Options Market Statistics: JPMorgan Chase Tops Profit Expectations, Shares Rise and Options Pop

News Highlights

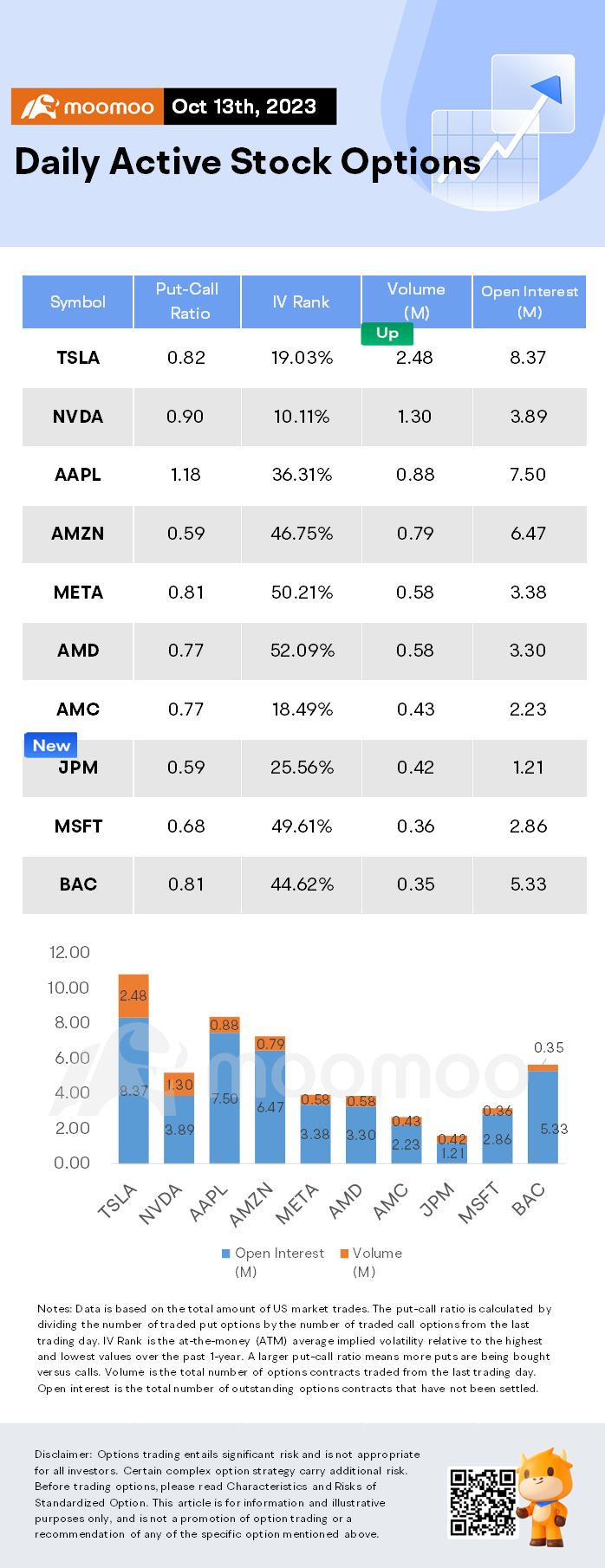

$Tesla (TSLA.US)$ shares fell by 2.99%, closing at $251.12. Its options trading volume is 2.48 million. Call contracts account for 55.0% of the whole trading volume. The most traded calls are contracts of $270 strike price that expire on October 13th. The total volume reaches 131,656 with an open interest of 34,687. The most traded puts are contracts of a $260 strike price that expires on October 13th; the volume is 87,804 contracts with an open interest of 21,680.

The electric vehicle transformation in the US hit yet another milestone last quarter, though further growth into the mainstream may still be elusive. This as Tesla's lead at the top is narrowing.

According to automotive research firm Kelley Blue Book (KBB), US EV sales in the third quarter crossed 313,000, nearly a 50% increase from a year ago, and around 15,000 more than the 298,000 sold in Q2. Cox Automotive (KBB's parent company) said EV market share hit 7.9%, its highest ever level and up from the 6.1% recorded a year ago.

Higher inventory levels, more product availability, and downward pricing pressure have helped spur continued linear growth of EV sales in the US market," said Jonathan Smoke, Cox Automotive's chief economist.

$NVIDIA (NVDA.US)$ shares fell by 3.16%, closing at $454.61. Its options trading volume is 1.30 million. Call contracts account for 52.8% of the whole trading volume. The most traded calls are contracts of $465 strike price that expire on October 13th. The total volume reaches 55,324 with an open interest of 10,409. The most traded puts are contracts of a $460 strike price that expires on October 13th; the volume is 36,065 contracts with an open interest of 4,123.

$JPMorgan (JPM.US)$ shares rose by 1.50%, closing at $148.00. Its options trading volume is 0.42 million. Call contracts account for 62.7% of the whole trading volume. The most traded calls are contracts of $155 strike price that expire on October 27th. The total volume reaches 4,657 with an open interest of 880. The most traded puts are contracts of a $130 strike price that expires on June 21st 2024; the volume is 2,902 contracts with an open interest of 7,640.

JPMorgan Chase on Friday topped analysts' estimates for third-quarter profit and revenue as the bank generated more interest income than expected, while credit costs were lower than anticipated.

Here's what the company reported:

Earnings: $4.33 a share

Revenue: $40.69 billion, vs. $39.63 billion LSEG estimate

The bank said profit surged 35% to $13.15 billion, or $4.33 a share, from a year earlier. That per-share figure includes 17 cents in securities losses and 22 cents in legal expenses. It wasn’t immediately clear which items were included in LSEG’s $3.96 a share profit estimate.

Revenue climbed 21% to $40.69 billion, helped by the stronger-than-expected net interest income. That measure surged 30% to $22.9 billion, exceeding analysts’ expectations by roughly $600 million. At the same time, credit provisioning of $1.38 billion came in far lower than the $2.39 billion estimate.

JPMorgan's retail banking division saw profit surge 36% to $5.9 billion, fueled by higher net interest income and the acquisition of First Republic. Its corporate and investment bank saw profit slip 12% to $3.1 billion on declines in trading and advisory revenue.

Unusual Stock Options Activity

Some notable call activity is being seen in $Nikola (NKLA.US)$, which is primarily being driven by activity on the November 3rd 1.50 call. Volume on this contract is 51,837 versus open interest of 1,143, so it's likely that nearly all of the volume represents fresh positioning.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Bolstergreat : Enjoy this very important news