Further Uncertainty Reigns in the Treasury Market? What's Next After Moody's Downgrades US Rating Outlook

In response to the heightened downside risks to the US fiscal strength and ongoing political polarization within Congress, Moody's downgraded the outlook on the U.S. government's ratings from stable to negative, while affirming the nation's rating at Aaa. The risk of the US losing its last top credit rating has left investors worried about ongoing uncertainty in the Treasury market.

Despite a relatively muted market reaction, Moody's recent changes will draw greater attention to the fiscal risks facing the United States. This is especially true given the imminent risk of another government shutdown next week (November 17th), which is bound to further dampen market sentiment.

Along with ongoing concerns about the U.S. fiscal situation, weak demand for new debt issuance, reduced likelihood of a recession, and hawkish speeches from Federal Reserve officials have all contributed to a weaker sentiment in the current bond market.

1. Last Thursday's 30-Year Bond Auction Saw One of the Worst Performances in a Decade

The recent 30-year bond auction offered investors a yield of 4.769%, which was 5.3 basis points higher than the yield when issued, marking the largest tail on record since 2016. Additionally, primary dealers were obligated to accept the remaining 24.7% of the total debt on offer, which is double the 12% average seen over the past year.

The weak auction reflects the poor demand for long-dated treasuries, as the U.S. government had to offer a premium over market rates to entice investors to purchase their debt.

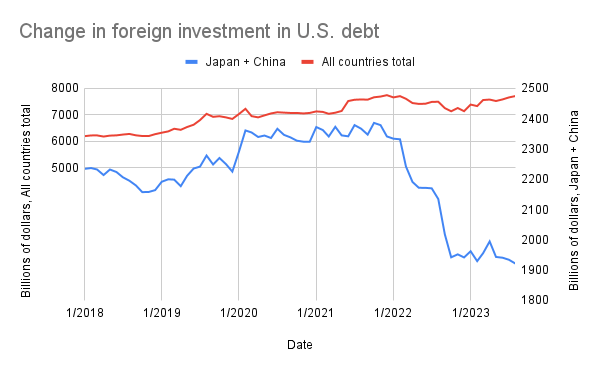

2. Japan and China, the Two Largest Foreign Holders of US Treasuries, See Significant Drop in Holdings

While the total proportion of US Treasuries held by foreign investors is still significant, China and Japan's holdings have been declining.

“Overseas investment in U.S. debt has been more volatile than domestic holdings when demand for the dollar and Treasuries is dampened by weak fiscal policy and poor economic performance, in part due to more attractive, global alternatives,” said Wells Fargo Investment Institute strategist analyst Jennifer Timmerman and global strategist Gary Schlossberg.

3. The Required Recession for a Big Bond Rally is Becoming Less Likely

Some Wall Street analysts believe that the US bond market will not observe a sustained rally unless the U.S. economy undergoes a considerable recession, exceeding even the Fed's expectations. However, the economy's present resilience increases the chance of a soft landing in the United States.

4. The Fall in US Bond Yields Disrupts Fed's Dovish Tone from Last FOMC Meeting due to Eased Financial Conditions

4. The Fall in US Bond Yields Disrupts Fed's Dovish Tone from Last FOMC Meeting due to Eased Financial Conditions

The decrease in long-term US Treasury yields in early November resulted in an easing of financial conditions, which undeniably disrupted the foundation for the Fed's previous dovish tone at the FOMC meeting. During that time, Powell stated that elevated long-term bond yields had tightened financial conditions and diminished the necessity for further rate hikes. The recent frequency of hawkish speeches by Powell and other Federal Reserve officials has confirmed this, as they have warned the market that there is no urgency to reduce interest rates.

Spencer Hakimian, CEO of Tolou Capital Management - a New York-based macro hedge fund - stated that "the noticeable drop in yields from last week may have prompted some caution at the FOMC; If their aim is to instill tighter financial conditions, they cannot allow those yields to decline. They must maintain restrictiveness to avoid raising rates."

Earlier this month, several factors contributed to a significant drop in US Treasury yields. These included the US Treasury's slow pace of longer-dated debt issuance, the dovish stance of the Fed, and weak non-farm payroll data. Consequently, as of November 8, the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ experienced a sharp decline of almost 45bp from its end-of-October high.

With the benchmark 10-year U.S. Treasury yield bouncing back by 17.8bp last week from its November 8 low, investors are being reminded to exercise caution as U.S. Treasuries have witnessed multiple false rebounds after experiencing slumps over the past three years.

George Catrambone, head of fixed income, DWS Americas suggested traders anticipating a Fed pivot should be wary, “because there’s been numerous head fakes over the past 18 months.”

Source:SeekingAlpha, U.S. Treasury, SA News, Bloomberg, Moody's, Barrons, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101664055 : the outlook downgrade is bad for equity market?