Options Market Statistics: MARA Options Pop as Traders Bet on SEC's Green Light for Bitcoin ETFs

News Highlights

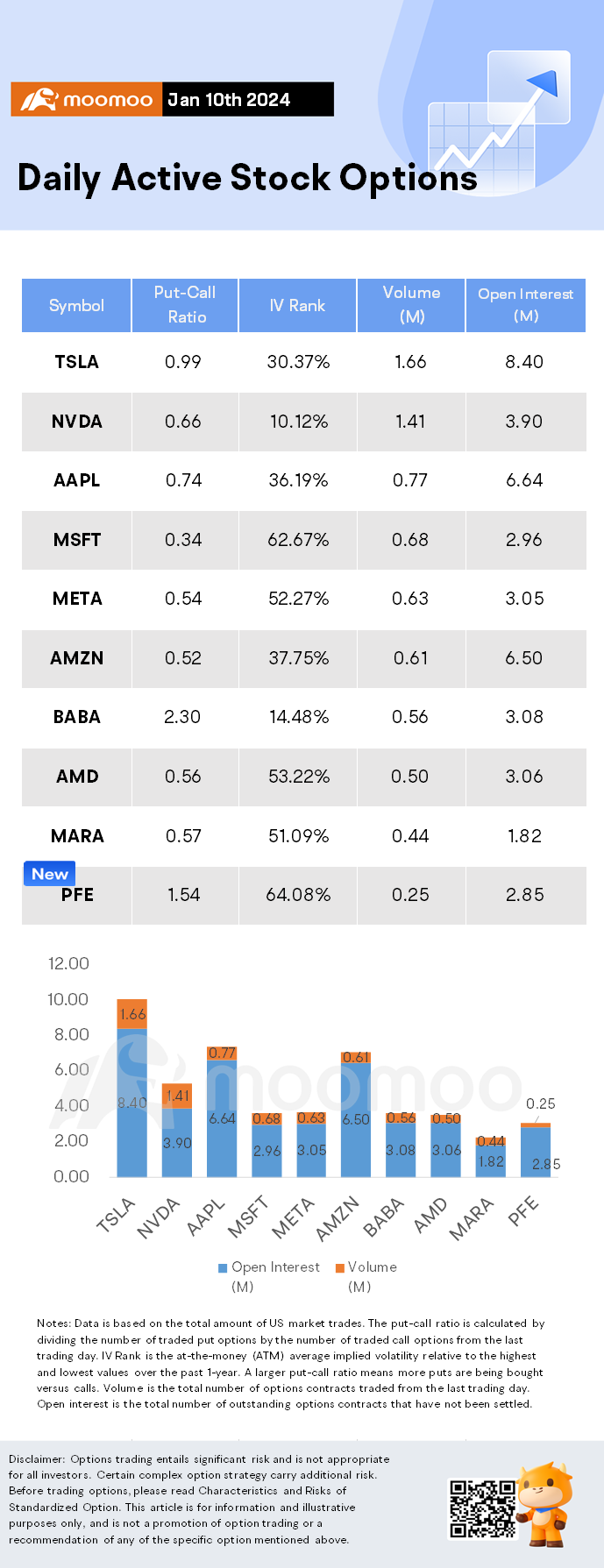

$Tesla (TSLA.US)$ shares fell by 0.43%, closing at $233.94. Its options trading volume is 1.66 million. Call contracts account for 50.3% of the whole trading volume.The most traded calls are contracts of $235 strike price that expire on January 12th. The total volume reaches 101,101 with an open interest of 10,626. The most traded puts are contracts of a $230 strike price that expires on January 12th; the volume is 85,349 contracts with an open interest of 18,875.

Tesla on Wednesday rolled out the restyled version of its Model 3 compact sedan in North America at unchanged prices, months after the vehicle attracted healthy demand upon launch in China and Europe.

The move will refresh Tesla's aging vehicle line-up in its biggest market and follows a price war last year that helped the company meet its annual deliveries goal at the cost of margins.

$NVIDIA (NVDA.US)$ shares rose by 2.28%, closing at $543.50. Its options trading volume is 1.41 million. Call contracts account for 60.2% of the whole trading volume.The most traded calls are contracts of $550 strike price that expire on January 12th. The total volume reaches 88,636 with an open interest of 17,865. The most traded puts are contracts of a $540 strike price that expires on January 12th; the volume is 43,299 contracts with an open interest of 1,827.

$MARA Holdings (MARA.US)$ shares fell by 0.39%, closing at $25.63. Its options trading volume is 0.44 million. Call contracts account for 63.9% of the whole trading volume.The most traded calls are contracts of $30 strike price that expire on January 12th. The total volume reaches 21,412 with an open interest of 12,551. The most traded puts are contracts of a $20 strike price that expires on January 12th; the volume is 23,035 contracts with an open interest of 13,345.

After a false start Tuesday, the Securities and Exchange Commission gave its approval Wednesday for some investment companies to offer "spot bitcoin" exchange-traded funds.

The regulator's highly anticipated move is expected to make bitcoin investing more accessible to Main Street investors, without requiring them to own the digital asset directly.

Unusual Stock Options Activity

Some notable put activity is being seen in $Meta Platforms (META.US)$, which is primarily being driven by activity on the 12-Jan-2024 put. Volume on this contract is 12,157 versus open interest of 123.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Kervencia Valmy : great

safri_moomoor : ok