Options Market Statistics: Nikola Stock Soared 34% After Announcing New COO, Options Pop

News Highlights

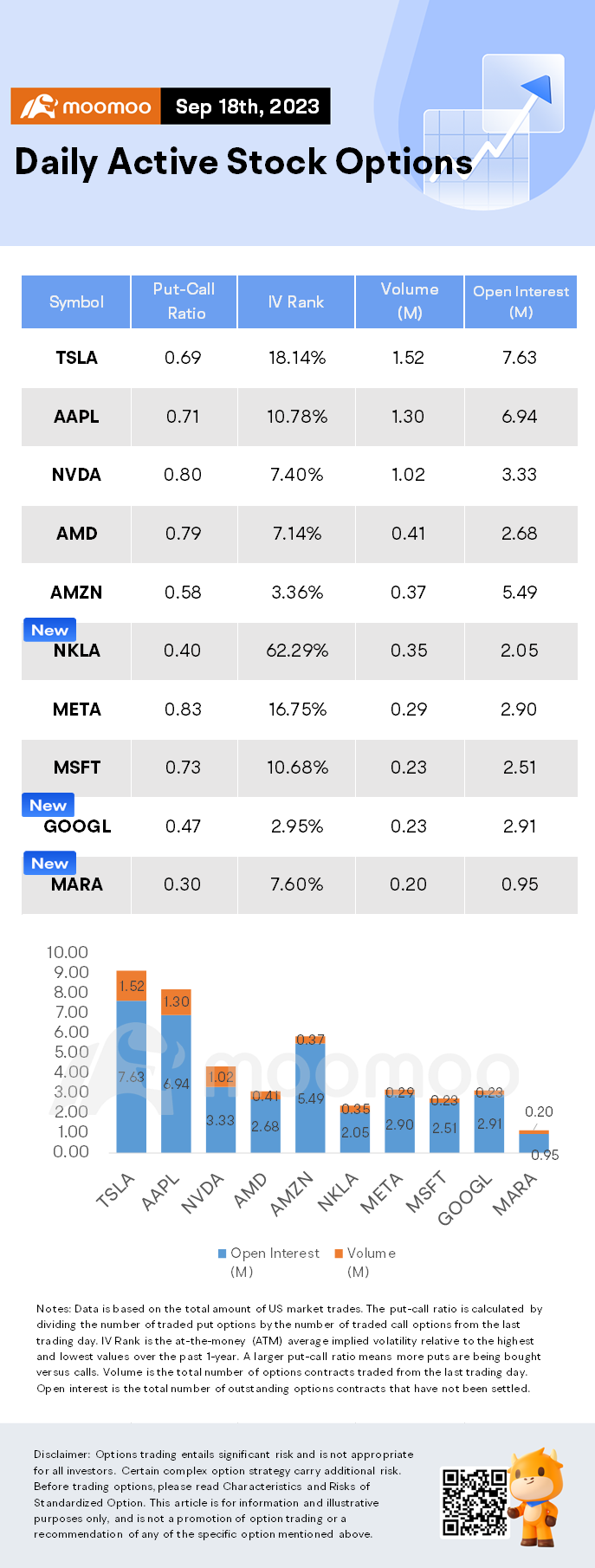

$Tesla (TSLA.US)$ shares fell by 3.32%, closing at $265.28. Its options trading volume is 1.52 million. Call contracts account for 59.3% of the whole trading volume. The most traded calls are contracts of $280 strike price that expire on September 22nd. The total volume reaches 48,086 with an open interest of 12,259.

Shares of the electric vehicle maker slipped over 3% after Goldman Sachs lowered its earnings estimate. Analyst Mark Delaney cited the potential for further price cuts and lower margins as reasons for the reduction.

$Nikola (NKLA.US)$ shares rose by 33.61%, closing at $1.59. Its options trading volume is 0.35 million. Call contracts account for 71.2% of the whole trading volume. The most traded calls are contracts of $1 strike price that expire on September 22nd. The total volume reaches 19,890 with an open interest of 34,339. The most traded puts are contracts of a $2.5 strike price that expires on September 22nd; the volume is 40,035 contracts with an open interest of 233.

Nikola appointed Mary Chan as chief operating officer. Chan previously served as a managing partner at advisory firm VectoIQ, where she helped with the public launch of Nikola, according to the company. She also previously held roles at $General Motors (GM.US)$ and $Dell Technologies (DELL.US)$. She will step into the role on Oct. 9.

Mary brings a solid understanding of business, combined with extensive experience in technology and transportation, spanning both engineering and management," said CEO Steve Girsky, who also serves as managing partner of VectoIQ.

$Alphabet-A (GOOGL.US)$ shares rose by 0.59%, closing at $138.21. Its options trading volume is 0.23 million. Call contracts account for 68.3% of the whole trading volume. The most traded calls are contracts of $140 strike price that expire on September 22nd. The total volume reaches 9,570 with an open interest of 2,182. The most traded puts are contracts of a $136 strike price that expires on September 22nd; the volume is 6,272 contracts with an open interest of 1,004.

Google is reportedly nearing the release of its Gemini AI, a response to OpenAI's GPT-4, aiming to secure its position in the rapidly evolving field of AI-driven conversational technologies. The tech giant plans to offer Gemini through its Google Cloud Vertex AI service, tapping into the enterprise AI market. The AI software is expected to assist in various tasks including code writing and generating original images based on user requests.

Unusual Stock Options Activity

Some notable put activity is being seen in $Colgate-Palmolive (CL.US)$ ,which is primarily being driven by activity on the June 21st 2024 60 put. Volume on this contract is 27,563 versus open interest of 411, so it's likely that nearly all of the volume represents fresh positioning.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Good find on those CL puts. If my math is right, I think around 95% of these were active sells. Interesting. Either somebody is super bullish, or they are balancing out a massive spread.

You see the same thing on the May 2024 expiration. No where else.

It seems like it is the first leg of some large spread

Chak : Wher a crappy company