Intel, TSMC Released Positive Signals: A Promising Spring for the Chip Industry?

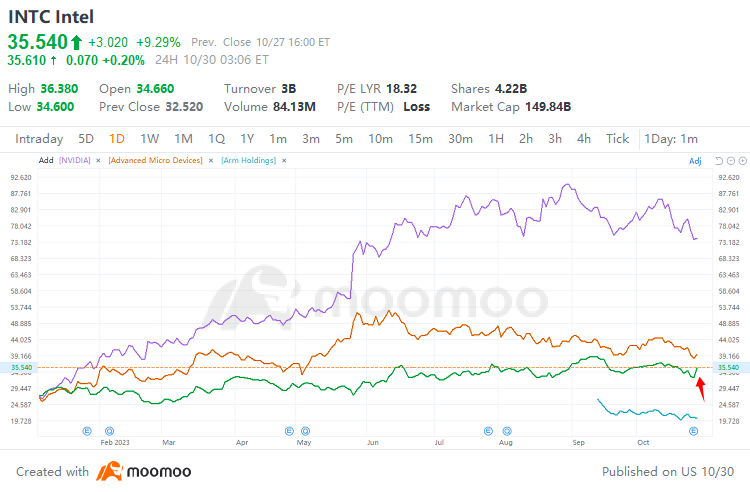

Following the release of stronger-than-expected Q3 results and an optimistic Q4 outlook, $Intel (INTC.US)$'s stock price soared last Friday, experiencing an intraday high of 11%.

Alongside Intel's notable performance, statements made by other key players in the industry chain, such as $Taiwan Semiconductor (TSM.US)$ and SK Hynix, have led some to believe that the long-awaited recovery of the chip industry may finally be on the horizon.

According to the World Semiconductor Trade Statistics (WSTS), the global semiconductor market will turn to a strong recovery after a YoY decline of 10.3% in 2023, and achieve growth of 11.8% in 2024.

$Intel (INTC.US)$, an established chipmaker, reported Q3 results that exceeded market expectations last week. Sales were US$14.2 billion, above analysts' projections of US$13.5 billion. Earnings per share almost doubled to 41 cents from the expected 21 cents, and the company provided optimistic data for the Q4 outlook, including better-than-expected total revenue, earnings per share, and gross profit margin levels.

The main driving force behind Intel's current recovery is the turn to optimism in PC demand according to analysts. $Intel (INTC.US)$'s personal computer business, which had been suppressed by excess inventory, is now showing clear signs of rebound. In fact, the PC chip business recorded $7.9 billion in Q3, a 16% increase from the previous quarter.

Additionally, data from Counterpoint Research shows that global PC shipments achieved quarter-on-quarter growth for the second consecutive quarter in Q3. The agency has reasserted that the PC market has bottomed out and that global PC shipments will bounce back to pre-pandemic levels next year, driven by the release of Windows 11, the next wave of Arm PCs, and AI PCs.

In addition to the positive trend in PC chip demand, there is also a strong demand for AI chips, which is driving inventory digestion and demand recovery across the industry and is expected to extend to 2024.

On the one hand, SK Hynix, which specializes in HBM memory and PC-side storage chips required for AI, was the first to identify this signal of recovery in chip demand. On the other, $NVIDIA (NVDA.US)$ has already placed substantial orders with $Taiwan Semiconductor (TSM.US)$ in preparation for 2024 in order to accelerate the production of a comprehensive range of AI GPUs for servers, suggesting that the robust demand for AI chips may continue into that year.

As for smartphones, data from Canalys indicates that the global smartphone market decline slowed down considerably in Q3 2023, with a YoY decrease shrinking to only 1%.

$Taiwan Semiconductor (TSM.US)$, the world's largest chip foundry, has also provided reason for optimism. The company anticipates a turning point in the chip market during Q4 and has released Q4 sales and gross profit margin outlook data that beat market expectations. TSMC believes that demand in the artificial intelligence sector will propel long-term market growth.

Additionally, according to DigiTimes, TSMC's foundry quotes below 7nm are set to "strongly increase" by 3% to 6%. Major manufacturers, including leading AI chipmaker $NVIDIA (NVDA.US)$ and one of the giants in PC chips, $Advanced Micro Devices (AMD.US)$, have agreed to this price hike. This further confirms the growing prosperity of the chip industry next year.

Further up the industry chain, $KLA Corp (KLAC.US)$, the world's largest chip manufacturing equipment supplier as $Applied Materials (AMAT.US)$, $ASML Holding (ASML.US)$, and $TOKYO ELECTRON (TOELF.US)$, has recently released results that surpassed expectations. This indicates strong demand for the company's chip manufacturing equipment from important customers such as $Taiwan Semiconductor (TSM.US)$, among others.

As both Samsung Electronics and SK Hynix are based in South Korea, the country's chip export data is considered indicative of global chip demand trends. Preliminary trade statistics for the first 20 days of October have shown that average daily shipments increased by 8.6% YoY, marking positive growth for the first time since September 2022. During the same period, YoY declines in South Korean semiconductor sales narrowed significantly to 6.4%, down from 14.4% in September. The Bank of Korea has also observed a recovery in semiconductor demand, noting that DRAM memory chip prices rose last month for the first time in a year and a half. Furthermore, they expect market optimism to continue growing next year.

Source: Best Anchor Stocks, Bloomberg, moomoo, WSTS, Canalys, DigiTimes

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment