Option Volatility | AI Stocks on the Radar as Palantir and Super Micro Face Earnings Verdict

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings.

Last week's market turbulence spilled into Monday, leaving investors on edge as the major U.S. stock indices braced for another volatile day. The CBOE Volatility Index, or VIX, surged over the key 50 level before the market opened on Monday, marking its highest level since April 2020. So much so that futures on the Cboe Volatility Index have inverted, a signal that the here-and-now uncertainty is higher than that further down the line. This spike has prompted a flurry of activity among market participants, as fears of a potential recession continue to mount.

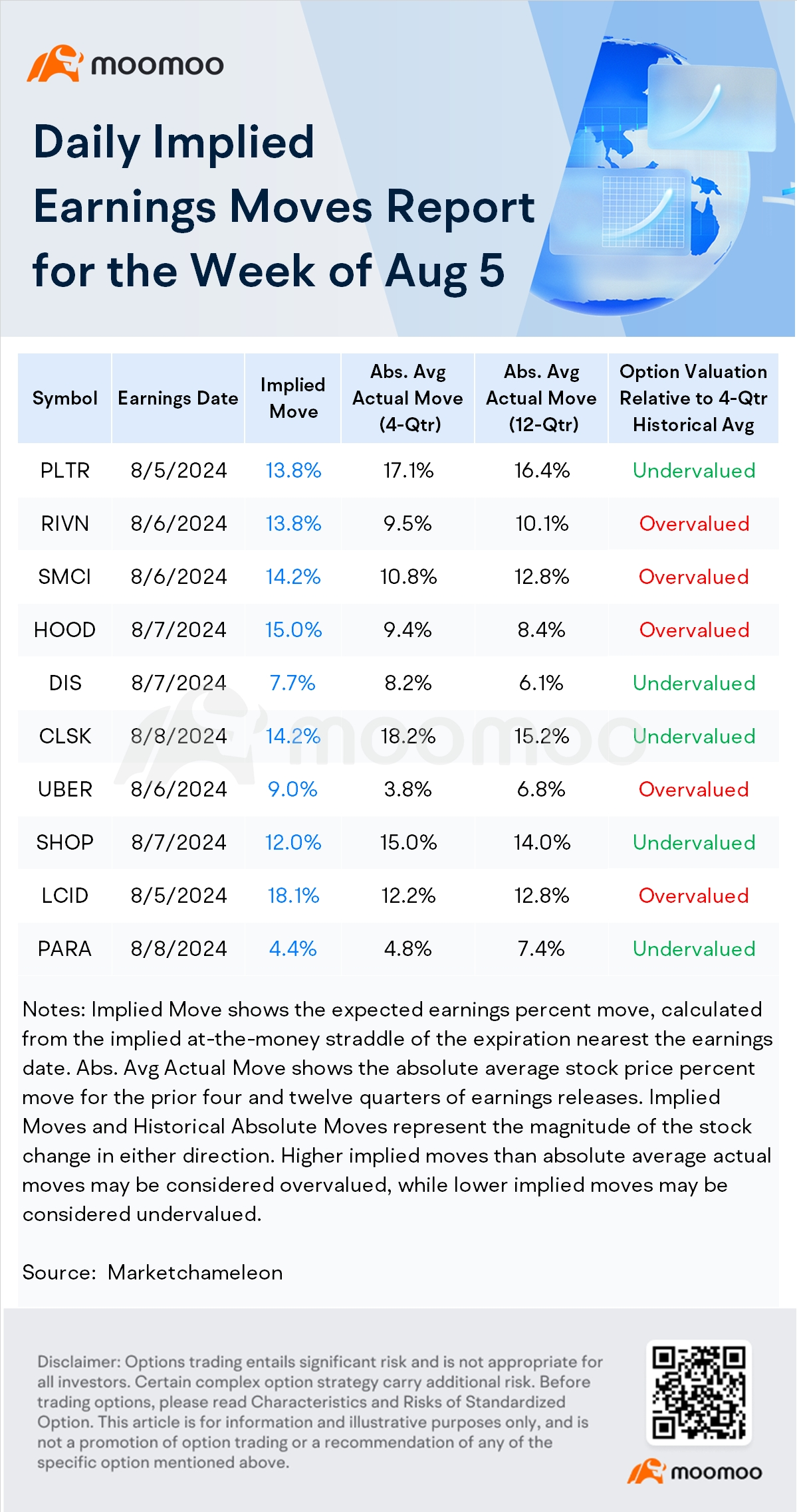

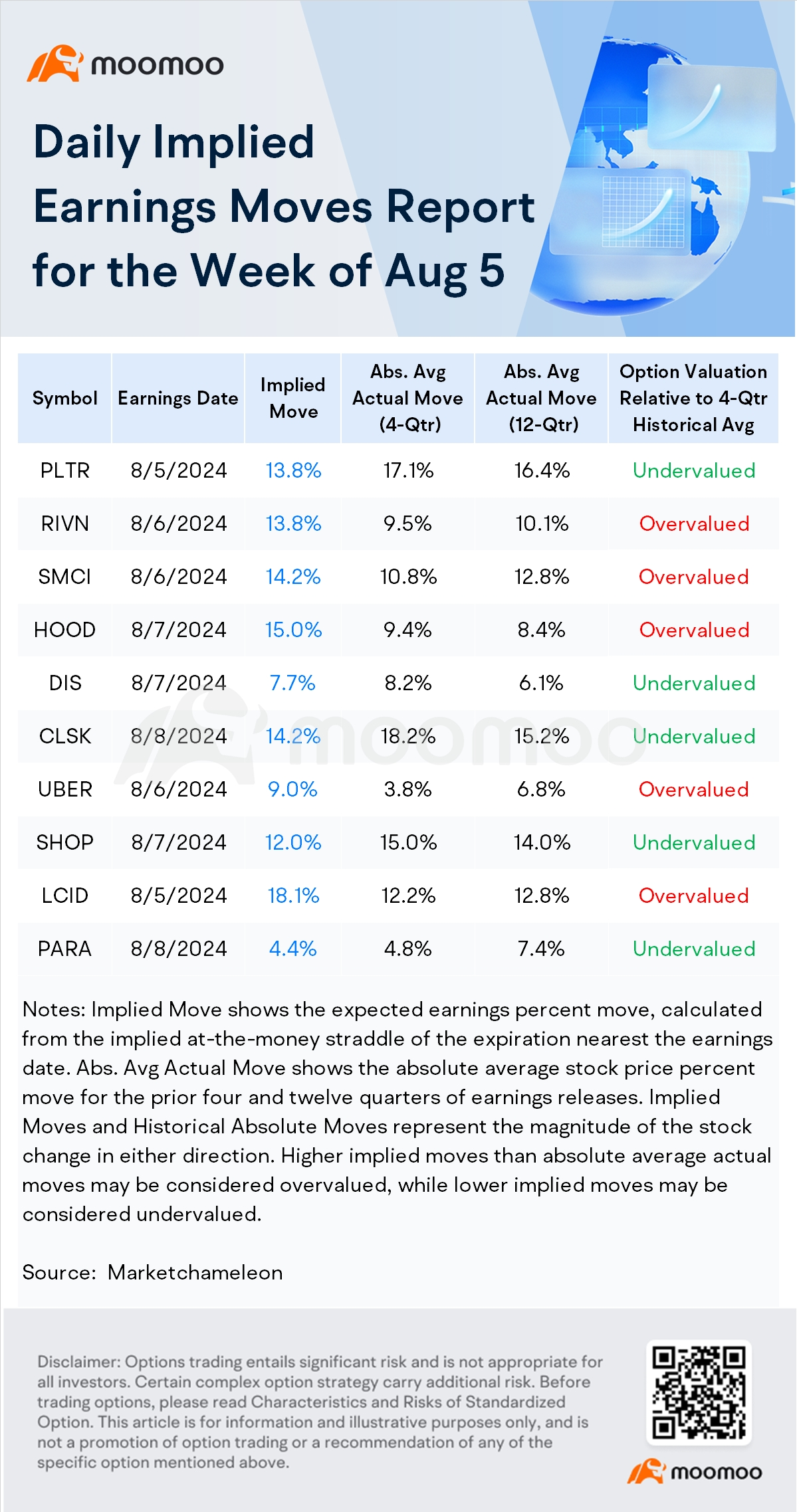

Here are the top earnings and volatility for the week:

-Earnings Release Date: Post-market on Aug 5

-Earnings Forecast: Q2 revenue of $652 million, up 22.33% year-over-year; EPS of $0.03, up 245% year-over-year

Over the last 12 quarters, the options market has not always accurately gauged the volatility of Palantir Technologies Inc. (PLTR) stock in response to earnings reports. The market predicted an average move of ±13.6% following earnings announcements, but the actual movements were more pronounced, averaging ±16.4%—indicating that Palantir's stock often experienced greater volatility than anticipated. This discrepancy occurred 25% of the time, underscoring that traders tended to underestimate the company's earnings-related stock price reactions.

