Options Market Statistics: Nvidia Stock Rises, Options Pop on Analyst Upgrades Amid Strong AI Demand

News Highlights

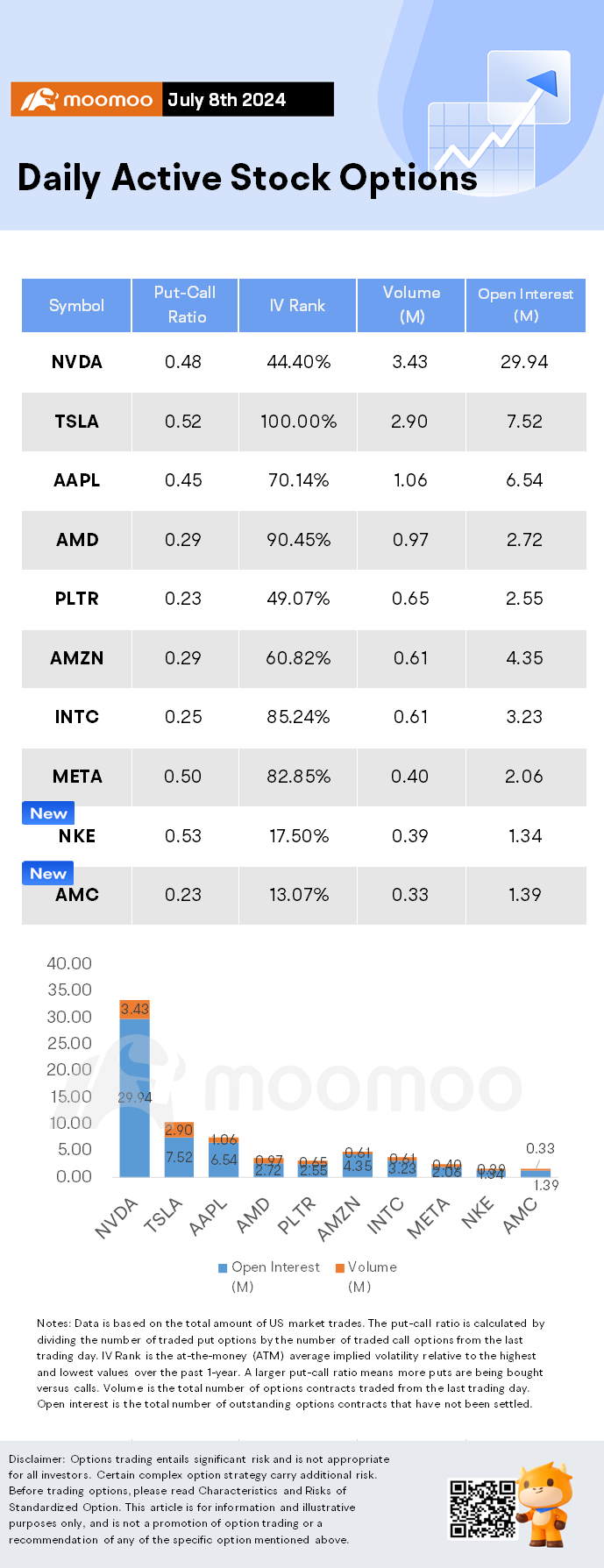

$NVIDIA(NVDA.US$ ended 1.88% higher. Its options trading volume was 3.43 million. Call contracts account for 67.6% of the total trading volume.

Nvidia shares rose on Monday as analysts from UBS and Wolfe Research increased their price targets for the stock to $150, citing strong demand for Nvidia's upcoming Blackwell platform. Analysts noted that demand for Blackwell has grown significantly, driven by big tech companies like $Microsoft(MSFT.US$, $Alphabet-A(GOOGL.US$, $Meta Platforms(META.US$, and $Amazon(AMZN.US$ increasing their investment in AI infrastructure. Supply chain checks indicated robust interest in Nvidia's data center components, partly due to their enhanced power efficiency. Analysts project that big tech will collectively spend over $1 trillion on AI in the next five years, bolstering Nvidia's growth prospects.

$Apple(AAPL.US$ ended 0.65% higher. Its options trading volume was 1.06 million. Call contracts account for 68.8% of the total trading volume. The $225 calls expiring July 12 were traded most actively.

Wedbush analysts predict Apple could reach a $4 trillion market capitalization driven by the upcoming AI-powered iPhone 16 upgrade cycle. They anticipate this "golden upgrade cycle" will significantly boost Apple's share value, especially with the recently announced iOS 18 featuring Apple Intelligence and a partnership with OpenAI. This partnership is expected to generate substantial monetization opportunities, potentially adding $10 billion in annual high-margin growth and increasing Apple's share value by $30 to $40. The analysts also highlight that 270 million iPhone users have not upgraded in over four years, suggesting strong pent-up demand. Additionally, improving iPhone supply stability in Asia and a recovery in the Chinese market are expected to support this upgrade cycle.

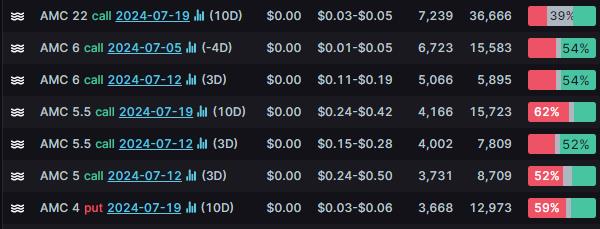

$AMC Entertainment(AMC.US$ ended 8.32% higher. Its options trading volume was 0.33 million. Call contracts account for 81.4% of the total trading volume. The $22 calls expiring July 19 were traded most actively.

AMC Entertainment shares are rallying Monday afternoon, buoyed by robust box office sales over the weekend. Attendance was largely driven by the success of animated release "Despicable Me 4." The film has grossed $230 million globally, with $122 million coming from domestic markets. This strong showing has not only boosted ticket sales but has also significantly increased merchandise revenue at AMC theaters.

Unusual Stock Options Activity

There was a noteworthy activity in $Archer Aviation(ACHR.US$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 71.9x with 7,619 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV、HV、IV Rank、IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk.

Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104534743 :

Paul Anthony : now raining session doesn't work hard to find out what the best person to the market today tq So much for your wonderful family together With this learn about your help me tq Sir God bless All you Amen

104327919 : ok

105089379 : these so-called analysts are confused conmen, one day downgraded and within a few days, upgrade the stock again.