Options Market Statistics: Major Indexes Plunge Amid Chip Stock Selloff and Economic Worries

News Highlights

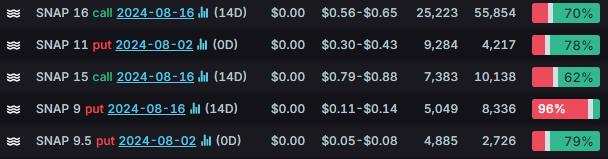

$Snap Inc (SNAP.US)$ stock dropped 3.83%. Its options trading volume was 0.58 million. Call contracts account for 73.6% of the total trading volume. The $16 calls expiring August 16th were traded most actively.

Snap shares plummeted over 16% in extended trading on Thursday after the company's third-quarter guidance fell short of analysts' expectations. The company reported earnings per share of $0.02 (matching estimates) and revenue of $1.24 billion (slightly below the $1.25 billion expected). Global daily active users were 432 million, slightly above expectations, but global average revenue per user was $2.86, below the forecasted $2.91. Snap's third-quarter revenue guidance ranged from $1.335 billion to $1.375 billion, below the $1.36 billion expected by analysts, and adjusted earnings guidance of $70 million to $100 million, trailing the $110 million estimate. Despite a 16% year-over-year increase in second-quarter sales, the company cited a weaker brand advertising environment. Monthly active users rose to 850 million, and Snap continued to grow its advertising platform and Snapchat+ subscription service. In contrast, Meta reported strong second-quarter earnings and revenue growth, leading to a 5% rise in its shares.

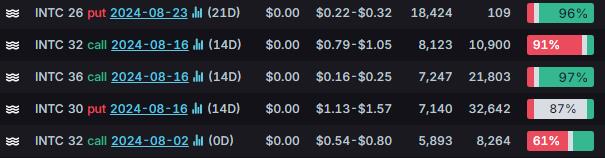

$Intel (INTC.US)$ stock declined 5.50%. Its options trading volume was 0.54 million. Call contracts account for 57% of the total trading volume. The $26 puts expiring August 23rd were traded most actively.

Intel shares dropped up to 20% in extended trading after the company announced a 15% workforce reduction as part of a $10 billion cost-cutting plan and reported disappointing quarterly results. The company will also cease dividend payments in Q4 2024 and cut full-year capital expenditures by over 20%. Intel's earnings per share were 2 cents, below the expected 10 cents, and revenue was $12.83 billion, slightly missing the $12.94 billion estimate. Revenue declined 1% year-over-year, and the company posted a net loss of $1.61 billion due to investments in AI-capable chips and competitive pricing pressures. Intel's Client Computing Group generated $7.41 billion in revenue, while the Data Center and AI unit posted $3.05 billion. For the next quarter, Intel expects an adjusted net loss of 3 cents per share on revenue between $12.5 billion and $13.5 billion, below analyst expectations. The company also announced a significant investment from Apollo in a joint venture and introduced new AI-focused processors. CEO Pat Gelsinger emphasized the need to align costs with the new operating model and adapt to trends like AI.

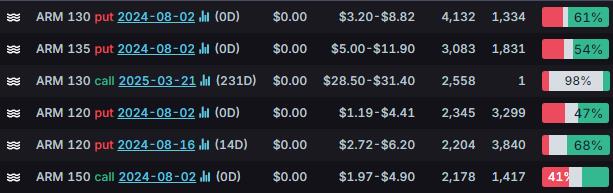

$Arm Holdings (ARM.US)$ stock tumbled 15.72%. Its options trading volume was 0.37 million. Call contracts account for 40.6% of the total trading volume. The $130 puts expiring August 2nd were traded most actively.

Chipmakers like Nvidia and AMD have seen significant gains from AI processors, but Arm doesn't expect an immediate benefit from generative AI designs due to its revenue model based on licensing fees and royalties. Arm CEO Rene Haas noted it could take around four years to see returns from current AI server chip designs. Arm benefits from designs included in some Nvidia H100 AI chips and anticipates greater revenue from Nvidia's upcoming Blackwell chips.

Arm forecasted second-quarter revenue between $780 million and $830 million, aligning closely with analyst expectations. Despite impressive first-quarter earnings, with a 39% revenue surge to $939 million, Arm's cautious full-year forecast dampened investor spirits. The revenue boost was due to significant licensing deals, though royalty revenue was impacted by weak end markets.

Unusual Stock Options Activity

There was a noteworthy activity in $Coinbase (COIN.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 104.2x with 16,145 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Jose Escobar676 : How to make money

Buddhist Jesus Jose Escobar676 : dont be poor

151706928 : success is not luck ..... !!?

151706928 : just ask with you Leo doesn't matter but sastancy!!

104371487 On Paris : thanks you this sharing