Hedging Demand Resurges Amid Political Uncertainty and Big Tech Exodus

As a tsunami of uncertainties dangles over the markets, including the US presidential election, critical second-quarter earnings reports, economic growth estimates, and interest rate expectations, investors are once again turning to hedging.

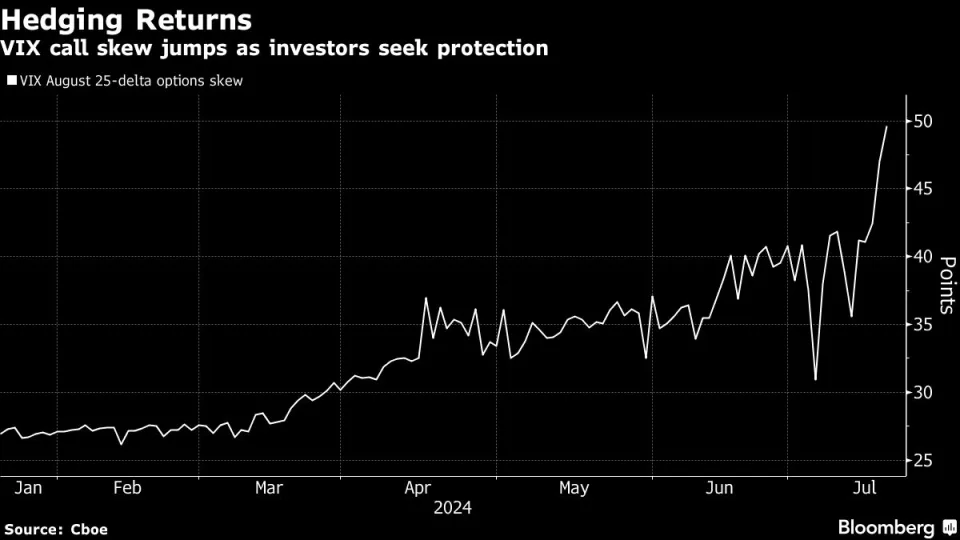

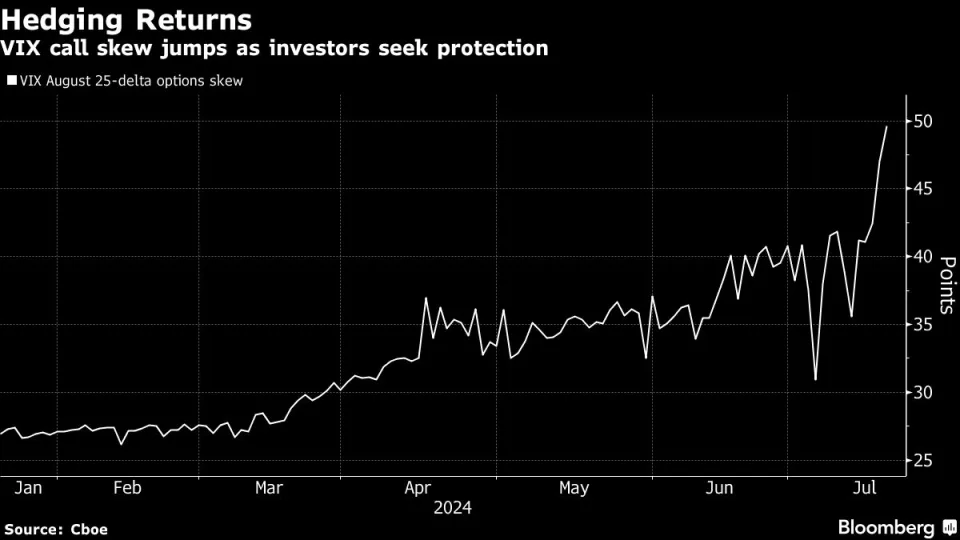

The $CBOE Volatility S&P 500 Index(.VIX.US$, often referred to as the market's "fear gauge," experienced its most significant surge in over a year last week, coinciding with a sharp decline in stock prices. This surge was prompted by growing calls for President Joseph Biden to withdraw from the presidential race, a move that has since materialized, plunging US politics into uncharted territory.

The cost of options on the gauge—often used to hedge against sharp market selloffs—also hitting a three-month high. Notably, more than 170,000 August calls betting the VIX would reach 21 traded, a level the index hasn't seen since October.

Political Uncertainty

"Policy continuity means she [Vice President Kamala Harris] is the closest proxy for Biden among the alternatives, so the volatility pricing will look very similar," commented Stuart Kaiser, head of US equity trading strategy at Citigroup Global Markets. "Perhaps with a bit more risk premium given the late change and recent events on the Trump/GOP side of things."

This shift in political dynamics has reignited traders' interest in protective measures, a stark contrast to the first half of the year when they shunned such strategies amid a bullish market.

Path of the Monetary Policy

Political uncertainty is not the only factor driving the resurgence in hedging demand. Attention is also shifting to the Federal Reserve's potential moves on interest rates. Traders are positioning themselves to gauge the chances of a rate cut by the end of this month or a more significant reduction in September. This adjustment in positioning reflects the market's efforts to hedge against various economic scenarios, including a potential rate-cutting cycle starting as early as this month or a significant move in the September meeting.

Big Tech Needs Good Earnings Release to Keep Rising

Investors are also closely monitoring the performance of major technology companies, which are set to report their second-quarter earnings this week. $Tesla(TSLA.US$ and $Alphabet-C(GOOG.US$, Google's parent company, are among the key players under scrutiny. The outcome of these earnings reports will be critical in determining whether the lofty valuations of these tech giants can be sustained.

The most important signal to keep an eye on when determining when the dot-com bubble burst in 2000 was analyst revisions of revenue growth, according to David Kostin, Chief US Equity Strategist at Goldman Sachs. In light of the seemingly unending hoopla surrounding AI, it might be a helpful statistic for investors to monitor this time around.

In the late 1990s DotCom boom, sales revisions were the key variable to watch because they ultimately signaled when momentum reversal would be sustained," commented Kostin. " $S&P 500 Index(.SPX.US$ outperformance will resume if Big Tech beats and raises its forward sales guidance. If not, then $Russell 2000 Index(.RUT.US$ will continue to outperform," Kostin added.

As the market grapples with these uncertainties, the quieter summer months may amplify market movements. "The market has been conditioned to buy the dip and volatility mean reverts quickly, but high market concentration is a risk," said Tanvir Sandhu, chief global derivatives strategist at Bloomberg Intelligence. "The summer period, when liquidity can be light, can leave the market more exposed than usual to headlines."

With the stakes high and the landscape ever-changing, investors are clearly preparing for a range of possible outcomes, making hedging an essential strategy in navigating these turbulent times.

Source: Bloomberg, Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment