Options Market Statistics: Apple to Increase iPhone Shipments by 10% in 2024, Shares Reach All-Time High, Options Pop

News Highlights

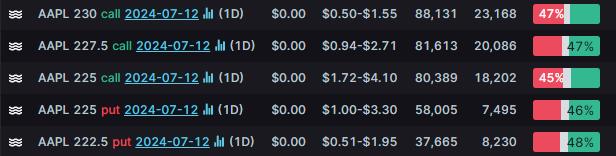

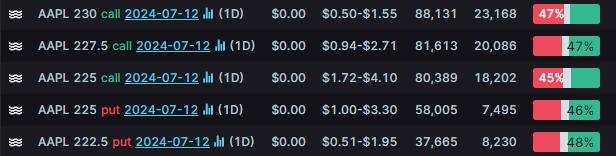

$Apple (AAPL.US)$ ended 1.88% higher. Its options trading volume was 1.65 million. Call contracts account for 67.5% of the total trading volume. The $230 calls expiring July 12 were traded most actively.

Apple plans to ship at least 90 million iPhone 16 devices in the latter half of this year, aiming for a 10% increase in shipments compared to the iPhone 15. The company is relying on new AI features to boost demand after a challenging 2023. Apple expects a stronger 2024 despite competition from AI-enhanced smartphones by rivals like Samsung and Xiaomi. The tough comparison with 2023, especially in China, where Huawei's Mate 60 Pro gained popularity, also plays a role in these projections.

$Advanced Micro Devices (AMD.US)$ ended 3.87% higher. Its options trading volume was 1.64 million. Call contracts account for 73.6% of the total trading volume. The $180 calls expiring July 12 were traded most actively.

Shares of AMD surged after the company announced its acquisition of European AI lab Silo AI for approximately $665 million. Silo AI specializes in adding AI capabilities to customer products, including training multilingual large language models using AMD GPUs. This move is seen as a commitment by AMD to enhance its AI capabilities and market share.

The market's reaction suggests that while the acquisition is significant, it isn't transformative for AMD's overall business perception. This follows a recent 7.5% stock gain 20 days ago when Piper Sandler analyst Harsh Kumar named AMD a "Top Pick," citing strong performance and upcoming chip releases. AMD's shares have been notably volatile, with 18 moves greater than 5% over the past year.

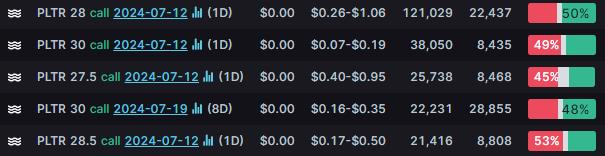

$Palantir (PLTR.US)$ ended 3.76% higher. Its options trading volume was 0.47 million. Call contracts account for 78.4% of the total trading volume. The $28 calls expiring July 12 were traded most actively.

Palantir Technologies has seen its stock rise over 60% in 2024, prompting speculation about whether it could double by year's end. The company's strength in AI software, particularly with its new Artificial Intelligence Platform (AIP), has driven its popularity. AIP integrates AI into company workflows, and its unprecedented demand suggests strong future growth potential.

In Q1, Palantir reported a 21% increase in sales, with U.S. commercial revenue growing 40% year-over-year. However, its largest clients, government entities, have yet to adopt AIP fully. For Q2, Palantir expects revenue of $651 million (24% growth) and has raised its full-year revenue expectations, reinforcing its bullish outlook. This growth is crucial to justify Palantir's premium stock valuation.

Unusual Stock Options Activity

There was a noteworthy activity in $Advanced Micro Devices (AMD.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 292.4x with 57,602 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV、HV、IV Rank、IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Malik ritduan : ok

Gary Stoeber : What are the best 7 oil and gas pipelines

Gary Stoeber Gary Stoeber : That pays dividends