In the lead-up to Palantir's earnings releases, the consensus among options traders was an expected move of ±14.0%. However, the reality proved to be slightly more volatile, with an average actual move of ±15.1%, exceeding predictions by 1.1%. This pattern was reflected in the opening price gaps, which averaged ±10.3%, and was followed by average intraday drifts of ±5.7%. The most extreme moves during regular trading hours post-earnings saw the stock surge to highs of +32.7% and plummet to lows of -22.8%, highlighting the potential for substantial price swings following the company's financial disclosures.

Option volatility skew suggests that the current market sentiment leans towards a bearish outlook on Palantir. Last Friday's options trading volume and open interest were particularly high for the puts expiring this week, with a strike price of $20, both exceeding 10,000 contracts.

Earnings Release Date: Post-market on Aug 6

Earnings Forecast: Q2 revenue of $5.305 billion, up 142.83% year-over-year; EPS of $7.83, up 128.31% year-over-year

In examining the last 12 quarters, it appears that the options market's predictions for Super Micro Computer Inc. (SMCI) stock's earnings-related moves were more conservative than the actual outcomes. The market's average projection for post-earnings stock price movement was ±12.0%, whereas the actual earnings moves averaged ±12.8% in absolute terms. This indicates that SMCI's stock exhibited more volatility than expected in 58% of the instances, suggesting a tendency for the stock to react more sharply to earnings reports than the options market typically anticipated.

In examining the last 12 quarters, it appears that the options market's predictions for Super Micro Computer Inc. (SMCI) stock's earnings-related moves were more conservative than the actual outcomes. The market's average projection for post-earnings stock price movement was ±12.0%, whereas the actual earnings moves averaged ±12.8% in absolute terms. This indicates that SMCI's stock exhibited more volatility than expected in 58% of the instances, suggesting a tendency for the stock to react more sharply to earnings reports than the options market typically anticipated.

When looking closer at the pre-earnings forecasts, traders expected an average earnings move of ±11.8% for SMCI's stock. However, the actual average move post-earnings was a slightly higher ±12.3%, outpacing the predicted move by a margin of 0.5%. The pattern continued with the opening price gaps averaging ±7.6%, followed by an average intraday movement of ±6.3%, reflecting continued volatility after the market open. The stock's most dramatic movements during regular trading hours after earnings releases saw a maximum upswing to +31.8% and a steep decline to -25.1%, showcasing the significant potential for drastic shifts in SMCI's stock price in response to earnings announcements.

The current option volatility skew indicates a slightly bearish sentiment in the market towards Super Micro Computer.

Earnings Release Date: Aug 15

Earnings Forecast: FY2025 Q1 revenue of 247.3 billion yuan, up 5.6% year-over-year; EPS of 12.08 yuan, down 9.2% year-over-year

The options market has consistently overestimated the volatility of Alibaba Group Holding Limited (BABA) stock in response to earnings over the past 13 quarters. With options pricing in an expected post-earnings move of ±6.9%, the actual move resulted in a smaller -6.0% change. This pattern of overestimation occurred 69% of the time, as the average anticipated move was ±6.6%, compared to a lower actual average move of 5.8% in absolute terms.

The options market has consistently overestimated the volatility of Alibaba Group Holding Limited (BABA) stock in response to earnings over the past 13 quarters. With options pricing in an expected post-earnings move of ±6.9%, the actual move resulted in a smaller -6.0% change. This pattern of overestimation occurred 69% of the time, as the average anticipated move was ±6.6%, compared to a lower actual average move of 5.8% in absolute terms.

Leading up to BABA's earnings announcements, the market braced for an average move of ±5.9%, but the reality was less dramatic, with an actual average move of only ±4.3%, falling short of expectations by 1.5%. This trend was evident from the outset, with opening price gaps averaging ±4.2% and subsequent stock drifts averaging ±3.1% after the market opened. In terms of intraday extremes during regular trading hours post-earnings, Alibaba's stock experienced its largest surge to a high of +15.5% and its deepest drop to a low of -12.2%, reflecting the significant but often overestimated volatility surrounding its earnings reports.

Source: Bloomberg, Market Chameleon, FactSet, Dow Jones

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment