Will Rate Cuts in Canada And Europe Affect the United States?

Canada on Wednesday announced to cut rates to 4.75% from 5%, becoming the first G7 nation to cut rates. Governor Tiff Macklem indicated further easing would be gradual and dependent on data.

The European Central Bank on Thursday also confirmed a widely-anticipated reduction in interest rates at its meeting in Frankfurt. It takes the central bank's key rate to 3.75%, down from a record 4%. Markets have priced one further reduction this year.

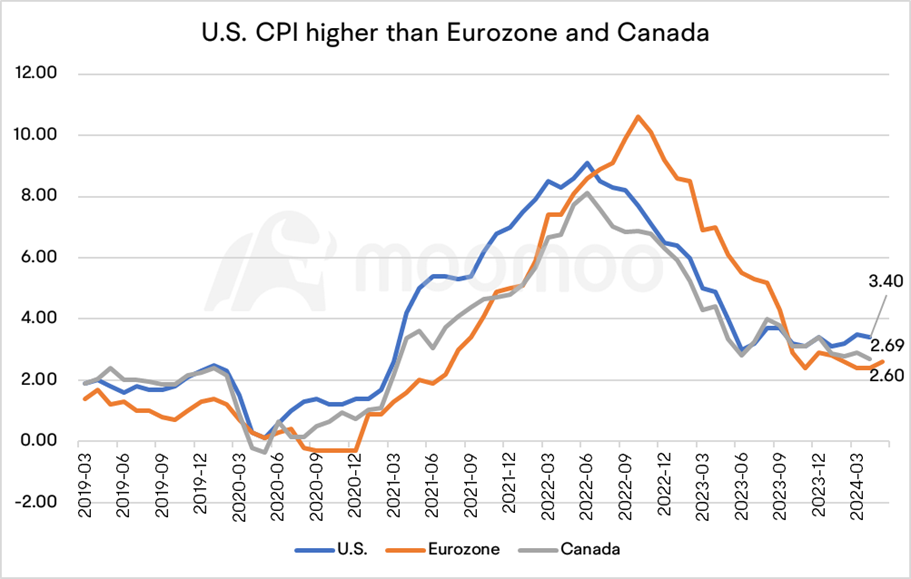

Although Europe and Canada have taken the lead, the US is not expected to follow the pace of interest rate cuts soon, considering the different macro conditions in each country.

■ Why might the United States not immediately follow the interest rate cuts?

The divergence between the U.S. and these regions is indeed due to other developed nations' weaker economies, whether it's in terms of CPI, employment, or technological advancements. However, the differences in decision-making are not solely due to these reasons.

More critically, the U.S. economy relies heavily on a beneficial economic cycle fueled by international capital inflows attracted by higher interest rates. A reduction in rates, associated with recessionary fears, could disrupt the logical consistency of the economic cycle under President Biden's administration. Consequently, the U.S. may not unthinkingly follow the immediate rate-cut actions of other economies.

Moreover, the U.S. dollar serves as a broad pricing anchor for commodities, with oil and gold prices set in dollars rather than euros or Canadian dollars. While rate cuts in the Eurozone and Canada may not directly cause reflationary pressures, the Federal Reserve must be more cautious in changing its stance than other central banks since the dollar carries the "burden" of preventing the mainstream currency system from failing.

■ Nonetheless, this doesn't mean that Europe and Canada's interest rate cuts have no impact on the U.S.

1. Weakness in European and Canadian economies could weigh on U.S. exports.

The widening interest rate differentials between the U.S. and these regions could weaken the Canadian dollar and the euro, making the U.S dollar stronger for some time.

Since the EU and Canada are major trading partners of the U.S., any signs of weakness in their economies may potentially pressure U.S. exports and exacerbate the trade deficit, which could be one of the medium-term factors leading the U.S. to consider lowering rates.

2. The ECB's measure means central banks can cut interest rates while maintaining a hawkish stance at the same time.

Given that inflation levels in Europe are still relatively high, the ECB's preemptive rate cuts could pave the way for the Fed, suggesting that central banks don't necessarily need to maintain rates at their peak. Instead, they could make modest reductions as long as the subsequent rate range remains above inflation levels and continues to have a restrictive effect, waiting for further inflation declines before making additional decisions.

Actually, the ECB's staff economists revised up headline and core inflation for both 2024 and 2025. The monetary policy decisions statement struck a more cautious note on wage growth in June than it did in April. That will limit the number of rate cuts that materialize this year. President Christine Lagarde is expected to refrain from endorsing another move in July.

The two-year swap rate (a gauge of near-term policy expectations) climbed four basis points in the minutes following the policy announcement. Traders appear to have interpreted the statement as somewhat hawkish relative to their prior expectations.

Similarly, Canadian officials flagged global tensions, and a faster-than-expected rise in home prices relative to productivity as potential risks to the outlook. “If we lower our policy interest rate too quickly, we could jeopardize the progress we’ve made,” Macklem said. Besides, Bank of Canada claims they will continue quantitative tightening and normalize the balance sheet.

This approach by ECB and Canada is reminiscent of the approach taken by former Federal Reserve Chairman Alan Greenspan's policy in the 1990s. In periods when the economy was at risk of reflation, Greenspan advocated for a preemptive and slight easing of interest rates to provide some relief to the economy, while maintaining a degree of restrictiveness.

Since last year, Powell has consistently claimed to have taken lessons from Arthur F. Burns to avoid making the same mistakes for not taking decisive action to curb inflation. While Paul Volcker is lauded for his aggressive and successful tactics to quash high inflation in the late 1970s and early 1980s at the expense of the economic pain that such measures can inflict, Greenspan could be another example for Powell to seek a balance between the assertive stance and the nuanced tactics.

The CME FedWatch tool currently shows that the Fed's first interest rate cut may occur in September, and it may keep interest rates unchanged in November until another rate cut in December. This interest rate forecast reflects market expectations for gradual policy change. Since the Fed is data dependent, next week's CPI after Friday's nonfarm payrolls is also another important data that the Fed weighs. If the U.S. inflation gradually moves closer to Europe and Canada, it is not ruled out that the United States will also join the ranks of interest rate cuts.

Source: Statistics Canada, Eurostat

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102188459 : Tq

TechTrek Invest : The USA should be reducing interest rates immediately, Fed always leaves it too late. they delayed raising and they will delay reducing interest rates.

the economy will crash and then the FED will be scrambling to reduce rates whilst Millions of people will be jobless and lose almost everything. it happens during every big tightening cycle.

102259708 : A country that lack compassion, enjoy their citizens to be unemployed.

poem_view : It's definitely going to have an impact. However, the US is unlikely to catch up right away.