Meta Attracts Whale With $28 Million Bet The Rally is Just Getting Started

A big whale has taken a shine to $Meta Platforms (META.US)$ , placing a $28 million bet that the stock still has room to run after its meteoric rise to a record this year.

At 10:000:22 a.m. New York time Thursday, a block trade of long call options was posted with the active buyer paying a $28.07 million premium for the right to purchase 350,000 Meta shares at $550 each by June 20, 2025. At that exact time, another block trade for call options expiring at that exact date was also posted, signaling the two could be part of a strategy.

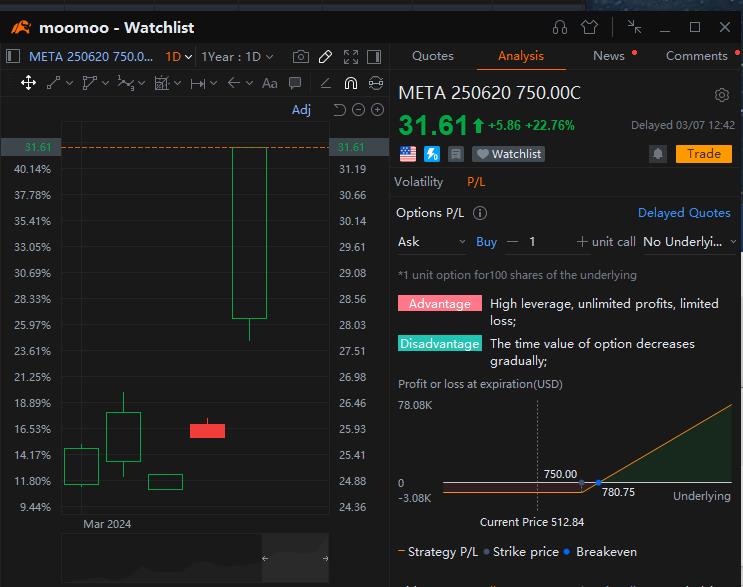

That second block trade involved an active seller who stands to collect $9.7 million for writing call options that give the holder the right to buy 350,000 Meta shares at $750 each. The short call options, sold at $27.70 a share, are currently out-of-the-money and could be profitable for the seller as long as the stock doesn't climb above that $750-strike price before they expire on June 20, 2025.

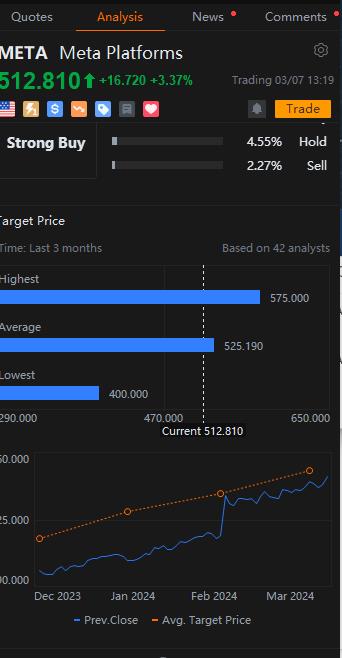

The wave of optimism on Meta's prospects extends beyond the options market. About 93% of the analysts tracked by Moomoo have a "Buy" recommendation on the stock and only 2.3% have a "Sell" rating. The positive sentiment has fueled Meta's 180% climb over the past year. The stock touched an all-time high of $519.85 Thursday morning before paring gains to 3.5%. It traded at $513.35 at 1:18 p.m.

The rally was fueled by the social media giant's "year of efficiency" that resulted in blowout earnings. That helped the company announced a quarterly dividend, joining an elite group of Big Tech dividend payers that include $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$ .

Doug Anmuth, an analyst at $JPMorgan (JPM.US)$ raised his price target to $535, from $420 as he sees the company's 2025 earnings rising to $24.49, from $14.87 last year. Anmuth has maintained an "overweight" rating on Meta since December 2022. He applied a premium to the stock over the S&P 500 in calculating its value, given "greater confidence in Meta's strong top-line growth and ongoing cost efficiencies."

"We believe Meta's virtual ownership of the social graph, strong competitive moat, and focus on the user experience position it to become an enduring blue-chip company buit for the long-term," Anmuth said in a note to clients March 6. "Meta is also focused on the two big tech waves of AI and Metaverse and it will spend into those major growth opportunities while remaining disciplined."

But after the surge in the share price, at least three technical indicators tracked by Moomoo are now warning that Meta is severely overbought and another seven are showing bearish signals. Only the moving average is flagging a relatively bullish trend.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

MuscMoo : how do we know they're not hedging their short positions and sharpening their knives? :)

funny Giraffe_6930 MuscMoo : you right look before you leap

73413672 : How do you know if they are long or short. Do you have A or AA trade info?

73963281 73413672 : @mooster Han @Luzi Ann Santos @Moomoo Recap US @Moomoo Breakfast US @Moomoo News US @Movers and Shakers @Jodom_Jay @Options Newsman @Popular on moomoo @72973431 @efficentupup

Luzi Ann Santos OP 73963281 : The moomoo app labels the unusual trades as long calls and short calls. Check out the options functions on the app. There are more data on options you can use there.