD's stock experienced extreme highs and lows during regular trading hours. The greatest upward surge saw the stock climb by +19.7%, while the most significant downward movement led to a -18.9% drop. These statistics highlight the volatility that JD's stock can exhibit in the wake of earnings announcements and serve as a caution for investors and traders who rely on options market predictions for their decision-making.

Source: Bloomberg, Market Chameleon, FactSet, Dow Jones

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment